Become an insider!

Get our latest payroll and small business articles sent straight to your inbox.

Updated February 2018

Becoming an entrepreneur is full of ups and downs. There’s the fun stuff, like interacting with customers, creating awesome products, and living the entrepreneurial dream. But there’s also the not-so-fun stuff — like paying your business taxes.

Tax season doesn’t have to be a nightmare, especially if you plan ahead.

Learn how to prepare for tax season by addressing the five points below, and you will be well on your way to breathing easier when April rolls around.

1. Get — and Stay — Organized

You already know that throwing documents into ever-taller stacks behind your desk isn’t the best way to run your business.

But as long as you can find what you’re looking for relatively quickly, you may not think this method is that big of a deal. Think again!

If you wait until tax season to do your spring cleaning, you’ll spend hours sifting through mountains of paperwork, and the odds are high that you’ll miss something important.

Whether it’s a color-coded filing cabinet or automated tools like Receipt Bank and Hubdoc, if you’re trying to undo some damage, commit yourself to at least locating and saving any financial statements, tax forms you received from the government and any receipts for charitable donations. Then resolve to do better next year! (Maybe make a checklist of the things you’d wished you’d done this year.)

2. Speak the Language of Deductions

While your tax professional will be able to help you navigate the complex and lengthy list of deductions for which your startup might qualify, it helps to have a little knowledge of your own. This way you can make smarter business decisions throughout the year.

For example, take stock of the bad debt that is owed to your business. If you can prove that you loaned money to customers, employees, or even suppliers and they did not pay you back, you may be able to deduct the debt. There are a few extra hoops to jump through, such as proving that you tried to collect on the debt and were unsuccessful, but this can be a great tax-saving deduction if properly used.

As mentioned above, keeping all contracts and loan documents organized and readily accessible will make this process easier.

3. Choose the Right Tools

Many business owners choose to streamline their accounting department with bookkeeping software. It’s a great way to stay organized and save hours on financial tasks, but make sure that your software is helping and not hurting.

Take the time to select the best software for your business’ needs and update it regularly. You want to ensure that your income and expenses are getting tracked accurately, so you’re not wasting countless hours generating manual reports.

4. Gather Necessary Reports Now

Speaking of reports, your tax professional will be forever grateful if you show up with profit and loss statements, a comparative balance sheet, and a retained earnings statement in hand.

If you don’t have or can’t generate these, you may have to pay a hefty fee for an accountant or bookkeeper to do it for you.

Take the time now to experiment with your accounting software and make sure that you are entering all of the data needed to generate your reports. Then, even if you’re missing something at tax time, it will be easy to go back in and find what you need.

5. Listen to the Professionals

As an entrepreneur, you strive to invest your money wisely. Often this means foregoing certain expenses so you can afford others. Don’t let hiring a tax professional be one of the expenses you skip. (Note: When you use a professional bookkeeper or accountant, you may claim the fees as deductions.)

While you might be able to log into basic tax software and knock out your personal returns in an afternoon, your business taxes are another matter entirely. (Although as a business owner, your personal taxes are more complicated too!)

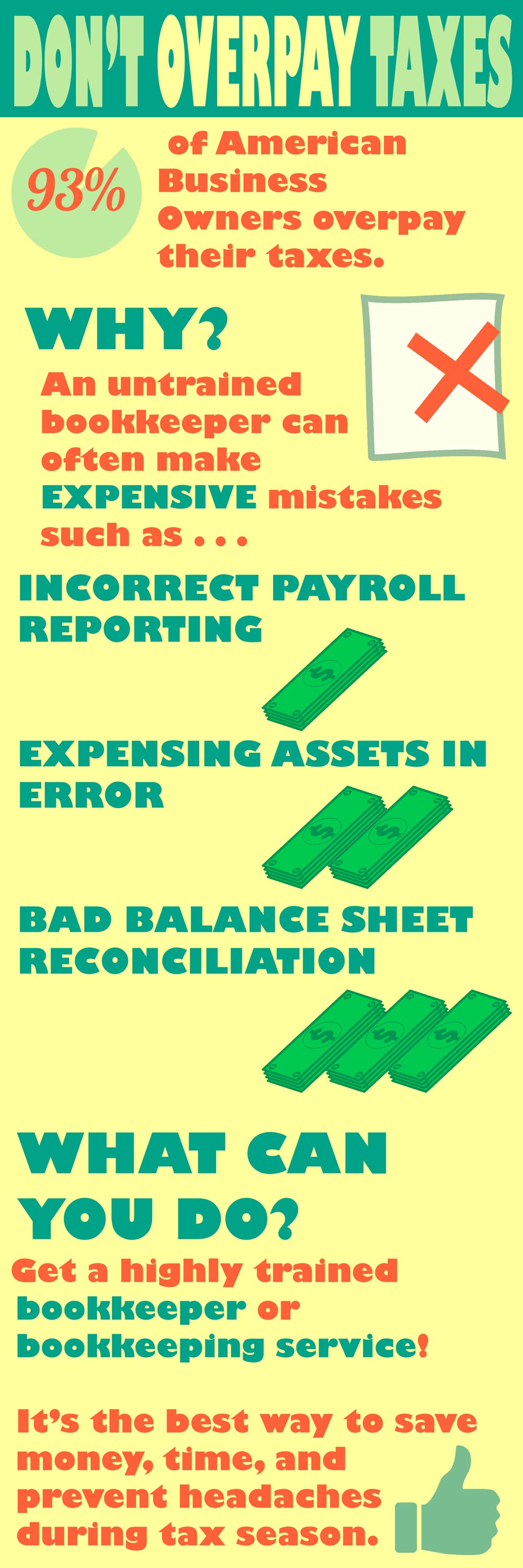

Did you know that 90% of American business owners overpay their taxes? This infographic from SLC Bookkeeping helps explain how professional bookkeepers and accountants can really help.

Professionals, who are well trained and understand how to process your tax information correctly, can greatly reduce the pain of tax time. Plus, you can work on your startup’s next big goal with the time you’ll save hiring a payroll provider. (Note: Business owners are still ultimately held responsible for the forms that are filed. Make sure you work with someone who is certified and who you feel you can trust.)

The information contained in this blog is general. Please consult a tax attorney or other appropriate business finance professional for specific advice.

This blog post by entrepreneur Derek Distenfield (@dDistenfield ). Thank you, Derek.