Become an insider!

Get our latest payroll and small business articles sent straight to your inbox.

As the general world evolves, so does the work world. Many companies were already offering remote work experiences, but recent years have caused a shift, and now even more businesses have remote employees. Maybe you’re one of them.

If you are, you know that means carving out a space to work in your home, using your own internet and other things like that to do your work. Did you know that if your employer doesn’t reimburse you for home work-related costs that there are instances in which you can claim those expenses during your tax filings?

Claiming remote employee expenses: Introducing Form T2200.

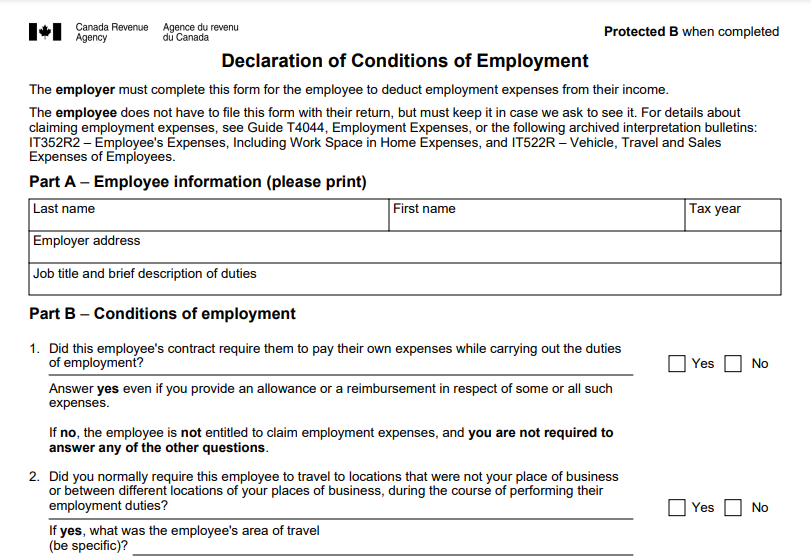

Like most forms the Canada Revenue Agency (CRA) provides, there’s a long name for a form and the name everyone uses. For the Form T2200, the long name is T2200 Declaration of Conditions of Employment. Sometimes it’s even just shortened to T2200.

Now that the introductions have been made, what is a T2200? Quite simply, a T2200 is a form given to remote employees that take on expenses required to do their job that aren’t reimbursed by the employer.

In other words, you work remotely and can’t do your job if you don’t take on the costs, but your employer also doesn’t pay you back for them. What the T2200 does is give you a bit of a tax break.

Partial screenshot of Form T2200 Declaration of Conditions of Employment (2021).

Who gets a T2200?

While it sounds like a super good deal, it’s not as simple as using one of these forms and claiming expenses all willy nilly. Not everyone is eligible to get a T2200. This form is intended for employees such as permanently remote workers.

The CRA is pretty strict about this, and employees must meet all of these points in order to be eligible for a T2200:

- You were required to work from home.

- You needed to pay expenses related to your home workspace.

- The expenses were directly for work.

- Your employer filled out, signed and provided you with a T2200.

- One of the following applies to your situation:

- You worked in your home workspace more than 50 percent (50%) of the time for four consecutive weeks or longer.

- Your workspace is only used for your job, and you also regularly have to use it for meeting people such as clients and customers while you work.

If you match up with all of these points, your employer should give you a T2200 so you can claim some expenses for being a remote worker.

Note: For work-from-home situations due to the COVID-19 pandemic, things are slightly different. Hang tight, and we’ll cover those in just a bit!

What expenses can I claim as a remote employee?

Like with who qualifies for a T2200, it’s not up to you to decide what does and doesn’t qualify as a claimable expense. The CRA carefully outlines what expenses remote employees can claim with their T2200, and it also depends on what kind of employee you are.

Salary-based employees

Remote salary-based employees can claim the following expenses:

- Electricity

- Heat

- Water

- The utilities portion of condominium fees*

- Home internet access costs*

- Costs for maintenance and minor repairs*

- House or apartment rent*

Note: There is additional information on the CRA website about the asterisked items above.

Commission-based employees

Remote commission-based employees can claim the following expenses:

- Home insurance

- Property taxes

- Leasing of office supplies (phone, computer, laptop, etc.) that reasonably relate to the job

And, just to make sure everyone is on the same page, the CRA also outlines what cannot be claimed.

- Interest on mortgage

- Principals mortgage payments

- Costs for home internet connection

- Furniture

- Capital expenses such as replacing windows, flooring, furnaces, etc.

