Become an insider!

Get our latest payroll and small business articles sent straight to your inbox.

Whether you’re hiring your first employee (or contractor) or your fifty-first, you need to know that you’ve defined the working relationship properly. You need to know the factors that constitute someone being classified as an employee or contractor and which of these factors makes the most sense in terms of your business needs and the needs of the person or people you’re hiring.

Before we dive into the difference between an employee and a contractor, we want to provide a quick overview of the changing employment landscape.

Employment trends and the rise in self-employment.

In Canada, self-employment (contract work) has been on the rise and is currently at 2.9 million — representing an increase of nearly 15% over the past four decades.

Although it hasn’t hit the 45% mark as once predicted by Intuit Canada, the shift brings to light one thing every employer should know — the difference between a traditional employee and a contractor.

Why do some people prefer to be self-employed?

More workers in professional, scientific and technical services have chosen to be independent contractors. Many of these individuals state that they make this choice because it gives them more freedom and independence in how and when they work.

The nature of the work is another factor in self-employment.

Some industries, like marketing and advertising, work on a contract basis with a majority of their clients. That’s the nature of their industry. There are many businesses that don’t need a full-time marketing team or specialized service, which is why it makes sense to contract for these needs.

Conversely, a small business itself needs to look at the industry in which it operates and the role it’s trying to fill to determine if it needs an employee or a contractor. For example, if you’re running a cafe, it’s likely that you don’t need a freelance barista.

What on earth is the gig economy?

Since companies like Uber and Lyft (also known as gig economy giants) have entered the scene, there’s no question that the Canadian labour market has shifted. Both companies have built their models around self-employed drivers who work at will. However, there have been several legal challenges to this because there are times when the lines between employee and contractor get blurred.

The growing rate of remote work.

Remote work or working from home is another trend that shows no sign of slowing down. According to recent research, more than half of workers work outside the office two or more days a week.

While these workers can either be employees or contractors, the point is that with technology, people can work from almost anywhere.

How the difference between an employee and a contractor affects small businesses.

With contract work now growing at a faster rate than permanent employees, almost every small business is faced with the question: “Do I hire an employee or contractor?”

This has also gone hand-in-hand with newly unemployed, skilled middle-aged workers making a career shift into self-employment and Millennials starting their own businesses as a result of fewer traditional job opportunities. In fact, 40% of Millennials have participated in the gig economy.

Small businesses and startups can certainly reap the benefits of self-employment. Depending on the job role, small businesses can employ contractors more easily than employees, subsequently lowering their burn rate.

The key is classification.

There’s often a strong market backlash against employing contractors when they’re actually employees. The technical term for this is misclassification.

Cases against Uber, Scotiabank and Modern Cleaning Concept are clear indicators that the government won’t put up with small businesses purposely misclassifying self-employed workers and hoping to get away with it.

Determining whether someone’s an employee or contractor.

Don’t be ashamed if you don’t know the answer off the top of your head. It’s a question that trips up even some of the most experienced business owners.

As a starting point, it’s best to consult the Canada Revenue Agency (CRA)’s RC4110 Guide. Generally, the CRA determines a worker’s status by looking at:

