Payroll management is the set of processes a business undertakes to handle employee compensation. Processing payroll involves tracking and calculating employee hours, deducting taxes, and issuing payments. With effective processes, you can ensure everybody is paid correctly and on time while complying with financial regulations. In Canada, payroll is a tricky territory where human resources […]

Payroll articles and news, from your payroll BFFs.

Payroll management is the set of processes a business undertakes to handle employee compensation. Processing payroll involves tracking and calculating employee hours, deducting taxes, and issuing payments. With effective processes, you can ensure everybody is paid correctly and on time while complying with financial regulations. In Canada, payroll is a tricky territory where human resources […]

As an employer, there are many decisions that you’ll have to make when it comes to hiring and paying your employees. Minimum wage, AKA the lowest hourly pay rate that an employer can pay an employee? That’s not one of them. In Canada, minimum wage by province or territory falls under the domain of the […]

When it comes to the unique needs of your business, payroll software features can make or break which platform you choose. It can be a lifesaver or a time-drainer, and we all know which side of the payroll solution coin we’d rather be on. Good payroll software? It gives you the expertise of managing payroll […]

Of all the things that are prone to internal errors in a company, payroll is certainly the most essential. It sustains the livelihoods of all the employees, maintains a brand reputation and minimizes operating costs. But it’s easy to get it wrong. According to a Ceridian survey, 85% of respondents struggle with payroll technologies, which impedes […]

The Wagepoint 2023 Canada Small Business Payroll Calendar gives you a year-long overview of key small business payroll deadlines so you can focus on running your business without worrying about missing important dates.

Have a smoother payroll year-end with this guide created just for you.

On of the most feared year-end documents is the Pensionable and Insurable Earnings Review (PIER). Unfortunately, that’s because it tends to make payroll professionals or employers feel like they’ve done something wrong. Meaning, there’s a sense of wanting to avoid it at all costs. Before diving into how to avoid a PIER, it’ll first help […]

T4s, T4As and Relevés — what do they have in common, other than the fact that T4A and Relevé rhyme? Or, that you could easily refer to these things as “T4-ehs?” for all the confusion they cause. Don’t worry, this article will help answer some of your most burning questions about these forms. 🔥 What […]

A collection of our best small business articles.

Payroll automation systems are the superhero many finance teams don’t realize they need. Imagine you could recycle all those time-consuming hours spent sweating over intricate spreadsheets, panicking over whether your formulas are up to date and if you’ve remembered to account for tax. Picture yourself getting it all done within a few button clicks, confident […]

Direct deposit is the most convenient and fast way to send money. This digital and secure process saves the hassle and time of cutting physical cheques and money easily makes its way to your employee’s bank account. A win-win for both of you! Technology can feel daunting while tradition can feel comforting. We know that […]

Today’s market features a number of payroll software pricing models. No matter what kind of business owner you are, knowing the different options and how much payroll software costs is the best way to avoid surprise additional expenses. Different payroll software providers also offer different pricing models. Luckily, some include a handy quote generator so […]

When it comes to the unique needs of your business, payroll software features can make or break which platform you choose. It can be a lifesaver or a time-drainer, and we all know which side of the payroll solution coin we’d rather be on. Good payroll software? It gives you the expertise of managing payroll […]

What are some benefits of payroll software for small businesses like you? At first, paying employees for the work they do is something many small business owners do with a spreadsheet or a basic online tool. However, even at this beginning stage, compliance, accuracy, nuance and accessible tools play a role in the success of […]

Payroll software for schools isn’t just about getting teachers and other education staff paid. It’s about bringing value to educational institutions and the unique needs that came to small businesses in this space. Today, we look at some of the best payroll software for the education sector along with its unique human resources and payroll […]

While ADP Payroll is one of the better-known options for payroll services, we’re here to guide you through the best Canadian ADP Payroll alternatives on the market and why people look for alternatives in the first place. You’re a busy business owner, and you need the best possible fit in payroll software. Let’s dive into […]

Of all the things that are prone to internal errors in a company, payroll is certainly the most essential. It sustains the livelihoods of all the employees, maintains a brand reputation and minimizes operating costs. But it’s easy to get it wrong. According to a Ceridian survey, 85% of respondents struggle with payroll technologies, which impedes […]

A collection of our best articles for the accounting and bookkeeping community.

