Become an insider!

Get our latest payroll and small business articles sent straight to your inbox.

Every time you run a payroll to pay your employees, they get their paycheque emailed or mailed out to them.

As an employer, you are legally required to provide your employees with a record of their payroll i.e. a paycheque, so you are doing your part in being compliant when you give your employees access to their paycheques.

However, for most employees, it is just a slip of paper that they ignore until they need to show copies of their most recent paycheques to get that rental agreement/car loan, etc. approved.

Our theory is that by making it easier for your employees to understand their paycheques, they’ll be less inclined to ignore that all important payroll notification on pay day.

To accomplish this task, we have compiled a comprehensive list of all the key elements your employees will find on their paycheques and everything they need to know in understanding how to figure these payroll amounts.

All you have to do is share this post with your company and everyone will be one step closer to understanding their pay stub.

The Key Components of a Paycheque

Employer & Employee Details

Typically, a paycheque should include your business details like company name and address. In addition, it should have the employee’s full name, spelled correctly, as well as their home address.

The home address comes in handy when your employees need to use the recent copies of their pay stubs when completing certain applications, like the ones mentioned earlier.

So, as an employer, you should always ensure that addresses for all your employees are kept up-to-date.

Payroll Cycle Details

The paycheque should include the payroll cycle dates so that your employees always know for what time period they are getting paid.

This typically matches up with your payroll frequency, unless you are running an off-cycle payroll. It’s for the same reason that dates should be available on the paycheque.

The paycheque should also list the employee’s pay rate and indicate if that’s an annual or hourly amount. This will help both you and your employee keep track of any raises they receive and ensure that the right amount is being used in payroll calculations.

There are four types of payroll frequencies, and while bi-weekly or semi-monthly payrolls are the most common, some small businesses and startups might process payroll on a monthly or weekly basis.

|

Payroll Frequency |

Number of Pay Periods |

Type of Worker |

Costs & Processing Time |

|

Weekly |

52 pay periods 40 hours per pay period for hourly employees |

Typically used with hourly employees in the trades i.e. construction, electricians, etc), and the standard is to hold back the payroll by one week. |

Can be an expensive and time consuming frequency |

|

Bi-weekly |

26 pay periods 80 hours per pay period for hourly employees |

The payroll frequency commonly used with salaried employees. |

Either one of these frequencies can be manageable from a processing time and cost standpoint. |

|

Semi- monthly |

24 pay periods 86.67 hours per pay period for hourly employees |

||

|

Monthly |

12 pay periods 173.33 hours per pay period for hourly employees |

This frequency is only used with salaried employees, or contractors who are billing you for hours worked on a monthly basis. |

This frequency offers small business owners the most convenience in terms of cost and processing times. |

Depending on the frequency your company uses, there will be a specific number of pay periods each year. It helps if your employees keep this in mind when they are reviewing the payroll calculations on their paycheques.

Federal & Provincial Taxes

In the words of Benjamin Franklin, “In this world nothing can be said to be certain, except death and taxes.”

Sure enough, all paycheques will have a tax component unless you hire mostly self-employed/contract workers.

As an employer, you are responsible for withholding and remitting all the federal and provincial taxes owed on behalf of your salaried employees. With self-employed/contract workers, the responsibility of paying those source deductions lies solely with the worker.

There are two kinds of taxes that are accounted for on the paycheque – Federal and Provincial taxes. Depending on your employees’ gross payroll amounts, they will be taxed at different percentages because of the graduated income tax system in Canada.

Your salaried employees could be paying anywhere from 15 – 29% in Federal Income tax and these amounts are adjusted each year to account for inflation and other factors.

In addition to Federal Income tax, you are also responsible for remitting the provincial taxes applicable for each employee, based on their location of work.

Provincial/Territorial Tax Rates for 2015

|

Provinces / Territories

|

Rates | Range |

| Newfoundland and Labrador | 7.7% on the first $35,008 of taxable income, + | 7.7% – 13.3% |

| 12.5% on the next $35,007, + | ||

| 13.3% on the amount over $70,015 | ||

| Prince Edward Island | 9.8% on the first $31,984 of taxable income, + | 9.8% – 16.7% |

| 13.8% on the next $31,985, + | ||

| 16.7% on the amount over $63,969 | ||

| Nova Scotia | 8.79% on the first $29,590 of taxable income, + | 8.79% – 21% |

| 14.95% on the next $29,590, + | ||

| 16.67% on the next $33,820, + | ||

| 17.5% on the next $57,000, + | ||

| 21% on the amount over $150,000 | ||

| New Brunswick | 9.68% on the first $39,973 of taxable income, + | 9.68% – 17.84% |

| 14.82% on the next $39,973, + | ||

| 16.52% on the next $50,029, + | ||

| 17.84% on the amount over $129,975 | ||

| Quebec | 16% on the first $41,935 of taxable income, + | 16% – 25.75% |

| 20% on the next $41,930, + | ||

| 24% on the next $18,175, + | ||

| 25.75% on the amount over $102,040 | ||

| Ontario | 5.05% on the first $40,922 of taxable income, + | 5.05% – 13.16% |

| 9.15% on the next $40,925, + | ||

| 11.16% on the next $68,153, + | ||

| 12.16% on the next $70,000, + | ||

| 13.16% on the amount over $220,000 | ||

| Manitoba | 10.8% on the first $31,000 of taxable income, + | 10.8% – 17.4% |

| 12.75% on the next $36,000, + | ||

| 17.4% on the amount over $67,000 | ||

| Saskatchewan | 11% on the first $44,028 of taxable income, + | 11% – 15% |

| 13% on the next $81,767, + | ||

| 15% on the amount over $125,795 | ||

| Alberta | 10% of taxable income | 10% |

| British Columbia | 5.06% on the first $37,869 of taxable income, + | 5.06% – 16.8% |

