Become an insider!

Get our latest payroll and small business articles sent straight to your inbox.

Updated January 2020

For the past few years, an update to the Fair Labor Standards Act (FLSA) has been working its way through the judicial system. It was planned for a new overtime rule, intended to increase the fairness and protection of overtime pay and practices for “white collar” workers, to go into effect December 1, 2016. After four years of delay, it’s in effect as of January 1, 2020.

As a small business owner, you may be getting a few palpitations realizing that this ruling can greatly impact your business. First, take a deep breath. If you’re using payroll tools, like Wagepoint, you already have many of the records you need to comply with this rule, including the current pay level and status of each of your employees.

Update #1 — The new overtime rule has been blocked.

On November 23, 2016, a federal judge issued a decision blocking the new overtime rule. In its updates on the subject, the Society for Human Resource Management (SHRM) notes that while the rule will no longer take effect on December 1, there is still the chance that it will become law in the future.

In its article The Overtime Rule Has Been Blocked. Now What?, the SHRM lists the following advice from wage and labor expert Alfred Robinson Jr.:

- If you have already raised salaries or reclassified employees as nonexempt, you should leave these decisions in place.

- If you were planning on reclassifying employees to comply with the legislation, you may want to consider waiting until a final legislative decision is made.

- Don’t assume that this rule is permanently off the table — it may still be enacted in the future.

Update # 2 — The new overtime rule continues to be blocked.

According to the American Payroll Association, the latest on the topic of the new overtime rule is:

- The Department of Justice has requested an extension for filing its brief, which means that the appeal might not be heard until summer.

- Regardless of the ultimate court ruling, strong opposition from the president and congress may also delay or prevent implementation.

Update #3 — Overtime rule to be voted on May 21, 2019.

The new overtime rule will be voted on again in May of 2019.

After the proposed increase was blocked in 2016, an adjustment is being made: “minimum salary level for the Fair Labor Standards Act (FLSA) “white collar” exemption [will increase] from $455 to $679 per week (or $23,660 per year to $35,308 per year) beginning on January 1, 2020.”

Update #4 — It’s happening!

The new FLSA overtime rule raises the salary threshold from $23,660 per year ($455 per week) to $35,568 per year ($684 per week) — making more than 1.3 million more US workers eligible for overtime. Note: This is much less than the $46,476 threshold proposed in 2016. However, there are plans to regularly increase the threshold amount which would have affected 4.2 million employees.

The new legislation also:

- Ups the yearly compensation for top earners from $100,000 to $107,432.

- Lets employers use annual or nondiscretionary bonuses and incentives to meet up to 10% of the standard salary level. (Same as before)

- Adjusts salary levels for workers in US territories and the motion picture industry.

Another helpful tool: Infographic Map of Overtime Requirements by State

Other key points you should know.

“White-collar employees are still defined as executive, administrative, professional, information technology (IT) specialists and outside salespeople, but the biggest change is the salary threshold.

Non-discretionary bonuses and commissions may count as up to 10% of the threshold.

The threshold for highly compensated employees (HCEs) has been raised from $100,000 to $107,432 per year. (No one is complaining too much about this one.)

The sticking point — appropriate compensation for “white collar” employees.

While executives, professionals, administrators, information technology (IT) specialists and outside salespeople are still considered “white collar” workers — by raising the minimum thresholds, the DOL hopes to reduce the number of workers defined as white-collar in title only. In other words, these employees may be called a manager, but they are not being compensated as such. An example would be a retail or restaurant manager, making $30,000 a year while working 50-70 hours a week without being eligible for overtime.

The three basic tests for “white collar” exemptions.

These are the salary level, salary basis and duties test. Why three? Why not? It’s much more fun than one, right?

To be included in the “white collar” exemptions list, your employees must “pass” all three of the tests. The salary level and salary basis tests are basically fancy ways for saying that someone has to make at least $684 per week / $35,568 per year or more and be paid on a salary basis in order to be exempt from the new overtime rule. The duties test relates to the functions these employees perform, meaning a majority of their time must be spent doing X, Y or Z.

The DOL has at least tried to make the information as clear as possible by outlining these tests in their Small Entity Compliance Guide to the Fair Labor Standards Act’s “White Collar” Exemptions. If you like exceptions, read up on the rule that allows for certain professionals to qualify under a “fee basis” as long as the calculations still net out to the required thresholds.