Payroll automation systems are the superhero many finance teams don’t realize they need. Imagine you could recycle all those time-consuming hours spent sweating over intricate spreadsheets, panicking over whether your formulas are up to date and if you’ve remembered to account for tax. Picture yourself getting it all done within a few button clicks, confident […]

Of all the things that are prone to internal errors in a company, payroll is certainly the most essential. It sustains the livelihoods of all the employees, maintains a brand reputation and minimizes operating costs. But it’s easy to get it wrong. According to a Ceridian survey, 85% of respondents struggle with payroll technologies, which impedes […]

The Wagepoint 2023 Canada Small Business Payroll Calendar gives you a year-long overview of key small business payroll deadlines so you can focus on running your business without worrying about missing important dates.

On of the most feared year-end documents is the Pensionable and Insurable Earnings Review (PIER). Unfortunately, that’s because it tends to make payroll professionals or employers feel like they’ve done something wrong. Meaning, there’s a sense of wanting to avoid it at all costs. Before diving into how to avoid a PIER, it’ll first help […]

Clients look to their bookkeeper or bookkeeping firm as their guiding light when it comes to payroll and paying their employees. No surprise then that as a bookkeeping firm owner, we do a lot of payroll. Meaning I needed to find the right payroll software. And my goal was to find a payroll software that […]

When I first started my bookkeeping business, I was using about ten different software for bookkeeping, payroll and organization. Not to mention programs for email, HR and other administrative tasks. Oof. Thinking about it gives me a headache! I knew I had to simplify things — not just for myself, but for my clients as […]

On March 28, 2023, the government released its federal budget for 2023, titled “A Made-in-Canada Plan: Strong Middle Class, Affordable Economy, Healthy Future” (Budget 2023, for short). As inflation has created significant financial hardships for many Canadians, Budget 2023 proposed measures to provide various relief to both small businesses and individuals, while simultaneously tightening certain […]

In this post, we’ll outline the types of payroll deductions you need to make, along with which kind of remittance schedule you’ll need to follow. As advocates of simple, fast, friendly payroll, we’ll do our best to try to make this as painless as possible.

Our best stories about time and attendance tracking for small businesses.

As their name suggests, Olson’s GLO Estate Home for Special Care is a special place. As a small Residential Care Facility, they have the big job of caring for their residents. The last thing Nicole Spinney, Manager, needed was issues with time and attendance that took away from other aspects of running the business. Nicole […]

Meet Jaclynn and Caleb, proud owners of a thriving landscaping business, Elevate Your Landscape. With a bustling operation and a team of hardworking employees, Jaclynn found herself juggling multiple tasks, including the daunting task of time, attendance and payroll management. Let’s dive into their journey of transitioning from manual processes to a more streamlined solution […]

Finding the best employee time management software isn’t just about finding a handy tool — it’s about being functional, smoothing out workflows for your teams and meeting any of the other specific needs a business might have. Whether you’re a small business owner looking to track shifts and billable or non-billable hours for your small […]

One of the best ways a small business owner can make sure employees get to jobsites on time is by using geofence time tracking software. There’s nothing less professional than having your people turn up late, especially when it’s you and your company’s reputation that’s on the line. Let’s go through this list of the […]

Learning how to track employee hours is part of doing business. Time-tracking makes it possible to pay your team the right amount and accurately manage your business workflow. Small businesses don’t have a ton of people to keep track of, so you should be able to streamline team tracking and payroll management on your own, […]

As a small business owner, you know that time is money. Accurate payroll, efficient project management and improved productivity are a big part of your business’s success. But managing time can be a daunting and, well, time-consuming task. Especially when you’re juggling various jobs, specific projects, billable hours, invoices… The list goes on. Keeping up […]

Punch cards, folded up pieces of paper, written timesheets and emails with best-guessed numbers were once the common ways of tracking employee time. For some of you, it may still be! The reality is these methods had their time, and with efficient time and attendance software now here to do the job, we think that […]

We all love a good hack or two that makes life so much easier, and that’s no different for small business owners. Productivity is the name of the game for smooth sailing in small business, so why not use time management tools and other hacks that make it happen? We’ve gathered some of our favourite […]

Our best HR articles and tips.