-

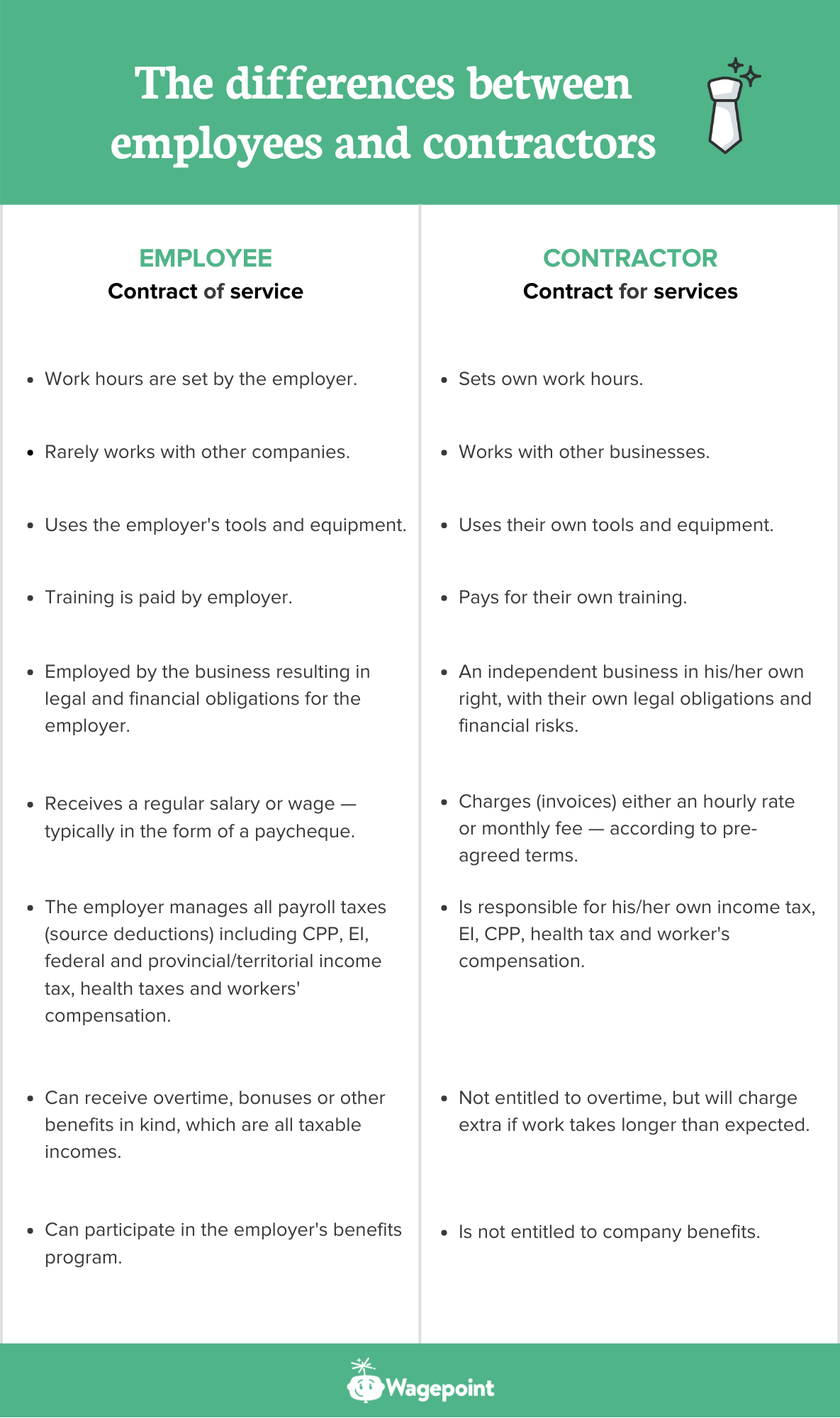

The intent of the relationship. Specifically, they look to see if the written agreement is a “contract of service” — which signals an employer-employee relationship or a “contract for services” — which signals a business relationship.

-

The amount of control the worker has within the relationships. The more that the employer controls the worker, the less likely it is that the person is a contractor. The formal terms for this are “subordination” and “independence.” In the CRA’s eyes, employees are “subordinate” whereas contractors are “independent.”

Additional factors you should consider when determining a worker’s employment status include:

-

Whether the worker provides their own tools and equipment.

-

Whether the worker can subcontract the work or hire assistants.

-

The degree of financial risk the worker takes.

-

The degree of responsibility for investment and management the worker holds.

-

The worker’s opportunity for profit.

-

Any other relevant factors, such as written contracts.

Determining worker status in Québec.

If you’re a business owner in Québec and you and your worker have a disagreement over the worker’s status, then either of you can request for a ruling from Revenu Québec. Regardless of the applicant, the following forms must be filed:

- Form RR-65-V — Application for Determination of Status as an Employee or a Self-Employed Worker

- Form RR-65.A-V — Questionnaire to Determine the Status of an Employee or a Self-Employed Person

Request a ruling from the CRA.

For small business owners outside of Québec, you can ask the CRA for a ruling. There are a couple of ways to do it:

- Log into your CRA account and select “Request a CPP/EI Ruling.”

- Ask your authorized representative to request a ruling.

- Print and complete Form CPT1, Request for a Ruling as to the Status of a Worker under the Canada Pension Plan or Employment Insurance Act and mail it to your designated tax services office.

Note: You must request a ruling before June 30 of the year following your worker’s employment term. For example, if the employment period took place in 2020, the ruling request has to be made before June 30, 2021.

