Become an insider!

Get our latest payroll and small business articles sent straight to your inbox.

Austin is described as “a new city that is well-poised to become Silicon Valley part two.”

Host city to the hottest and most vibrant tech gathering on the planet, South by SouthWest (SXSW), Austin is a great city with a lot of advantages for entrepreneurs who are looking to start their own small business.

The most advantageous reason of all is that the city of Austin has no state income taxes to worry about, which is a big plus in terms of savings alone. It also means that you pay less to get three times the office space in Austin compared to Silicon Valley!

Some of the other benefits include;

-

An abundance of venture dollars, with $1B in funding invested in 2014 alone, according to data from Innovate Austin.

-

A strong community, including numerous events, co-working spaces and accelerators, such as Capital Factory, Techstars, Dreamit Ventures, WeWork and TechRanch, you will never be alone in the Lone Star State.

But even with a long list of pros, starting a business is no easy feat – you need to work hard, pick the right team and get access to the resources you need to make your small business a success.

Speaking of resources to help, Wagepoint not only handles your online payroll services for small businesses but we also have all the information you need to register your business in Austin, Texas. Learn how to keep your company and employees payroll compliant as per state-specific regulations.

Steps to Setting up your Payroll in Austin, Texas

As a small business owner, you have three action items you need to complete properly in order to be set up in Austin:

-

Business registration

-

Tax payments

-

Compliance requirements

Let’s take a closer look at each one and see what’s involved.

Business Registration

The first phase is to set up your business with the appropriate governmental departments, namely, the IRS, State of Texas, and TEXNET, which is the State of Texas Financial Network.

-

IRS: Apply for your Federal Employer Identification Number (FEIN).

-

State of Texas: Register for Unemployment taxes

-

State of Texas: Fill out the Texas Online Tax Registration form to register your business for Sales Tax.

-

TexNet Online portal: Register your business so you can pay your business taxes online using the TexNet electronic payment network.

We also recommend checking out the Texas Secretary of State website because they have a number of helpful start-up and small business resources you can refer to on this topic as well.

Tax Payments

With your business registration out of the way, let’s look at the next phase i.e enrolling your business with the appropriate tax agencies (local, state, and federal).

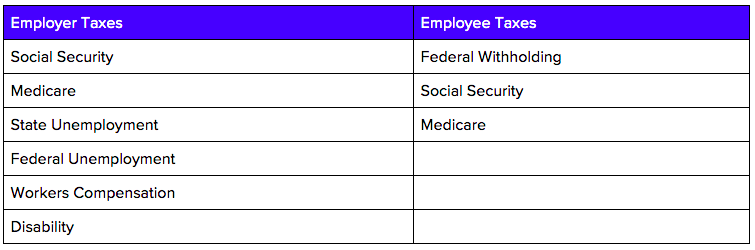

Here’s a quick outline of the various taxes you’ll have to pay for your business and your employees:

Once that’s done, it’s time to figure out your tax payment schedule for all levels of government. For that, you’ll need to know how much payroll you paid your employees in the previous year and/or quarter.

Federal Taxes: Payable to the IRS via electronic funds transfer (EFTPS)

-

You’ll pay Semi-weekly, if you paid more than $2,500 in payroll.

-

You’ll pay Monthly, if you paid less than $2,500 in payroll.

-

You’ll pay Next Day, if you paid more than $100,000 in payroll.

Note: These are based on your previous quarterly payroll payments.

As there are no state income taxes in Texas you’ll only have to worry about paying your state and Federal unemployment taxes quarterly.

Compliance Requirements

Complete and accurate paperwork is the cornerstone of all compliance requirements, so it is no surprises then that the final step in this process of setting up your employees is to make sure that all the right government tax forms are completed.

Some of these forms are required right when you hire them, while you have the option to wait until year-end for some of the other forms.

For every employee you hire, complete the following forms when you hire them:

-

W4 Federal Withholding Allowance Certificate

-

I-9 Employment Eligibility Verification

Keep in mind that this second group of forms are necessary for every employee, regardless if they’re still working for you at year-end or not.

-

For every employee that works for you throughout the year, you’ll need these forms for each one at year-end: W2 Wage and Tax Statement and/or 1099 Misc. Income – Contractors.

Successful businesses are built on great ideas, great products, and great administration, and while we can’t help with the ideas or products, we’ve got you covered on the administration front.

By following these steps, your small business or startup will be registered with all the appropriate tax agencies. You’ll also know what your tax payment schedule is and how to pay these taxes, assuming this is not being handled by your payroll provider. You’ll even have all the employee forms ready for your staff when they come on board.