Become an insider!

Get our latest payroll and small business articles sent straight to your inbox.

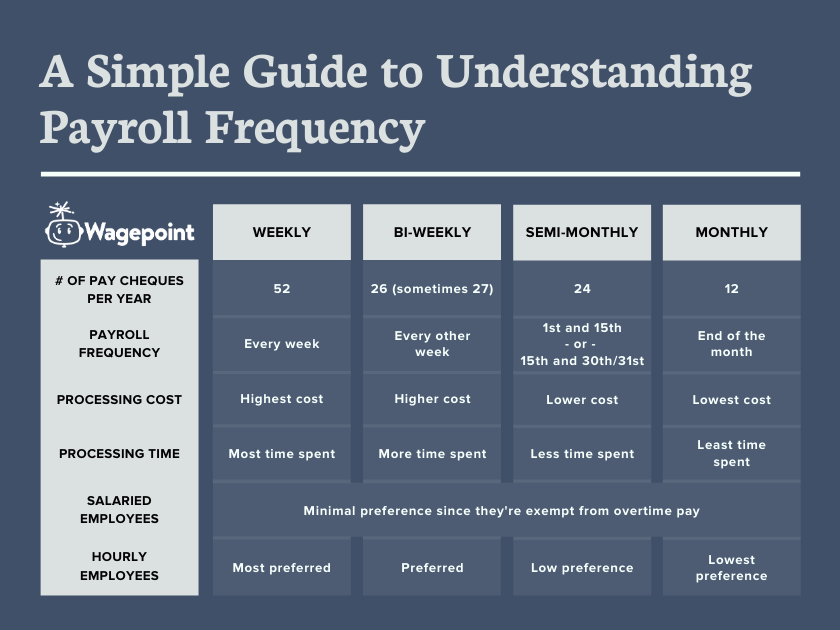

A year can be divided in multiple ways: 52 weeks, 365 days, or 12 months. This means there are different payroll schedules that a business owner can follow — weekly, bi-weekly, semi-monthly, or a combination of a few. How do you know which payroll frequency is the most optimal for your business?

While there are a few factors to consider such as labor laws and employee preferences, it’s imperative that you first understand exactly what payroll frequency is and how it affects payroll before you make a decision.

What is payroll frequency?

In the simplest terms, payroll frequency is how often you pay your employees.

Every employer needs to follow a payroll schedule so their employees know exactly when they can expect to get paid.

Just like how there are many ways to brew your coffee, there is more than one payroll schedule to consider. However, there are a few options that are more popular than others, each with their own benefits and drawbacks.

The four most common options are:

- Weekly

- Bi-weekly (once every two weeks)

- Semi-monthly (twice a month)

- Monthly

Weekly payroll schedule

A weekly payroll schedule is exactly that: the employee is paid on the same day, every week. This results in 52 payrolls per year.

The most common day for a weekly payout is everyone’s favorite F-word: Friday. However, this is not a hard and fast rule. Payday can be any day of the week.

As their hours can fluctuate significantly on a week to week basis, this method is best suited for hourly workers and employees in trades, such as construction workers, plumbers, electricians, etc.

Benefits of a weekly payroll schedule:

- Calculating overtime is easier since the workweek should match the pay period.

- Employees receive overtime pay sooner. Cha-ching!

- Helps employees with budgeting. Many employees appreciate getting paid on a weekly basis since the steady flow of income can make it easier for them to manage their money.

- More paydays for employees.

Drawbacks of a weekly payroll schedule:

- More costly. Weekly paychecks = processing payroll 52 times a year. This will likely result in higher expenses regardless of whether you’re automating this process or if you’re administering payroll in-house. Companies that provide payroll services often charge per frequency. Your costs become even higher depending on how you issue the checks.

- More time consuming. This pay structure requires your attention every week which can take you away from other pressing duties.

Bi-weekly payroll schedule

Similar to a weekly schedule, a bi-weekly schedule means employees get paid on a specific day of the week. The difference is that payroll is processed every other week which typically results in 26 payrolls per year — sometimes 27.

For example, payday for companies who follow this schedule could be every other Friday.

It’s also common for both salaried and hourly employees to be paid under this structure.