If you’re a small business owner in Canada, let’s talk about something that’s probably been on your mind: HR software. Now, before you start thinking about daunting spreadsheets and endless forms, let me tell you, there’s a light at the end of the tunnel. Choosing the right HR software can free up your time and […]

Employee management software helps to take the burden of managing HR-related tasks off your shoulders and boosts employee satisfaction in one. With the right tool, your workforce stays productive and happy, and you get to free up time to focus on your core business needs. As a small business owner, you already know how much […]

New employees can be vulnerable, out of their element, stressed, and eager to please. Instead of providing a nurturing environment and offering instant validation, however, many businesses expect their new hires to turn into genuine attack dogs in a matter of weeks, providing little training coupled with high expectations. Given that the newest workforce generation […]

It’s the end of December! Businesses around the world are planning for the new year and thinking about what they’d like to accomplish in the coming year. Call them what you will — goals, objectives, milestones, Key Performance Indicators (KPIs) — it’s important for small businesses to plan and set targets for the business and […]

Whether you’re just starting your small business and looking ahead to your future needs or you’re at the cusp of growth where you’re considering a human resources (HR) solution, you probably have questions. HR gets a bad rap, but realistically, it’s people management, and something you’ll want to consider as you grow your team. So, […]

There are a lot of challenges facing workplaces these days — from employee shortages to layoffs to the continued fight for equal pay. You may have even heard of the two latest buzzwords (that really aren’t new to the workplace at all): Quiet quitting and quiet firing. Quiet quitting = An employee doing the bare minimum […]

