Become an insider!

Get our latest payroll and small business articles sent straight to your inbox.

When the pandemic came on the scene, it shook the world — from small businesses to government agencies.

During CPB Canada’s Ignite 2020 event, we hosted a breakout session to discuss with our accounting and bookkeeping friends the role that payroll played in helping small business owners navigate through this year and going forward.

Note: If you attended the event, you can log into PheedLoop and watch our breakout session for CPD credit.

How small businesses were feeling — our survey results.

March was transformative for all of us. At Wagepoint, we processed 70X the normal volume of Records of Employment (ROEs) and worked around the clock to ensure our clients’ needs were being met.

However, March was an incredibly challenging month for the small businesses we serve.

As events unfolded and economic relief measures were unveiled, we wanted to know what small business owners were really experiencing… so we asked!

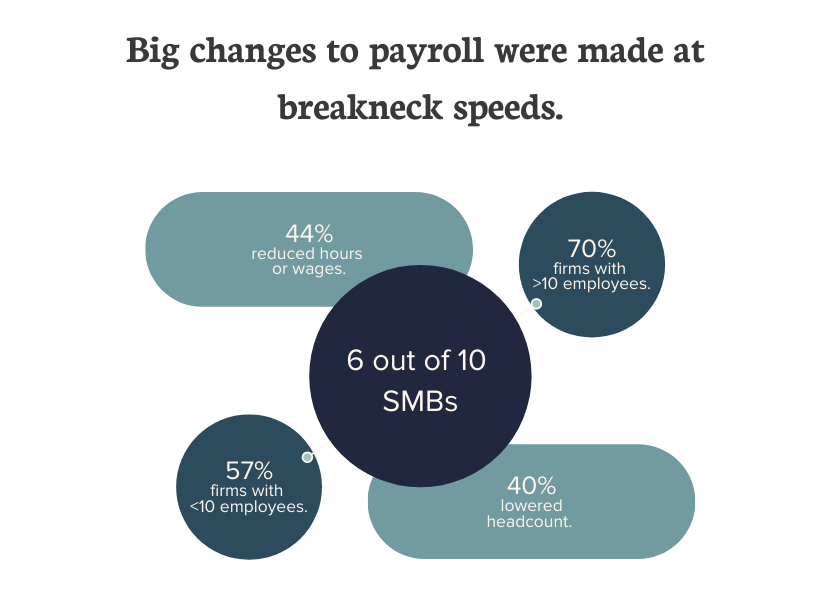

In July, we conducted a survey of 300 Canadian small business owners. Here’s what they said:

- The biggest changes happened in March.

- 6 out of 10 (60%) of Canadian small businesses made some sort of change to their workforce.

- 44% reduced hours and/or wages.

- 40% lowered headcount.

- The more employees a business had, the more they were affected.

- 70% of firms with more than 10 employees made changes.

- While only 57% of those with less than 10 employees made changes.

On the plus side, as of July when the survey was conducted, 58% of the businesses who laid off employees were rehiring. What was also interesting was how this experience had changed how small businesses viewed payroll.

On an introspective level, these same businesses told us that this experience had given them an entirely new appreciation for payroll and payroll software.

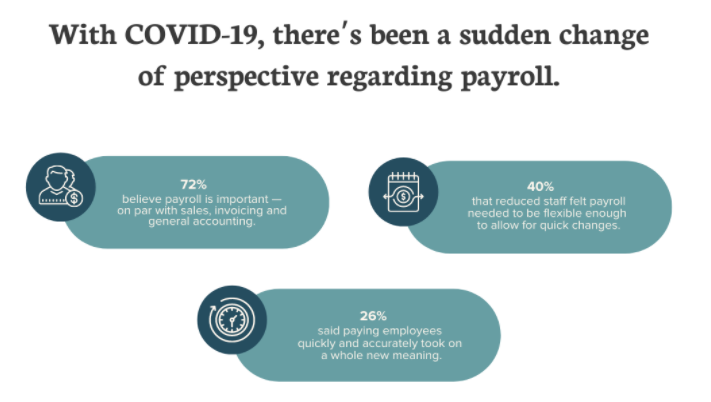

- 72% of respondents said that payroll was just as important as sales, invoicing and general accounting.

