Become an insider!

Get our latest payroll and small business articles sent straight to your inbox.

Payroll can mean completing a lot of scary tasks for small business owners — like making the right calculations and filing taxes correctly and on time to the government. On top of that, consider needing to make corrections during a busy year-end season! Now that sounds like a real nightmare.

As the old adage goes, mistakes happen — and we all make them! So first thing’s first: Go easy on yourself. We’re human, after all, and sometimes we overlook something or our fingers seem possessed and input whatever they please.

How to keep your payroll accurate, all year long.

The thing with payroll errors (or payroll terrors 😉) is that they can be like ghosts lurking about and coming to haunt you when you least expect. But, by keeping your payroll on track all year long, you can have a smoother year-end, feeling confident that a mistake from months ago won’t be causing you stress. That’s boo-tiful, right?

At Wagepoint, we like to deliver treats, not tricks — we promise! That’s why we’ve put together this guide for small business owners for avoiding payroll errors and hitting the ground running this year-end season.

1. Be mindful of your employee setup.

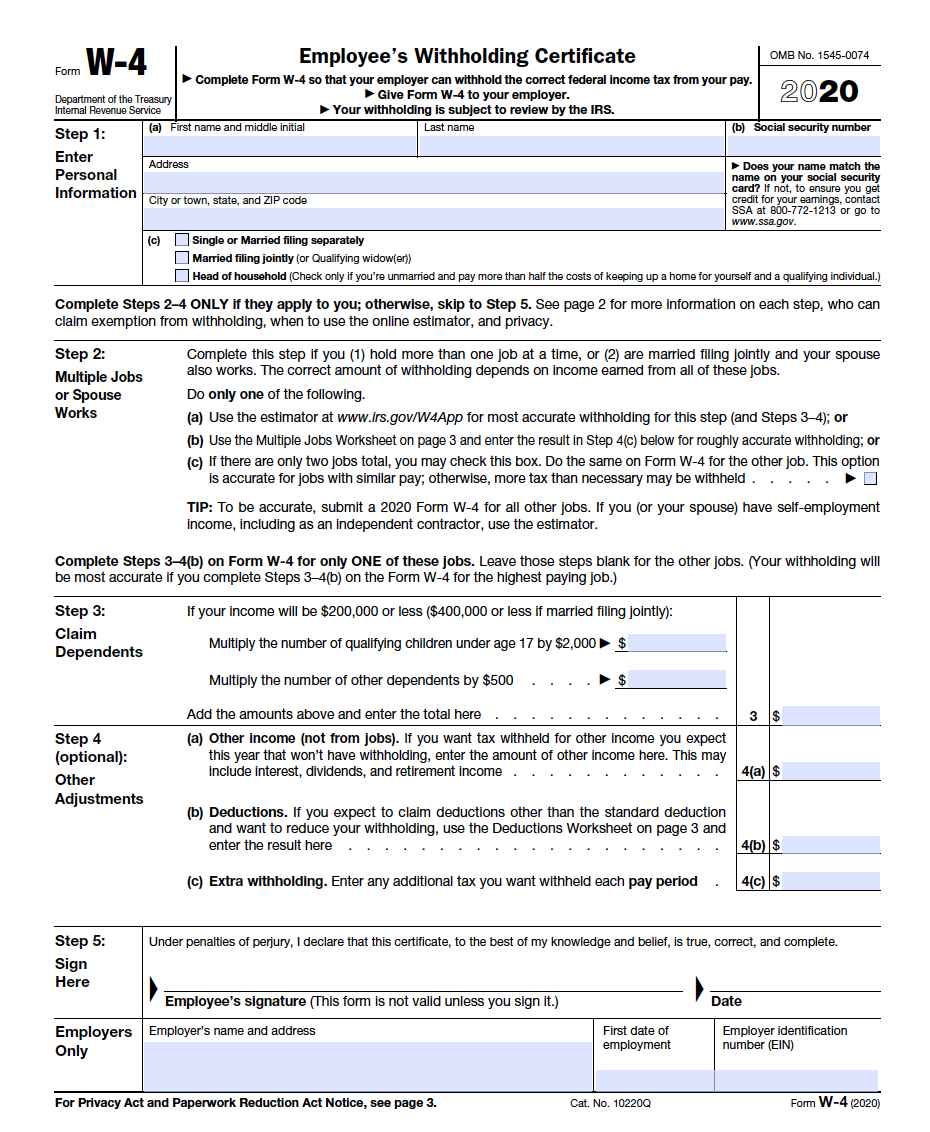

With employee setup, we’re looking at things like the TD1 Personal Tax Credit Return form (TD1) if you’re from Canada or Form W-4 Employee Withholding Certificate (W-4) if you’re from the United States. This is where you make sure employees have correct tax amounts and exemptions at both the federal and provincial or state levels.

For instance, something as simple as the “Date of birth” field on a TD1 can mean the difference between having hired someone with a realistic age whose taxes are correctly deducted versus an immortal being well beyond tax-paying age.

