Become an insider!

Get our latest payroll and small business articles sent straight to your inbox.

Unless you’re us, or an accountant, you probably don’t get too enthusiastic about payroll topics. Well, today that’s all about to change with our 5 craziest payroll rules of the past!

Over the years, employees have been paid in strange ways, and we’ve compiled a list of the craziest ones complete with beer, clay tablets and by far the most unfortunate and popular – inequality!

Payroll plays a critical role for every business with an employee, but it’s undergone many changes before becoming what it is today.

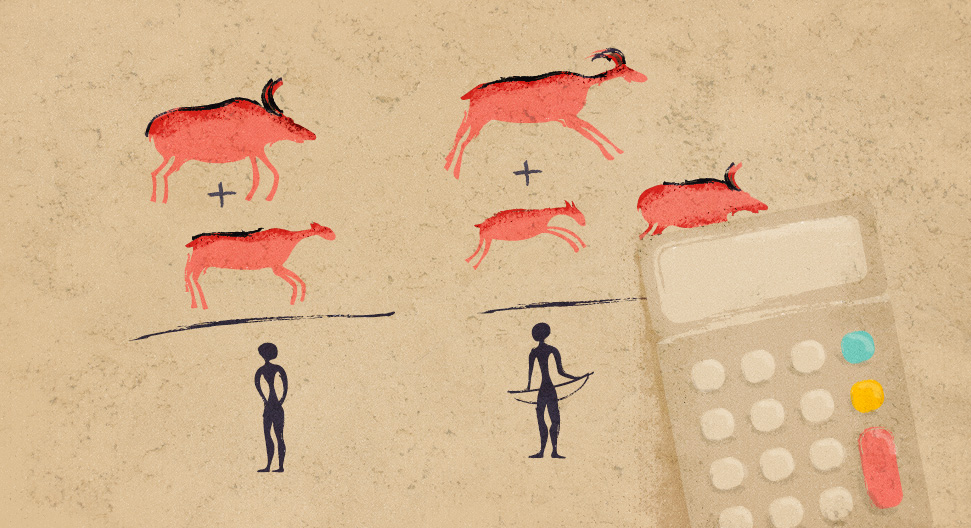

The exact origin of payroll is uncertain, likely beginning in the form of a payment of goods for service. Most suppose that the first salary would have been paid in the Neolithic Revolution, sometime between 10,000 – 6,000 BC.

This probably looked nothing like the salaries and hourly pay we have today, and judging from our research, that’s probably for the best.

1. Employees paid in beer

The ancient Egyptian economy was based on the redistribution of commodities. Egyptian workers were compensated for work with beer, bread, grain, meat and cloth rations, which were the necessities of life at the time.

Some may agree that these are still the basic necessities today.

Imagine your employer paid you 385 beers a week instead of your $40,000/year USD salary. But maybe it’s best we don’t get paid in beer because at least with currency, you can purchase your own drink of choice.

2. Payroll numbers recorded on inscribed clay tablets

Beer has a role to play in this history of payroll systems too.

BBC says some of the earliest writing in the world, called ‘cuneiform,’ meaning wedge-shaped, was used to record rations.

A tablet was used to record worker’s daily beer rations. On the clay tablet, beer is represented by an upright jar, and a human head eating from a bowl depicts rations.

You can bet your accountant is glad they don’t have to use clay tablets for generating year-end reports. Does Quickbooks even have a cuneiform option?

3. Doubled wages for workers living the “American” way

In the early 1900s, Henry Ford famously doubled his employee’s wages, going from $2.25 a day to $5. However, not every employee was able to receive this raise.

To determine who among his employees was eligible, a group called the “Socialization Organization” would visit the homes of each employee to determine if they were living according to the standards of Henry Ford. For example:

- Men did not qualify if their wives worked outside of the home.

- Women did not qualify unless they were single or the sole provider for their family.

- Immigrants had to attend classes in order to be “Americanized”.

- Men and women were not permitted to drink alcohol or gamble.

We’re pretty sure none of these qualifications would fly today, and if your boss has sent people into your home to find out how you live, please contact HR immediately.

4. Women paid 53% less than men

During WWII, when women took on male positions as factory workers, engineers, drivers, conductors and nurses, they were compensated with much lower wages.

Although the women frequently went on strike, there were limited agreements on equal pay, as many of the employers were able to evade the issue. Women were paid an average of 53% of the wage earned by the men they replaced!

Inequalities in the workforce are no longer what they used to be, but, unfortunately, they still exist. This is one crazy payroll fact that should be history by now!

5. Soldiers paid in salt

Roman soldiers were historically paid in coin, but it is also said that they were paid in salt. Some even say the word salary is derived from the word salt, due to the salt allowances of soldiers.

The Latin salarium may have originally been “salt-money, soldier’s allowance for the purchase of salt,” using salarius “pertaining to salt.”

You’re probably glad you’re not paid in salt today, but you might think differently if your food was bland and salt was a scarce commodity.

Disclaimer: The advice we share on our blog is intended to be informational. It does not replace the expertise of accredited business professionals.