Become an insider!

Get our latest payroll and small business articles sent straight to your inbox.

Updated January 24, 2022

When the calendar turns to the start of a new year, small business employers, and the accountants, bookkeepers, and payroll processors that support them, start thinking about closing out the payroll year. There are several things that are of importance that need to be done, forms that need to be considered, beans to be counted… and it can get a bit overwhelming for those that are not as familiar with the process, for example, a new employer or new bookkeeper.

5 things to check when reviewing T4s.

Before I share my list of five things to verify before submitting your T4 forms, I wanted to call out a guide that can help you get started. A Canadian Small Business Employer’s Guide to T4s and T4As is a very comprehensive overview of these two payroll forms, what they are, when they need to be prepared. I am not going to delve into what’s already been tackled in the guide. Instead, I’ll expand on a few best practices that years of work in accounting and payroll have taught me.

1. Check (and re-check) that checklist.

As the payroll processor (whether business owner or accounting pro), having a checklist for the payroll year-end to understand the information you need, and need to do, is incredibly useful. It is also important, however, to consider some best practices and tips that might not be on your current checklist.

To get started, download the year-end checklist from the link in the guide above. Now, let’s build on that to make this payroll year-end smooth sailing!

2. Verify employee and subcontractor details.

As part of the checklist, verifying details, such as SIN and first and last name, are of course very important. But what if there was an error in the SIN that you are not aware of or that the employee did not tell you after you filed last year? In most cases, this doesn’t stop the Canada Revenue Agency ( CRA) from filing the forms, but it is an error that should be remedied for the current year.

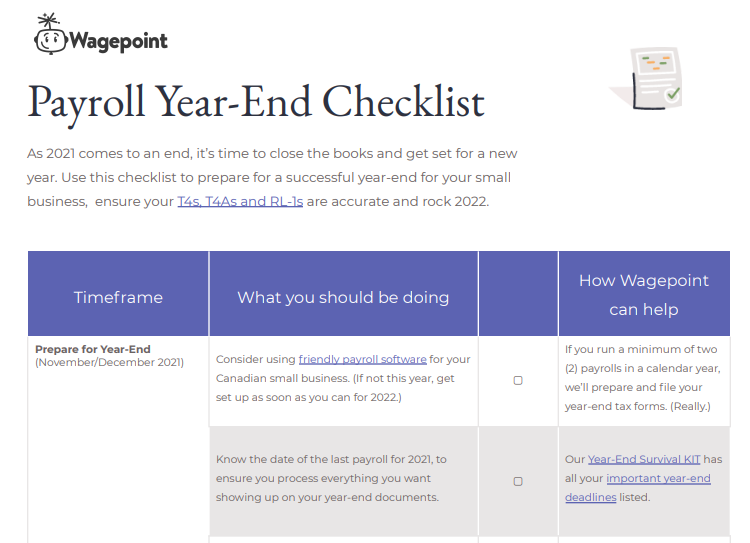

How to know if there’s an error in a SIN

If you have been filing the T4s and T4As directly with the CRA and there was an SIN error, the CRA does not advise you of this with paper anymore. In fact, you likely won’t receive any notification other than through the online portal. In the Message Centre of the CRA account (business portal or represent a client access) you will see a notification telling you that there is an issue with one of the SINs you provided. You will then go to the Payroll section (RP) and click on Download Reports. This is where you will be told which SINs need to be corrected going forward.

When it comes to subcontractors, sometimes payroll processors are unaware of the need to complete T4As (or T5018s for construction contractors) until they are finishing their year-end reviews. This is likely an issue if the bookkeeper and payroll processor are two different people.

One of the most frustrating things is when you do realize you have subcontractors that require these forms, but you do not have the necessary details to complete them. Begin your year-end review well before the filing deadline so that you can collect this information with time to spare. If you need a refresh on who you need to file these forms for, you can find the rules surrounding subcontractors and T4As and T5018s on the CRA website.

💡 Best Practice Tip: When a new subcontractor is retained, gather this information beforehand, just as you would an employee, so you have what you need for the year-end forms. If the bookkeeper does not manage the payroll as well, make sure they know to advise the payroll team of the need for subcontractor year-end forms and to provide the necessary details.

3. Confirm additional payments to Owner-Managers and Shareholders.

Part of the year-end process is reviewing gross earnings and source deductions and to ensure they are being reported correctly. But what if there were payments made to owners/shareholders that were not processed through the payroll software?

Shareholders of corporations have a couple of ways to take money from their business.

They can take a dividend based on the equity in the business or they can pay themselves as an employee of their business. The choice is most often made based on the owner’s personal tax situation and what is best for the corporation. Some business owners do not take salaries throughout the year and often choose to take a management bonus or bulk payment at the end of the calendar or fiscal year. This is still a payroll transaction and needs to be treated as such. The same applies for year-end bonuses to management or employees, if not processed through the payroll software.

Year-end bonuses are taxable income

Withholdings and company contributions (payroll taxes) must be applied, and then those deductions must be submitted by January 15 if the payment was made in December to the owner/shareholder. For example, a payment made in December 2021, would be due January 15, 2022.

How to calculate payroll taxes on a year-end bonus

Make sure to use a payroll calculator, or the CRA’s Payroll Deductions Online Calculator, to help you determine the proper amounts of CPP, EI (if not EI exempt) and income tax that need to be withheld and contributed. (This post also provides sample calculation methods.) This payment can be done through the CRA’s My Payment feature, or through your business bank account if set up.