- Decorations for your walls

Note: Your employer is not required to submit a T2200 to the government, so it’s up to you to include the information in your income tax filing process.

At this point you might be thinking, “Hold on a gosh darn minute. I don’t see anything there about office supplies and phone expenses.” Fear not!

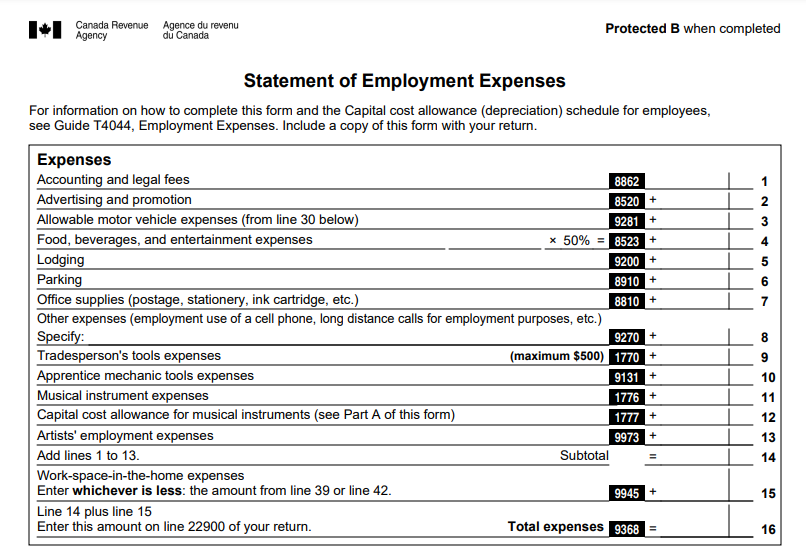

If part of your remote work situation also means phone expenses or buying office supplies, you may be able to claim those as well. The reason they’re not included with the above is because those kinds of items don’t relate to the physical workspace the same way the other things mentioned do. For any phone or office supply expenses, you’ll want to instead take a look at a Form T777 Statement of Employment Expenses. That’s right, another T-form.

What phone and office expenses can I claim on a Form T777?

Once again, the CRA leaves little to question, breaking down what can and cannot be claimed as phone and office supply expenses on a T777. The list is pretty extensive, so we’ve highlighted a few that both salary-based and commission-based remote employees can claim if they file a T777.

Claimable office supply expenses:

- Envelopes

- Folders

- Highlighters

- Ink cartridges

- Notebooks

- Paper or binder clips

- Pens or pencils

- Printer paper

- Specialty paper, such as graph paper or tracing paper

- Stamps or postage costs

- Stationary items

- Sticky notes

- Toner

Claimable phone expenses:

- Basic service plan if the cost of the plan is reasonable, the cost has been reasonably portioned out between work and personal use, and you are able to show minutes or data used directly for your job.

- Work-related long-distance calls.

To see a full list of what can and cannot be claimed for remote employees, review this office supplies and phone expenses list.

Partial screenshot of Form T777 Statement of Employment Expenses. (2021)

Limitations on expenses as a remote employee.

Before you dive into figuring out your remote employment expense calculations for your T2200 or T777, there are a few limitations you’ll want to keep in mind.

- If you only worked a portion of the year at home, you can only claim expenses from that part of the year, not the entire year.

- If you have more than one source of income, you can only claim the expenses on the job they’re related to, not all of them.

- The amount of expenses you can claim is limited to your net income (income after all other deductions are taken off). If your expenses are more than your income, you cannot claim the excess because it’ll mean you’re at a loss. Instead, you can carry it over into the next year provided you’re still working for the same employer. Commission-based employees may not be able to claim the expenses and should refer to the CRA’s T4404 – Chapter 2 – Employees earning commission income.