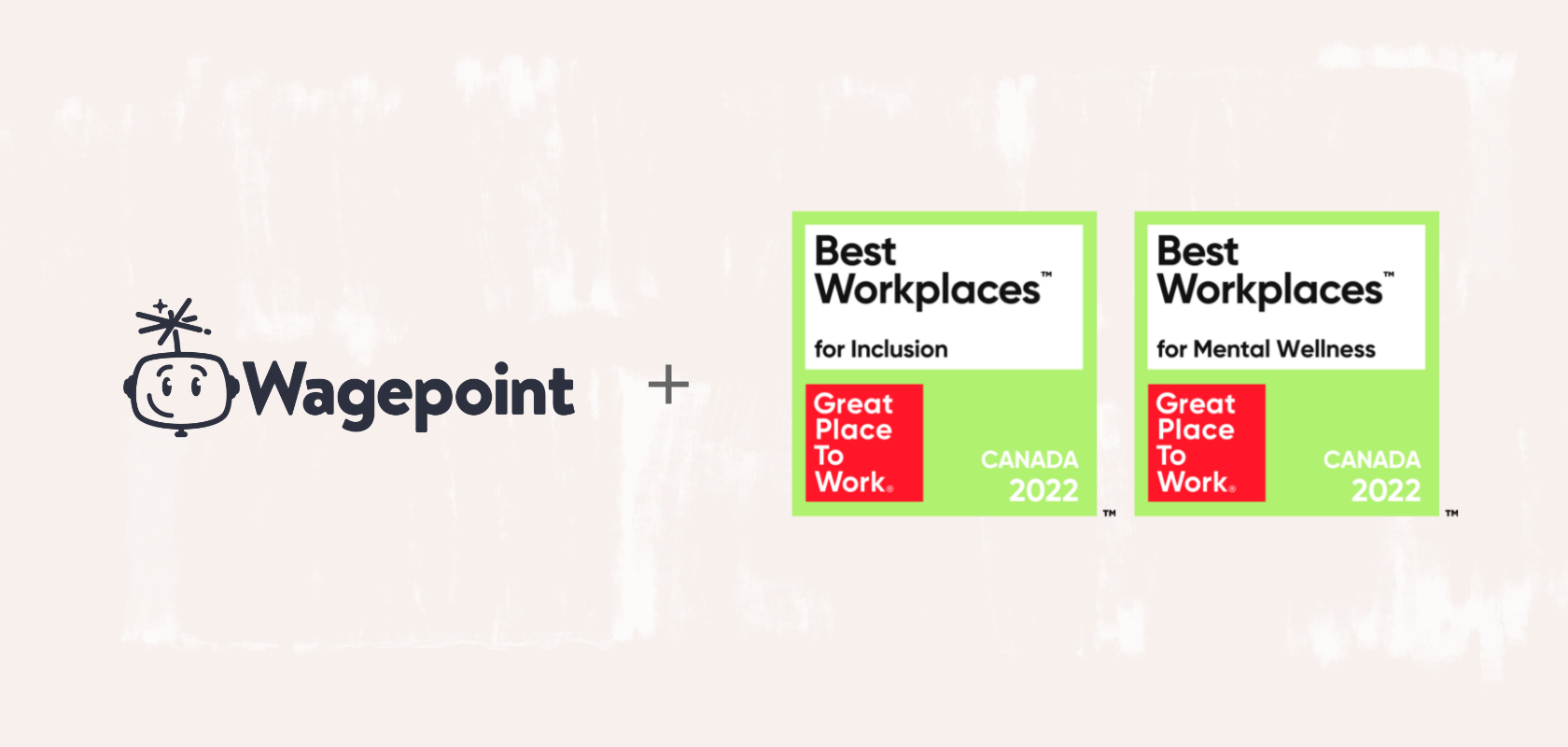

Wagepoint may be in the business of payroll, but it’s the business of people that truly sets it apart. This week, we’re super excited to announce that Wagepoint was named one of Canada’s 2022 Best Workplaces for Inclusion and Mental Wellness by Great Place to Work®, a global authority on high-trust, high-performance workplace cultures. Our […]

Today, Canadian fintech company Wagepoint is doubling-down on its mission to bring happiness to small businesses and their teams with a new acquisition. KinHR – soon to become People by Wagepoint – has joined Wagepoint’s family of products, which will create a single solution that takes payroll, time and attendance and (now) human resources tasks […]

Real stories from real Wagepoint customers, just like you.

“Payroll is now seamless and stress-free.” Meet Dr. Sara Markovic, the driving force behind River Street Endodontics, a specialized dental practice that focuses on root canal procedures. Since opening in August 2019, Dr. Sara has been dedicated to providing top-notch dental care and carving out a niche as the go-to provider for root canals. Her […]

As their name suggests, Olson’s GLO Estate Home for Special Care is a special place. As a small Residential Care Facility, they have the big job of caring for their residents. The last thing Nicole Spinney, Manager, needed was issues with time and attendance that took away from other aspects of running the business. Nicole […]

Meet Jaclynn and Caleb, proud owners of a thriving landscaping business, Elevate Your Landscape. With a bustling operation and a team of hardworking employees, Jaclynn found herself juggling multiple tasks, including the daunting task of time, attendance and payroll management. Let’s dive into their journey of transitioning from manual processes to a more streamlined solution […]

“I value my time as really important. So the work-life balance is crucial.” What do you get when you combine a last minute need for flowers (for your own wedding) with an eye for business? Floral haven Thyme Studio started when co-founder Nas Neufeld was about to get married and didn’t know where to turn […]

As a payroll practitioner and professional bookkeeper, Melissa Lenos, CPB, PCP, of King Business Solutions knows her stuff when it comes to the payroll and bookkeeping process. She understands the implications of many finer payroll details that small business owners might not know to look for, what the consequences are of not meeting compliance or […]

Venom Classics is all about revving up engines and memories. This auto shop specializes in customizing and repairing American classic and muscle cars and trucks between the 50s and the 80s. Co-owner Mary Hinton says the core of Venom Classics is integrity and honesty. Whether doing minor repairs or major overhauls, keeping their clients’ classic […]

As the name suggests, Flux Connectivity‘s space is connectivity equipment such as cables, wire harnesses, junction boxes and control panels. Founded in early 2018, the Alberta-based company describes itself as an innovative contract manufacturer of various connectivity products, but they aren’t just making any old cables and boxes. The company’s mix of 16 employees and […]

Walk the Store is a force behind brands in the Consumer Packaged Goods (CPG) space looking to get their products on store shelves. The mission doesn’t stop at representing a brand to a retailer and getting their items on the shelf. The brokerage also strives to help brands build relationships with retailers that’ll give them […]

Extra! Extra! Get the scoop on the latest Wagepoint news.