Don’t get caught in a web of provincial payroll taxes.

Speaking of taxes, let’s look at provincial payroll taxes in Canada. Say you have an employee that needs a TD1 for Québec, but you’re using the TD1 information for Ontario. You’ve been running payroll with those calculations, and now you realize the employee needs the information for Québec instead!

These two provinces have different tax requirements and even tax agencies to submit to. It can be a mess to unravel this kind of error, and it’s not something you want to be dealing with at year-end.

Not sure which provincial or territorial TD1 your employee needs? Check out this guide from the Canada Revenue Agency (CRA).

Not sure which provincial or territorial TD1 your employee needs? Check out this guide from the Canada Revenue Agency (CRA).

Use the most current Form W-4.

In the US, this same sort of issue can occur with Form W-4s, so make sure your employee has both a federal Form W-4 as well as the correct state Form W-4s.

Payroll errors can also come from using the wrong Form W-4. In 2020, the Internal Revenue Service (IRS) updated the Form W-4, but some companies still haven’t made the switch!

One way to avoid payroll mistakes with these kinds of forms as a small business owner is to keep an eye out for changes and to carefully read through the new versions. Not just the skim we do with Apple and Android agreements — a thorough, careful read!

That way, you’ll know what details your employee(s) should be providing, enter the information for your payroll correctly the first time and not have to scramble to make changes before handing out Form W-2s.

Learn more from our deep dive of the Form W-4 changes.

Learn more from our deep dive of the Form W-4 changes.

2. Get familiar with payroll laws and regulations.

We know… this is probably one of the least glamorous parts of payroll, but this is where some of the most hair-raising consequences of payroll errors can occur. Stopping for a spell to get to know about things like the regulations for different payroll items and procedures now will save you a lot of trouble later, including during year end.

For Canadians, that might mean exploring vacation policy regulations, which can vary by province when it comes to how it accrues, as well as the actual accrual rates. Or it could mean studying up on statutory holiday calculations and pay so your employees get the right pay when they work holidays.

Get started with getting to know stat holiday worker eligibility and pay outs.

Get started with getting to know stat holiday worker eligibility and pay outs.

Reciprocal tax agreements.

For our friends across the border, it might be reciprocal tax agreements that make heads spin. What even are reciprocal tax agreements? Good question! These are agreements between states when an employee lives in one state but works in another. A reciprocity agreement means the employee doesn’t have to file state and local taxes for the state where they work.

Not all states have this agreement, though, which is why you should get familiar with this and other regulations before processing to avoid payroll errors.

3. Review numbers and dates before completing payroll.

Whether you’re calculating payroll yourself in a spreadsheet or using a payroll software like Wagepoint that automates calculations during pay runs, reviewing the numbers and dates is key to avoiding mistakes.

Typos that invert numbers, missed digits, mixed up formulas, incorrect pay dates or pay periods and other kinds of data entry fumbles like these can cause big problems. A 2008 study notes that when it comes to manually entering data into spreadsheets, the likelihood for human error is between 18 and 40 percent. Eep!

It’s better to double check now rather than have to double back farther down the line to find where things went askew. Flex those attention to detail muscles by reviewing the page or screen and make use of reports, such as Wagepoint’s Payroll Register Report, that can give you another perspective on your data. That way, you’ll have confidence everyone is getting paid correctly and that your books are sound for the year-end push.

Curious what reports Wagepoint has to help you with your payroll? Check out our Report Library.

Curious what reports Wagepoint has to help you with your payroll? Check out our Report Library.

Wagepoint can help you fix payroll mistakes.

Sadly, there are no payroll error exorcists. (How awesome would that be though?) If you’re using Wagepoint and notice an error in your pay runs, you can contact Customer Support! Consider us your friendly sidekick through a haunted forest — one who won’t judge if you get spooked by something frightening.

A member of the Wagepoint team will let you know the best solution and, if it comes to it, they can take steps to fix the payroll mistake. What they’ll do to correct the payroll depends on whether or not the money has been withdrawn for the pay run.

In either situations, there are two key things to know about the Wagepoint process for correcting pay runs:

- Correcting the pay run can take time to complete.

- Correcting the pay run may have a fee attached to it.

This is why it’s so important to be mindful of details, know your stuff and review your information when processing payroll as a small business owner. Taking these steps will help you avoid being haunted by payroll errors and breeze through year-end like a pro.

Additional reading.

- 3 Payroll Nightmares You Might Have This Halloween

- Have No Fear, Here’s How To Avoid A PIER This Year!

Disclaimer: This article is intended to be informational and does not replace the need for working with an accountant, bookkeeper or other financial professional. While every care has been taken to ensure the accuracy of this content, the relevant laws undergo constant revision. It is a best practice to stay informed on these topics and to consult with experienced professionals. Any errors or inaccuracies brought to our attention will be corrected as quickly as possible.