Employees versus contractors — the “pros” and “cons”.

In this section, we’ll discuss the pros and cons of each option. However, we’re putting the terms in quotations because every business is different. A pro for one business might be a con for another and vice versa.

The “pros” of hiring employees:

-

More control over deliverables. As a business owner, you’re able to guide and supervise the work outcome using management techniques, workplace guidelines and key performance indicators (KPIs). Subsequently, this will ensure the work is done as planned, regardless of the volume.

-

More control over work hours. Contractors often set their own work hours as they’re working with other clients. It’s easier for employers to have oversight on work hours as employees are expected to work the specified hours and days outlined in their contracts.

-

Ability to foster better relationships. Compared to client-contractor relations, maintaining employer-employee relationships is generally easier for employers. This is due to the control factor and ability to measure work outputs more easily. Working in the same office also helps.

The “cons” of hiring employees:

-

More management required. A successful business owner needs strict processes and KPIs in order to properly manage employees. Employers are also responsible for all in-house training and the associated costs.

-

Greater financial responsibilities. In each province and territory, a mandated minimum wage needs to be paid. As well, salary costs, including all withholdings, employment taxes and other payments due to the federal and provincial/territorial government(s) and other regulatory agencies are the employer’s responsibility. There are also costs for employee benefits, like health care, pension plans and paid leave, where applicable.

-

Limited talent pool. Depending on the role, skills and seniority, the talent pool can be limited to the business’ locale. This means even where talent is plentiful, there’s usually a talent war amongst competitors, which impacts an employer’s ability to recruit the best talent.

The “pros” of hiring contractors:

-

Less investment in equipment. Employers don’t need to invest in equipment, office space or any capital outlays as that’s the self-employed worker’s responsibility. Additionally, contractors are also responsible for all their own training in order to have the necessary skills to complete a job.

-

Less financial responsibilities. All taxes are paid and reported by the contractor, either as an individual, an incorporated business or a mix of the two.

-

Less supervision required. A good contractor will work without supervision and deliver as expected without instruction.

-

Easier to find skilled employees. It can be easier for companies to find specialist skills at a more cost-effective price from contractors. This is especially true if the contractor isn’t needed at a comparable rate to full-time hours.

-

Flexible contract stipulations. The relationship can expand and contract depending on the needs of the client (your business). Contractors can also subcontract out other aspects of work, thus making it easier for their clients to receive a wider range of services while only doing so through a single provider.

-

Flexible work arrangements. Additionally, both parties are free to cancel the working relationship, depending on the terms of the contract.

The “cons” of hiring contractors:

-

Inability to deduct expenditures. Clients can’t deduct any of those expenditures off their corporate tax bills.

-

Potential for higher costs. If the market favours contractors due to supply and demand, hiring contractors can be more expensive than hiring employees.

-

Greater potential for bad quality work. While in a perfect world a contractor can work without supervision, gaps in communication and expectations can happen. This might force the client to terminate the relationship based on the terms of the contract and seek comparable services elsewhere.

-

Inconsistent availability. As ideal as it may be, contractors aren’t at your beck and call. Since they’re an independent business at their own right, they may already be working with a new client and might not have the capacity to take on your projects.

-

Less control over the work schedule. It’s not always possible to have deliverables completed exactly on your timeline. A self-employed worker will have other clients (otherwise they are actually an employee) and is, therefore, free to set their own working schedule within reason.

The differing tax benefits of employees and contractors.

Where there’s income, there are taxes. Below we outline the different tax benefits to consider when hiring either a contractor or an employee.

Tax benefits of hiring employees:

-

An employee can offset some of the costs of employment through the Canada Employment Credit.

-

The Apprenticeship Job Creation Tax Credit (AJCTC) allows an employer to claim up to $2,000 per year for an “eligible apprentice.”

-

The Co-operative Education Tax Credit in Ontario lets corporations and small businesses claim between 25% to 30% of the cost of hiring a student (either high school or college) for 10 weeks — up to $3,000 as a tax break for a placement.

-

Depending on your province or territory, there are a range of tax breaks, often as a way of encouraging hiring in at-risk regions, older workers, students or young people.