Benefits of a bi-weekly payroll schedule:

- Saves you money since you are processing payroll 26 times a year — half as many times as your weekly counterpart. The costs of distributing the paycheck is also cut in half.

- Saves you time. Remember those pressing duties? They can be tended to now that you’re running payroll every other week.

- Calculating overtime is still easy since this payroll frequency aligns well with work weeks.

Drawbacks of a bi-weekly payroll schedule:

“Pay period leap years” can lead to overpaying. Unfortunately, the world is not as precise as payroll. Our calendar year is actually divisible by 26.0893 bi-weekly pay periods, not 26, so an additional pay period is expected every 11 or 12 years. Employers beware: this can lead to overpaying salaried employees.

- Complicates monthly budget or costing estimates. Given that not all months are exactly four weeks long, there will be a few months out of the year that will have three pay periods instead of two. This can cause confusion as accountants run their monthly reports.

- Paying bills can be tricky. Since employees receive their paychecks on different dates throughout the month, it can make it difficult for them to schedule their automatic bill payments.

- Requires two (2) additional paychecks during the year since 26 doesn’t divide evenly into 12 months.

Semi-monthly payroll schedule

This option is most similar in frequency to a bi-weekly schedule, except that paydays are tied to two specific dates of the month. Regardless of how many days there are in a month, this results in only 24 payrolls per year, instead of 26/27 with a bi-weekly frequency.

If you ever get the two payroll terms confused, here’s an easy way to distinguish between them:

“Bi” means two = every two weeks

“Semi” means half = every half month

Employers often choose to pay their employees on the 1st and 15th or 15th and 30th/31st. If either of those days fall on a weekend, you can decide if your employees will receive their checks on the Friday before or the Monday after.

Since salaried employees are exempt from collecting overtime pay, this is the most ideal option for them as they don’t have to worry about making confusing calculations.

Benefits of a semi-monthly payroll schedule:

- No complications due to leap year.

- Most compatible with monthly bookkeeping/accounting services. Since monthly reports are often done at the end of the month, this payroll frequency is inherently simpler as payday often coincides with the end of the month.

- Paying bills is easier for employees since they know exactly which dates payday falls on.

Drawbacks of a semi-monthly payroll schedule:

- Calculating overtime is harder for hourly employees. Overtime is determined on a work week basis, but in a semi-monthly frequency, the average pay period spans roughly 86 hours. This means part of a workweek often falls in a previous pay period, making calculations harder to understand.

- Prone to employee complaints which is really no fun at all.

- Adjustments are necessary if payday falls on a weekend or holiday.

Monthly payroll schedule

With a monthly pay schedule, payroll is processed once a month. This results in only 12 payrolls per year.

The specific date can vary. For example, you can choose to pay your employees on every last Friday.

One thing to note about the monthly payroll schedule is that it’s the most regulated option and therefore isn’t used as often. Many states and provinces have different labor laws that determine minimum payday requirements. Employers need to make sure they meet the minimum frequency requirements.

A monthly payroll schedule is also the least attractive option for employees as they will be forced to stretch their pay across the month. This isn’t ideal since expenses come up throughout the month.

Benefits of a monthly payroll schedule:

- Least expensive payroll option in terms of administrative costs since payroll is run only 12 times a year.

- Matches up with monthly taxes and deductions. Remember those monthly reports? Running payroll at the end of the month coincides with these reports which makes payroll quicker and easier.

Drawbacks of a monthly payroll schedule:

- Not as appealing to employees, especially lower wage workers, as the large time gaps between payrolls can cause financial strain.

- Not universally compliant with minimum payday regulations. In both the US and Canada, the minimum payday requirements are state/province-dependent. Some specific provinces and states may require you to pay your employees more frequently.

Making your choice

When it comes to finding the optimal payroll schedule for your business, it’s clear that there’s no “one size fits all” solution. Each pay frequency has its own pros and cons. Ultimately, it’s a fine balancing act between making sure your employees are satisfied, meeting your state/province’s minimum frequency requirements and understanding your business’ needs.

The advice we share on our blog is intended to be informational. It does not replace the expertise of accredited business professionals.