💡 Best Practice Tip: If the owner did not take a salary or bonus, but the year-end accountant has determined a dividend needed to be paid from the corporation be sure to clarify whose responsibility it is to create the T5 slip. This way, as the payroll processor, you know if you need to get that done along with the T4s, as they are due at the same time.

👉 Download the 2022 Canadian Small Business Payroll Calendar.

4. Double-check those CRA balances.

As mentioned in the previous section, the final payroll withholdings for the previous year are due by January 15. This date is also very important because this means this is also the final payment (remittance) date for any missed payroll liability payments or additional liability payments for payroll paid during the calendar year — if you hope to avoid any additional penalties for non-payment. If you have missed liability payments throughout the year, you have likely been hit with some penalties and interest already. But if you wait until you file your T4s to make up for any discrepancy or add-on, you will be late again, and it will likely result in a failure to pay penalty.

The amount submitted to the CRA is equal to the CPP/EI and income tax withholdings from your/employees’ paycheques, along with the company’s contributions for CPP/EI. In reviewing your payroll files, or preview copies of your T4s/T4 summary, if the total you have is different, that means you did not send enough money to the CRA.

Remember though, you likely have not sent in December’s remittance yet, so take that into consideration too. Any excess is what you need to add to that December liabilities payment to make sure you balance and to hopefully avoid any additional penalties.

Is this the same as a PIER?

This might sound to you like you are doing your own Pensionable and Insurable Earnings Review (PIER), and in a sense you are, but more to ensure you’ve paid what you’re telling the CRA you have withheld and contributed vs the calculations of the deductions themselves.

5. Complete a final T4 figure check.

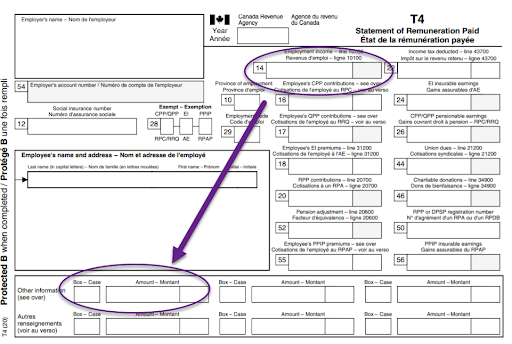

Even if you are using software, like Wagepoint, to prepare your T4 slips and summary, it is still important to review those T4 forms. Though the pensionable and insurable earnings amounts (CPP/EI) are very important and should be reviewed, there is often an amount that gets missed as it is not fully understood.

Don’t forget any taxable benefits!

These are amounts that, depending on what benefit or allowance it is, may need to be reported in box 14, Employment Income, and box 40, Other Taxable Allowances and Benefits, on the T4 slip. Some taxable benefits also require CPP or EI to be deducted, and those amounts reported on the T4 slip; you may have another amount to remit before January 15, if you have not taken these deductions on these benefits into consideration already.

If you have paid a taxable benefit but did not pay it through your payroll software then the software won’t know to report it on the T4 slip it creates, you will need to amend them before filing with the CRA. Some of the most common taxable benefits are contributions to RRSPs, Gifts, and Meal and Vehicle Allowances. However, there are many more that need to be considered. Review the taxable benefits chart on the CRA website to make sure you have handled the deductions properly, and you are reporting the amounts accurately on the T4 slip.

💡 Best Practice Tip: If you can, pay your taxable benefit allowances through your payroll software so they are taxed and tracked properly. If the benefits mostly consist of non-cash items or items that cannot be paid through the payroll software, be sure to have a tracking sheet so you are ready to complete your T4s on time, accurately.

When all is said and done.

After you’ve filed your T4s, and other forms with the CRA, it isn’t unheard of to have to make corrections or even create forgotten slips. If you’ve made an error, don’t panic. Correcting a T4 is actually quite simple and can be done through the CRA’s Web Forms.

No matter how much we try to be careful and thorough, and no matter how many checklists we follow, errors happen. Whether it is a typo in a SIN or forgetting the taxable benefit, the important thing is to fix it and learn from it for next year. Also, you must let the employee know there is an error right away and that you will be reissuing a new slip, so they don’t use the incorrect one for their tax return.

How to find payroll training or support.

If you are an accounting professional looking to boost your payroll skills, the Canadian Payroll Association offers education and training through online seminars and sessions, and payroll resources.

Consider also moving from a manual payroll process to software, like Wagepoint. Using this small business payroll software, with accredited payroll professionals backing it, will take the stress out of your filings, and make paying your employees, and pleasing the CRA, a breeze!

How to find a bookkeeper to help with your payroll.

Payroll can be difficult and complicated, but you don’t have to go it alone. Whether you are the payroll processor, or you’re looking for one, there are a lot of talented professionals out there able to help you get through it pay period by pay period, or even just at year-end. Looking for some help? Let Find Our Bookkeeper™ connect you with the right accounting professional for your needs.

The advice we share on our blog is intended to be informational. It does not replace the expertise of accredited business professionals or the responsibility of the business owner to ensure compliance.

To qualify for complimentary T4s with Wagepoint (included as part of your standard fees) — a business must run a minimum of two (2) payrolls in the current calendar year.

Remittance and reporting capabilities within Wagepoint vary by location.