- 40% said the flexibility of payroll software was crucial when they had to respond quickly.

- 26% said paying employees quickly and accurately took on a whole new meaning.

Case study: Unleashed Petsitters.

While statistics resonate on an analytical level, what brought things home to us even more was hearing from our own clients.

Unleashed Petsitters is a small doggy boarding daycare centre in Burlington, Ontario. When the shutdown began, it had an instant effect on their business and they had to take immediate action.

How using Wagepoint’s payroll software helped them:

Although the owners were in Florida on March Break, they were able to log in, lay off employees and issue ROEs — in order to ensure these individuals could access the emergency benefits more quickly.

As they were able to pivot their business — offering a doggy day park in place of the many parks that were closed — rehiring was as easy as toggling a switch within the Wagepoint system.

To read their success story in full, click on the image below.

Real-time feedback from our audience members.

Before diving into the survey results, we asked our audience how prepared they (and their clients) were for the shutdown.

While 10% said they weren’t prepared at all, the majority (46%) of our audience identified as “somewhat prepared.” Although they scrambled at first, they were able to figure it out!

We also asked if their clients experienced something similar to our survey. Most accountants and bookkeepers reported that some of their clients’ experiences were the same, while others were different.

Qualifying and applying for wage subsidies — Wagepoint’s response to the 10% TWS.

With the lockdown, the government had to respond as quickly as business owners. This included the development of the following subsidies:

As these subsidies became available, the challenge became applying for and claiming them.

At Wagepoint, we built the 10% subsidy directly into our app. Not only did we automatically calculate the TWS, we also tracked it to ensure everything was deducted properly and managed thresholds so that no one would over claim. On top of this, we adjusted the remittances made to CRA for that period.

Our clients’ response to our response.

The fact that we responded so quickly seemed to sit well with our audience members — some of which also happened to be our clients! Here’s what they said:

Y’all made me look GOOD to my clients!

Alexis Harrington, Sand Dollar Bookkeeping

We moved clients to Wagepoint because you were on the ball with the 10% toggle.

Tammy Christiansen, Aeble Business Services Inc.

Note: Any Wagepoint customer with unclaimed amounts of the TWS may still claim them outside the original March 18 – June 19 schedules.

Use payroll software to get the numbers you need for the 75% CEWS.

In order to apply for the 75% CEWS, businesses needed to apply using the CRA website.

To qualify for the 75% CEWS, small businesses had to document:

- Number of eligible employees.

- Number of eligible employees on leave with pay.

- Total eligible remuneration paid.

- If you retroactively rehired one or more employees during the application period.

Payroll software makes collecting this information much easier.

Businesses who’ve been using payroll software, like Wagepoint, will have historical records of their payroll amounts either through:

- Reports — like the Payroll Register or Direct Deposit Report.

- Journal and bill entries through integrations with your accounting software.

Either way, even if you didn’t have the exact figures you needed, you had a place to start.

Payroll reporting and compliance.

While T4s aren’t new, there are new T4 reporting requirements this year.

All employers must report all employment income and retroactive payments made to employees in four defined periods in 2020 using information codes corresponding to the defined periods. The four defined periods are below:

- Code 57: Employment income – March 15 to May 9

- Code 58: Employment income – May 10 to July 4

- Code 59: Employment income – July 5 to August 29

- Code 60: Employment income – August 30 to September 26

As Wagepoint users get to enjoy automated T4s, please note that we will adjust our T4s to meet these requirements. However, if you aren’t using payroll software, this is a DIY (do-it-yourself) exercise.

Have questions about Wagepoint? Let’s talk!

Thank you to everyone who attended our break out session — we had so much fun talking payroll with you. We hope you enjoyed CPB Canada Ignite 2020 as much as we did!

If you have any questions about Wagepoint, reach out to our team.

The advice we share on our blog is intended to be informational. It does not replace the expertise of accredited business professionals. Wagepoint assumes no responsibility for errors or omissions in this document. To qualify for complimentary T4s, a business must run a minimum of two payrolls in the current calendar year.