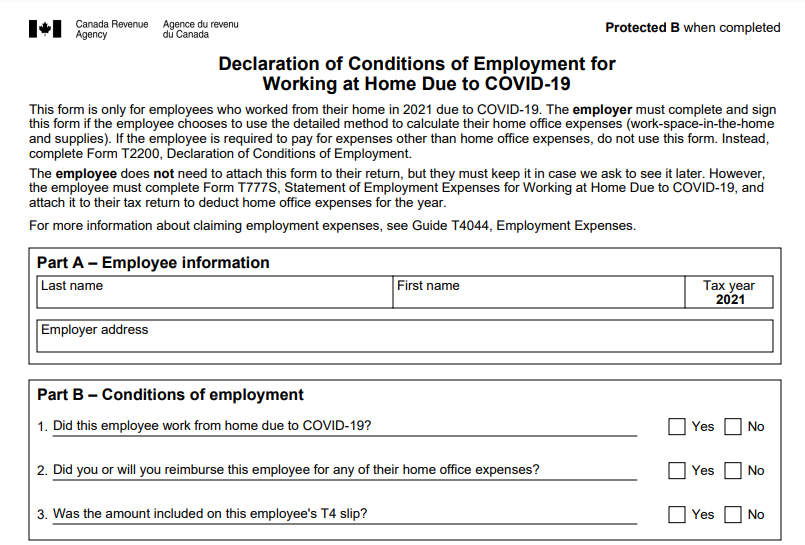

Remote work due to COVID-19: The T2200s and T777s.

Apart from adding an “s” to the ends of Forms T2200 and T777, claiming expenses for remote work due the COVID-19 pandemic is a little different. From eligibility to calculation options, you’ll want to be mindful when working with these forms. The big thing is that the expenses were incurred because the pandemic made you work from home rather than being a permanently remote employee.

You qualify for a T2200s Declaration of Conditions of Employment for Working at Home Due to COVID-19 if:

- You worked at home due to the pandemic.

- You needed to pay expenses related to your home workspace.

- The expenses were directly for work.

- Your employer filled out, signed and provided you with a T2200s.

- One of the following applies to your situation:

- You worked in your home workspace more than 50 percent (50%) of the time for four consecutive weeks or longer.

- Your workspace is only used for your job, and you also regularly have to use it for meeting people such as clients and customers while you work.

Partial screenshot of Form T2200S Declaration of Conditions of

Employment for Working at Home Due to COVID-19 (2021)

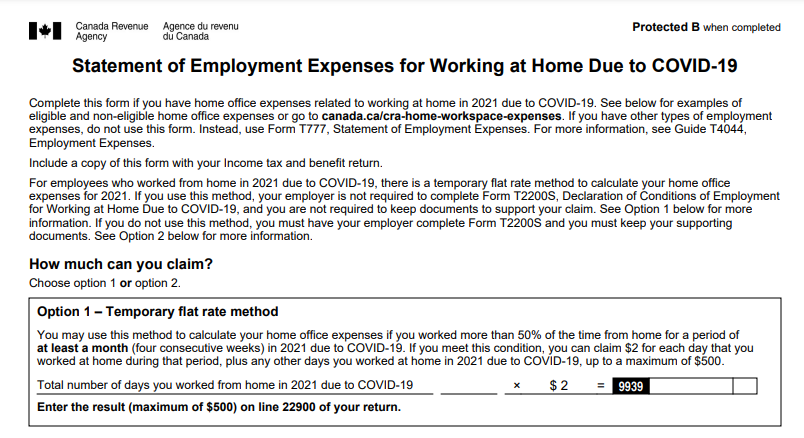

Partial screenshot of Form T777s Statement of Employmen

Expenses for Working at Home Due to COVID-19 (2021)

How to calculate remote employee expenses for tax filing.

Once you’ve figured out what you can claim and what you can’t, it means it’s time to figure out the numbers. There are currently two methods in place for calculating your expenses: The Temporary flat rate method and the Detailed method.

The Detailed method

The Detailed method is the staple of the two as it can be used for permanent remote employees or those who are temporarily working from home because of the pandemic. Let’s start there.

Calculating remote employee expenses using the Detailed method and has two components:

- You can claim the actual amounts you paid so long as you have the supporting documents.

- Your employer must have completed and signed a Form T2200/T2200s. Make sure you keep a copy of this in your records.

The Temporary flat rate method

The Temporary flat rate method is only used for COVID-19 related work-from-home expense claims. Here’s how this calculation method works:

- You’re able to claim $2 for every day worked at home because of the pandemic. (2020, 2021 and 2022)

- The maximum you can claim is $400 per year (2020) or $500 per year (2021 and 2022).

- Your employer doesn’t need to fill out, sign or give you a T2200.

- You don’t need to keep documents to prove your claimed amount.

Happy remote employee expense claiming!

As you can see, there are a number of things to consider when you’re a remote employee and looking to claim work expenses during tax time. Whenever you’re not certain, it’s always best to consult an accounting professional to be sure you’re getting things just right. None of us want any trouble with the CRA!

If you do need to contact the CRA, stop by the How to Contact the CRA Without Losing Your Mind blog first!