Once you’ve identified the employees who’ll be affected.

Complying with the new overtime rule will involve working with your in-house payroll and human resources experts or qualified third-party consultants to figure out if you should:

- Ask salaried workers to become hourly and pay time-and-a-half for overtime.

- Limit workers to 40 hours per week in order to avoid paying overtime.

- Reassign roles and responsibilities to keep employees under 40 hours a week.

- Raise salaries to $35,568 per year/$684 per week or more.

- Count non-discretionary bonuses and commissions as up to 10% of the threshold.

- Use any combination of the above.

Counting bonuses and incentive payments as income.

There are a few basic rules to this exemption:

- Non-discretionary bonuses and incentive payments (including commissions) credited as income must be paid on a quarterly or more frequent basis.

- Discretionary bonuses, like on-the-spot awards, cannot be counted as income.

- If an employee does not earn enough of a non-discretionary bonus or incentive payment in a given quarter to retain his or her exempt status, the employer may make a “catch-up” payment no later than the next pay period after the end of the quarter.

The businesses that will be most affected.

So far, many small business owners, as well as those in the retail and restaurant industries, have voiced the greatest concern. These employers worry that they won’t be able to afford increases in salaries required to avoid the payment of overtime. There are also concerns about a loss of morale, status and flexibility for salaried workers who are asked to become hourly as a result.

In their official statement on the new rule, the National Retail Federation states, “The retail industry is concerned because the change in wage levels – if allowed to take effect – would bring many store managers or assistant managers under overtime rules, taking away their ability to use their own discretion in deciding whether to put in the extra hours sometimes needed to do their jobs. And putting managers under overtime rules would undermine their status as career professionals rather than hourly workers.”

The risks of non-compliance.

In a recent Business News Daily article, Valerie Samuels, a partner in the law firm Posternak, Blankstein & Lund LLP, noted that the consequences of improperly classified employees could include “triple damages” in some states. In another article, Fortune, predicts this regulation could create a “perfect storm” for overtime lawsuits.

Lawsuits and prosecution are on the rise.

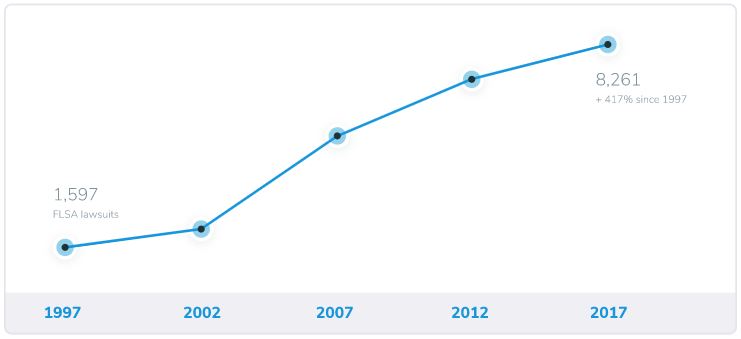

In partnership with Lexology and using data obtained from the DOL, scheduling and time-tracking software TSheets found that FLSA Wage and Hour Lawsuits are up 417% since 1997.

What else you can do to prepare.

In order to make the most informed decisions, small businesses will need to communicate with their employees in advance of the December 1, 2016, deadline. Practices like time tracking can also help verify the number of hours each employee is working and provide insight as to the best solution. Time tracking will also be useful for compliance once the overtime rule is in place.

Communicate with your employees.

Being open and honest is a crucial factor in this process. Letting employees know what the new overtime rule is, what it means and why you’re making the request to track hours can go a long way toward easing tensions and creating goodwill. For example, you can make them aware that you’re trying to ensure that they’re fairly compensated, rather than attempting to micromanage or plan layoffs.

Be careful what you say.

Think carefully about what you say when communicating with employees as well as internally within the management team. Remember, emails can be used as evidence in a lawsuit, so don’t overtly slam the new rule or complain about compliance.

📝 Now that you’ve had your dose of federal overtime regulations, prepare to be awed by an Infographic Map of Overtime Requirements by State.

The content in this post is informative and intended to complement the advice of payroll, accounting and human resources expert. The information in this post is accurate of the day of publication. Please ensure that you have checked credible sources for updates.