Tax benefits of hiring contractors:

There are no direct (government-funded) tax breaks for hiring contractors, except that the employer is absolved from the responsibility of overseeing federal and provincial/territorial employment tax obligations. That makes hiring contractors a financially viable alternative for many companies, provided the correct employer–contractor relationship is maintained.

Can a contractor become an employee or vice versa?

Yes. And it’s not unusual for this situation to come up. Sometimes people start as contractors but are then hired as employees. Typically, this happens when small businesses want to keep their costs low until the business grows. The flip side is also common. For several reasons, people who started as employees may choose to work as a contractor down the road.

Moving from a being contractor to becoming an employee isn’t automatic. No matter how long the duration — say, one year or even five years — if the contractual and practical terms of the contract of service remain much as it was when the contract was entered into, the contractor does not become an employee after a certain amount of time.

So, how do you go about doing it? You’ll have to formally update the original contract to reflect the new status. That means modifying the agreement from a “contract for services” to “contract of service” or vice versa.

Switching from contractor to employee.

Making the switch will require you to go through the normal procedures of hiring. That means asking them to fill out Form TD1, Personal Tax Credits Return and other traditional employment documents.

As well, you’ll need to understand how the nature of the relationship will change once a worker becomes an employee after being a contractor. Some things to consider are:

- Tax responsibilities. You’ll now be responsible for deducting income tax, CPP contributions and EI premiums from the employee’s paycheque and sending those amounts to the CRA.

- Benefits. Most employees will expect basic benefits, such as health insurance and vacation pay. Knowing this, you’ll likely be including the employee in your benefits plan.

- Employee handbooks. Usually, business owners provide their employees with an employee handbook. It sets clear expectations for them, highlights your legal obligations and defines employee rights. It’ll also help protect your business against employee lawsuits and claims.

Paying employees and contractors.

Not only is having a good understanding of the difference between an employee and contractor important — using software that can recognize the difference is just as crucial. Paying employees and contractors can be difficult since they’re not one and the same. Working with payroll software that has these capabilities will help simplify the payroll process — you’ll be able to skip paying the payroll taxes or apply them easily.

The consequences of misclassification.

Canada is strict when it comes to businesses avoiding paying taxes knowingly. Businesses can face potential prosecution, fines of up to $25,000 and a jail term of 12 months.

Failing to withhold the necessary source deductions ( CPP, EI, and income tax amounts), if done so “knowingly or under circumstances of gross negligence” will result in a fine of 20% of the amount overdue, plus the balance that must be paid.

Late payments also carry a 10% penalty, which would be the case if an employee was knowingly classified as a contractor when that wasn’t the case.

Another result of purposeful misclassification comes with the forms, such as the TD1, which wouldn’t have been submitted to the CRA, and thereby could result in a further $2,500 fine.

There’s also a risk to those who know of or advised this situation to have happened in the first place:

“Tax legislation contains various measures to encourage compliance, including penalties for a third-party who counsels others to file their returns based on false or misleading information, or who knowingly accept false information provided by their clients for tax purposes.”

Employers are deemed to hold funds in trust for the government, which means failure to pay those funds will result in a court judgment being made, allowing the CRA to:

-

Garnish wages or other income sources.

-

Seize and sell assets.

-

Use any other means allowed by the law to collect an amount owing.

Garnishment action allows the CRA to intercept funds payable to you by a third party, such as wages or other income sources, or from any other federal government department owing you money.

Purposeful misclassification is risky business.

It goes without saying, employment law, especially when classifying whether someone is an employee or a contractor is a complex legal matter.

When it comes to assessing the nature of the contractual relationship, the CRA advises that: “In a written contract, the parties may state that in the event of a disagreement about the contents of the contract, it is to be interpreted under the Québec law (civil code), even though the contract was formed for example in Ontario (common law). Depending on where the contract is formed, unless it is stated differently in the written contract, use the set of factors appropriate for your situation.”

An employer who has knowingly misclassified a worker has therefore broken multiple laws, which means the repercussions can be costly and penalties harsh to discourage others. Contractors themselves might be liable, as well as any other third-parties who aided those found guilty.

Make the right hire.

The problem for small business owners isn’t finding talent — it’s finding the right type of talent. Fully understanding the differences between employees and contractors can help you make the best choice. No matter which type of worker you choose, be sure not to misclassify them. The repercussions can be costly.

The advice we share on our blog is intended to be informational. It does not replace the expertise of accredited business professionals.