Become an insider!

Get our latest payroll and small business articles sent straight to your inbox.

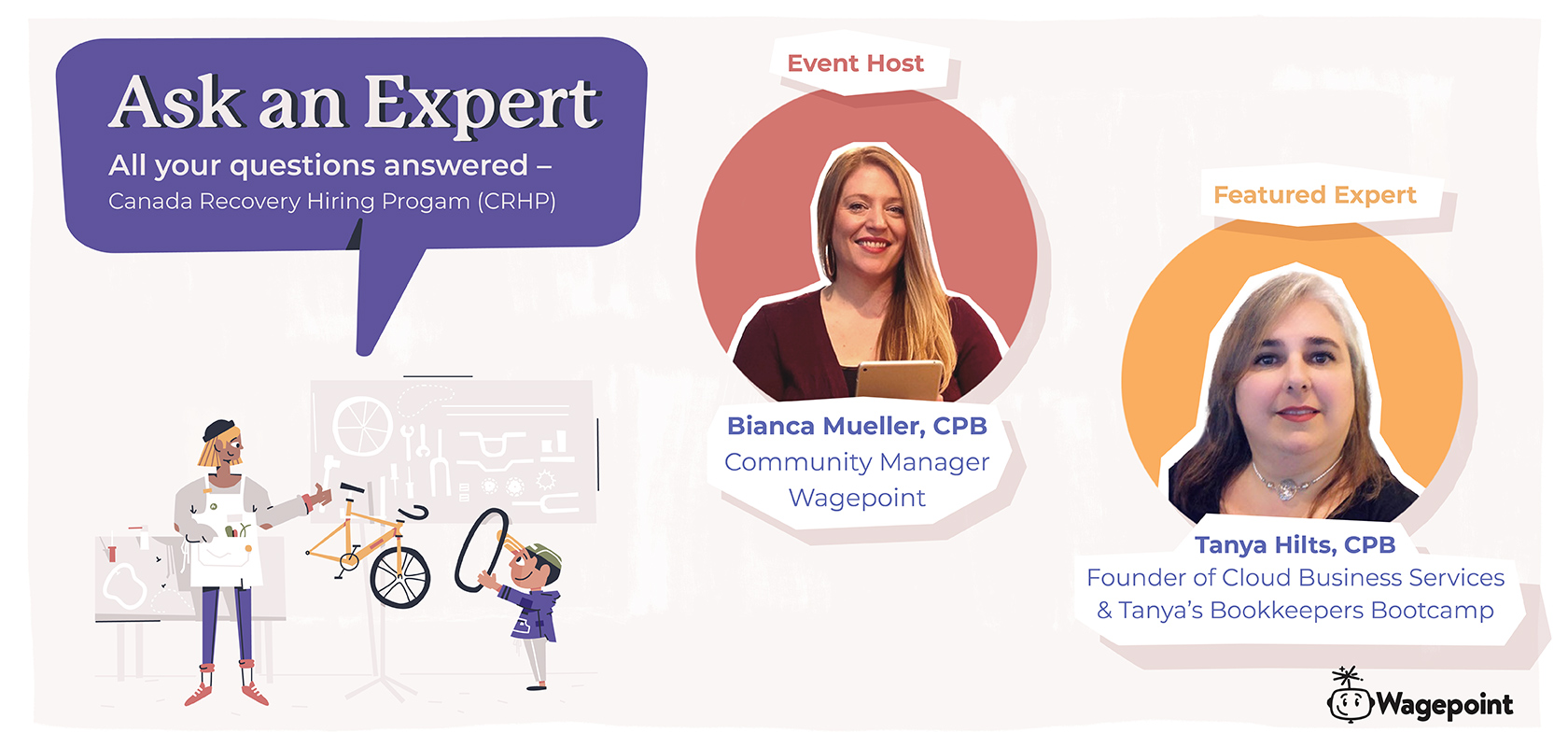

To streamline the many resources available to help small business owners, we launched an exciting new series called “Ask an Expert.” Through the series, I get the privilege of interviewing industry experts to share their advice, education, advisory skills and experiences with small business owners alike.

Shaping tomorrow’s entrepreneurs with Tanya Hilts, CPB.

Recently, I had the opportunity to sit down with Tanya Hilts, founder of Cloud Business Services and Tanya’s Bookkeepers Bootcamp. If you know her, you know she has a passion for streamlining processes and increasing office efficiency and client outcomes.

Her many accolades and certifications have catapulted her as a well-recognized top industry thought leader and mentor. Her passion is helping to guide and shape tomorrow’s entrepreneurs, SMBs and accounting professionals alike.

Understanding the Canada Recovery Hiring Program (CRHP)

As an expert who regularly works with the Canada Revenue Agency (CRA) to advocate for accounting service providers across Canada, I knew Tanya would be the perfect person to interview for our first topic: The Canada Recovery Hiring Program (CRHP). She recently sat down with some CRA representatives, along with other business owners, for a Q&A session. Now, she wants to share all the information with you!

With that said, please welcome Tanya Hilts!

What is the Canada Recovery Hiring Program (CRHP)?

- CRA link: Canada Recovery Hiring Program

Which subsidy should I claim: CEWS or CRHP?

- CRA links:

Can I claim the CRHP for both existing and new employees?

What is incremental remuneration?

- CRA link: What is incremental remuneration?

Who is an eligible employer for the CRHP?

Can I claim the CRHP for employees on leave with pay?

What is eligible remuneration for the CRHP?

Is the total base period remuneration the same as baseline remuneration?

What is qualifying revenue for the CRHP?

- CRA link: What is qualifying revenue for the CRHP?

How do I calculate my revenue reduction percentage for a claim period?

Where do you apply and or amend a CRHP application?

Will a separate CRA Business Number be required to apply to the CRHP?

When can I claim the CRHP?

- CRA link: When can I claim the CRHP?

Can subcontractors be included in the CRHP?

Extra tips for the Canada Recovery Hiring Program (CRHP).

- CRA links:

Everything counts — special shout-outs from an industry expert.

Watch the full interview with Tanya Hilts, CPB.

If you prefer to watch the interview in full, click the link below.

For more information on the CRHP program, please visit How The Canada Recovery Hiring Program (CRHP) Works.

Disclaimer: While every care has been taken to ensure the accuracy of this content, the relevant laws undergo constant revision. It is a best practice to stay informed on these topics and to consult with experienced professionals. Any errors or inaccuracies brought to our attention will be corrected as quickly as possible.