Become an insider!

Get our latest payroll and small business articles sent straight to your inbox.

The New York state government has it right when it said, “New York is open for business.” 98% of all businesses in NY are small businesses, employing almost half of all the private sector employees in the state.

But starting a business takes a lot of hard work, research, and investment to make it a success. There are plenty of things to do before you even serve your first customer, like registering your business, figuring out tax payments for both your business and employees, federal, state, and local taxes, and more.

It’s enough to make your head spin, and you haven’t even really started yet!

But we’ve got you covered in this post – everything you need to know about registering your business in New York and keeping your company compliant with state-specific payroll regulations.

Steps for Setting up your Payroll in New York

There are three major phases to setting up your payroll properly in New York state:

-

Business registration

-

Tax payments

-

Compliance requirements

Let’s take a closer look at each one and see what’s involved.

Business Registration

The first phase is to set up your business with the appropriate governmental departments, namely, the IRS, State of New York, and NY Business Services Online.

-

IRS: Apply for your Federal Employer Identification Number (FEIN).

-

State of NY: Register your business and fill out form NYS100.

-

NY Business Services Online portal: Register your business so you can pay your business taxes online.

Tax Payments

While none of us likes to pay taxes, they are a fact of life for everyone, especially small business or startup business owners.

The next phase is to enroll your business with the appropriate tax agencies (local, state, and federal), so you’ll account for all the taxes you’ll need to pay for your business and your employees.

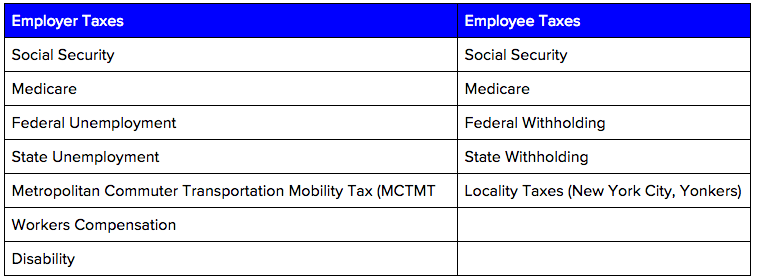

Here’s a quick outline of the various taxes you’ll have to pay for your business and your employees:

Once that’s done, it’s time to figure out your New York payroll tax payment schedule for all levels of government. For that, you’ll need to know how much payroll you paid your employees in the previous year and/or quarter.

Federal Taxes: Payable to the IRS via electronic funds transfer (EFTPS).

-

You’ll pay Semi-weekly, if you paid more than $2,500 in payroll.

-

You’ll pay Monthly, if you paid less than $2,500 in payroll.

-

You’ll pay Next Day, if you paid more than $100,000 in payroll.

Note: These are based on your previous quarterly payroll payments.

State and Local Taxes: Payable via NY Business Services Online.

-

You’ll pay every Three Days, if you paid more than $15,000 in payroll.

-

You’ll pay every Five Days, if you paid less than $15,000 in payroll.

Note: These are based on your previous year’s total payroll payments.

And finally, you’ll pay your state and federal unemployment taxes quarterly.

Compliance Requirements

The final phase to setting up your business properly for New York payroll is to have particular government tax forms completed for all employees. Some are required right when you hire them, while others can wait till year-end.

For every employee you hire, complete the following forms when you hire them:

-

W4 Federal Withholding Allowance Certificate

-

NY IT-2104 NYS Withholding Allowance Certificate

-

I-9 Employment Eligibility Verification

Keep in mind that this second group of forms are necessary for every employee, regardless if they’re still working for you at year-end or not.

-

For every employee that works for you throughout the year, you’ll need these forms for each one at year-end: W2 Wage and Tax Statement and/or 1099 Misc. Income – Contractors.

Starting a business is complicated, but we hope this post gives you a great foundation to build on.

Your small business or startup will be registered with all the appropriate tax agencies. You’ll know what your tax payment schedule is and how to pay these taxes, assuming this is not being handled by your payroll provider. You’ll even have all the employee forms ready for your staff when they come on board.