| 7.7% on the next $37,871, + | ||

| 10.5% on the next $11,218, + | ||

| 12.29% on the next $18,634, + | ||

| 14.7% on the next $45,458, + | ||

| 16.8% on the amount over $151,050 | ||

| Yukon | 7.04% on the first $44,701 of taxable income, + | 7.04% – 12.76% |

| 9.68% on the next $44,700, + | ||

| 11.44% on the next $49,185, + | ||

| 12.76% on the amount over $138,586 | ||

| Northwest Territories | 5.9% on the first $40,484 of taxable income, + | 5.9% – 14.05% |

| 8.6% on the next $40,487, + | ||

| 12.2% on the next $50,670, + | ||

| 14.05% on the amount over $131,641 | ||

| Nunavut | 4% on the first $42,622 of taxable income, + | 4% – 11.5% |

|

7% on the next $42,621, + |

||

| 9% on the next $53,343, + | ||

| 11.5% on the amount over $138,586 |

Sources: Canada Revenue Agency and Revenu Quebec

Your employees should review their paycheques often to ensure that you are remitting the right amount of Federal and provincial withholdings on their behalf.

Employment Insurance (EI)

As per the CRA, you have to deduct EI premiums from your employees’ insurable earnings, and it is your legal responsibility to pay 1.4 times the amount of your employees’ premiums.

The maximum insurable earnings amount and EI rate is provided by the CRA, so if you are using online payroll software to process your payroll, check with your provider to make sure that these updated amounts are being used in payroll calculations.

The EI rate for 2015 and 2016 is set at 1.88%, so for every $100 of insurable earnings, the employee contribution is $1.88 – the employer contribution would be 1.4 times that total employee premium, which would work out $2.632 per $100 in insurable earnings.

Assuming that your employees know what line items on their payroll are insurable, the method to determine if the right EI amount is being remitted is by multiplying all insurable earnings by 1.88%.

There are certain cases in which you might be able to pay a reduced amount or don’t have to pay EI at all as an employer:

-

If you provide your employees with a short-term disability plan, you may be eligible for a reduction on the employer portion of your EI contribution.

-

You are also exempt from paying out EI on behalf of your contract workers, and independent contractors also cannot collect EI benefits.

From an employee standpoint, these EI contributions have to be paid with each job, even if they hold multiple jobs with different employers within the year. And even if the employee reaches the maximum insurable amount for the year in a previous job, he/she still has to pay EI premiums for the year in their other jobs.

Canada Pension Plan (CPP) or Quebec Pension Plan (QPP)

If your employees work in Canada and are between the ages of 18 – 70, they have to contribute to the CPP, and these amounts are deducted from their pensionable earnings. The CPP was set up to provide pensions and benefits when contributors retire, die or become disabled.

However, there are a few cases in which employees don’t have to contribute to CPP:

-

If the employee is not in pensionable employment during the year,

-

Is considered to be disabled under the CPP or the Quebec Pension Plan (QPP), and

-

If the employee if 65 – 70 years old and has completed Form CPT30 to stop contributing to the CPP.

The CPP contribution rate for 2015 is set at 4.95%, and the QPP contribution rate is 5.25%, up to a maximum of $53,600 in annual pensionable earnings in both cases.

These contributions have to be withheld at source for your salaried employees, but your contract workers are responsible for making both the employer and employee contribution payments directly.

CPP exemptions are set at $3,500 per year, and in order to get the amount owed with each pay period, you would divide the $3,500 by your company’s payroll frequency. So, for a bi-weekly payroll frequency, the CPP exemption would work out to $134.61 per pay period.

Once you’ve worked out the CPP amount, based on your company’s payroll frequency, you need to subtract that amount from the total pensionable earnings and then multiply the amount by 4.95%, which is the CPP contribution rate.

This calculation will help your employees determine whether the right amount is being paid towards CPP.

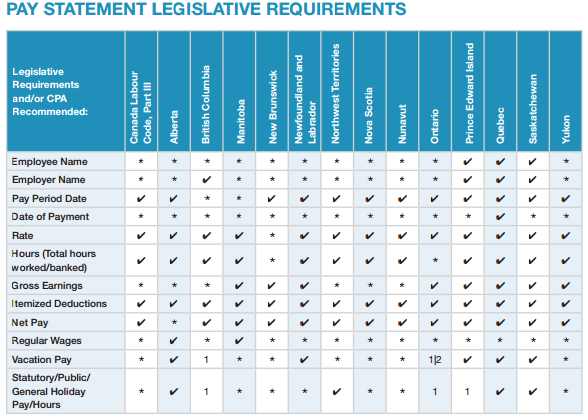

We’ve covered the main elements of a paycheque above, but there are other items that you might also see listed on the paycheque as per legislative requirements and/or recommendations by the Canadian Payroll Association (CPA). This overview will be really helpful for your employees to know what to expect on their paycheques.