As we bid farewell to 2023, it’s not just another year in the books; it’s a chapter of growth and partnership that we’re proud to share with our incredible accounting and bookkeeping allies. In 2022, we witnessed the unwavering dedication of accountants and bookkeepers across Canada, as they embraced the theme of “Evolve and Grow.” […]

Wagepoint may be in the business of payroll, but it’s the business of people that truly sets it apart. This week, we’re super excited to announce that Wagepoint was named one of Canada’s 2022 Best Workplaces for Inclusion and Mental Wellness by Great Place to Work®, a global authority on high-trust, high-performance workplace cultures. Our […]

Today, Canadian fintech company Wagepoint is doubling-down on its mission to bring happiness to small businesses and their teams with a new acquisition. KinHR – soon to become People by Wagepoint – has joined Wagepoint’s family of products, which will create a single solution that takes payroll, time and attendance and (now) human resources tasks […]

Inspired by small businesses who love simplicity and hate doing things the “ugh” way, Wagepoint is excited to announce a new integration with our friends at Xero, the global small business platform that helps SMBs and their advisors grow and thrive. (We love that!) Our relationship levels-up this week with the release of a new […]

Wagepoint announces its first acquisition deal with Timesheet Mobile (TSM), a like-minded friend and leader in geofence-enabled workforce management for small businesses in over 30 countries.

FoundersBeta is a global online community of founders, innovators and change-makers with over 6000 members. They’re on a mission to become the number one online destination for startups and scaleups across the globe to find top talent and resources. Wagepoint is proud to announce our partnership with FoundersBeta. We firmly believe in their mission and […]

“Awesomesauce” is not a word typically used to describe payroll companies, but for the People Ops team behind Wagepoint’s human resources successes (and shenanigans), it’s exactly the type of compliment that fits. The fintech company known as the world’s friendliest payroll provider is now being recognized for being a friendly employer, too, with a Silver […]

We’re excited to announce that Anastasia Valentine, Wagepoint’s very own Chief Revenue Officer (CRO), is the latest trailblazer in business to be accepted into the Forbes Business Development Council! The Council is an esteemed, invitation-only community for senior-level sales and business development executives from all walks of business. We are honored to welcome Anastasia Valentine […]

Handy research and reports about small businesses, accounting and payroll.

The Wagepoint 2023 Canada Small Business Payroll Calendar gives you a year-long overview of key small business payroll deadlines so you can focus on running your business without worrying about missing important dates.

New employees can be vulnerable, out of their element, stressed, and eager to please. Instead of providing a nurturing environment and offering instant validation, however, many businesses expect their new hires to turn into genuine attack dogs in a matter of weeks, providing little training coupled with high expectations. Given that the newest workforce generation […]

Have you ever wondered how much it costs your small business to pay its employees? Do you want to know what percentage of your revenue is being spent on payroll? Are you curious about how many hours your employees are working each week? The answers to these questions lie in your payroll reports! Payroll reports […]

Welcome to your all-in-one resource for T4s! ‘Tis the season to fill out or generate these forms to hand off to the Canada Revenue Agency (CRA) and your employees, so we thought it’d be handy to have the information you’ll need in one place. Whether you’re doing so manually or using a payroll software like […]

It’s no secret that the pandemic has challenged and continues to challenge businesses across Canada — and let’s not think about the fact that 2022 sounds like “2020, too.” Whether it’s reducing the amount of people you can have in your shop or a complete, temporary stoppage of operations, responding to these situations can look […]

Quick Links Request the report Business resilience defined What the numbers and businesses say The 2021 Canadian Small Business Resilience Report. As we look back on the events of 2020 and the ongoing social and economic impacts, narratives will be dominated by the word “pandemic.” However, as our research has uncovered, conversations about the past […]

In our fast-paced world, sometimes picking up the phone is the best way to ensure proper communication and get a problem resolved for our clients. Although you may not have time for a friendly chat, our friends at the Canada Revenue Agency (CRA) do. Emails are a frequent way to communicate on a timely basis, […]