Become an insider!

Get our latest payroll and small business articles sent straight to your inbox.

On an international stage, Los Angeles is overshadowed by San Francisco, Silicon Valley, and even New York.

However, many people are now saying that LA is “coming of age”, and ought to be taken seriously as a city to build a successful business. In the same way that New York or London are financial sector hubs, Los Angeles is fast becoming the home to consumer-focused startups.

This is no accident, given it has long been the home of the media and the film industry. People in Los Angeles get culture, consumer demand, and entertainment, which makes it the perfect place for startups like Snapchat, Beats (Apple bought them for $3B), and Oculus Rift (purchased by Facebook for $2B).

Billions are being poured into the startup scene, and there is already a strong support network in place, making Los Angeles a city worth considering for your business.

-

According to CB Insights, $4.7B was invested in the Los Angeles tech scene from 2010 to 2014. Significant sums are now flowing north from Southern California, and serial entrepreneurs are also investing their money in early-stage startups in the community.

-

The convergence of content producers (studios) and distribution producers makes this the heart of multi-channel network startups, with several of them (Maker Studios, FullScreen, AwesomenessTV) achieving nine-figure exits in 2014.

-

Top tier universities, i.e. UCLA, USC, Cal Tech and the lifestyle that Los Angeles offers attracts the kind of talent you would be hard pressed to find elsewhere.

It might seem like Los Angeles is the City of Dreams, but there are some challenges with starting up a business in Los Angeles that you need to be aware of as an entrepreneur.

-

Los Angeles does not work as well for B2B startups, given the pull of larger salaries and funding rounds in Los Angeles for the consumer-focused companies.

-

Folks in the startup community resist moving to LA for fear of missing out on crucial connections they might have access to in San Francisco, which creates an environment where there is not as much mentor support.

With some background on the startup scene in Los Angeles, let’s discuss some of the steps you need to take to register your business in Los Angeles, California. By following these steps, you’ll ensure you keep your company and employees payroll compliant as per state-specific regulations.

Steps for Setting up your Payroll in Los Angeles, California

As a small business owner, you have three action items you need to complete properly in order to be set up in the city of Los Angeles:

-

Business registration

-

Tax payments

-

Compliance requirements

Let’s take a closer look at each one and see what’s involved.

Business Registration

The first phase is to set up your business with the appropriate governmental departments, namely, the IRS, and the State of California’s Employment Development Department.

-

IRS: Apply for your Federal Employer Identification Number (FEIN).

-

State of California: Register as an employer to pay Unemployment and Withholding taxes

-

State of California: Register for Sales tax

-

State of California: Register online to make payments of your payroll taxes.

Tax Payments

With your business registration out of the way, let’s look at the next phase i.e. enrolling your business with the appropriate tax agencies (local, state, and federal).

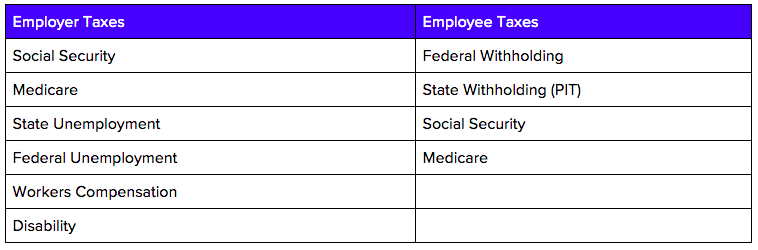

Here’s a quick outline of the various taxes you’ll have to pay for your business and your employees:

Once that’s done, it’s time to figure out your tax payment schedule for all levels of government. For that, you’ll need to know how much payroll you paid your employees in the previous year and/or quarter.

Federal Taxes: Payable to the IRS via electronic funds transfer (EFTPS)

(Note: These are based on your previous quarterly payroll payments.)

-

You’ll pay Semi-weekly, if you paid more than $2,500 in payroll.

-

You’ll pay Monthly, if you paid less than $2,500 in payroll.

-

You’ll pay Next Day, if you paid more than $100,000 in payroll.

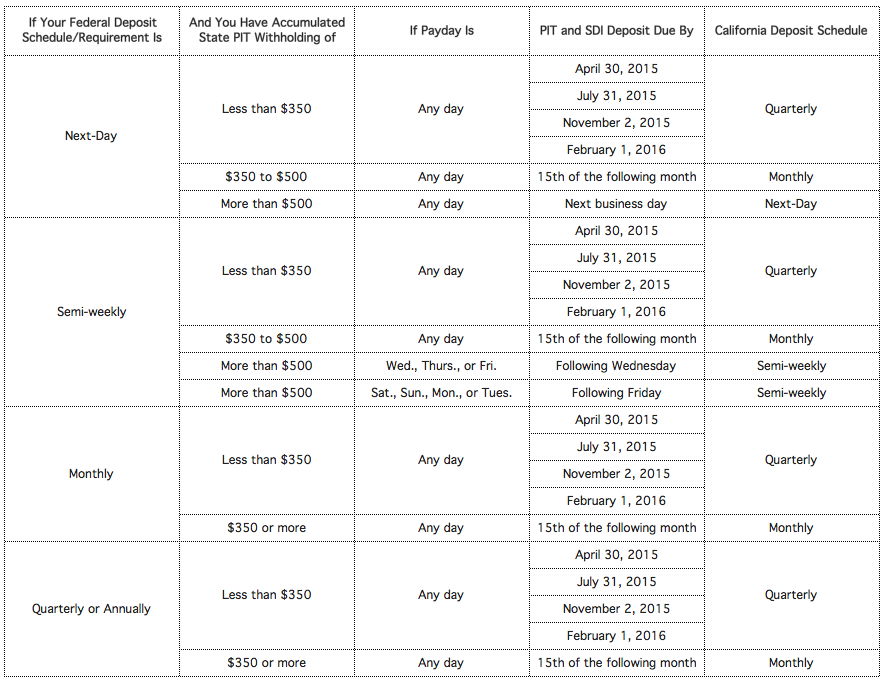

State Taxes: California state taxes or better known as Personal Income Taxes (PIT) follow the schedule below for deposits:

And finally, you’ll pay your state and Federal unemployment taxes quarterly regardless of your yearly payroll payouts.

Compliance Requirements

Staying compliant with payroll regulations is something that applies to all companies, irrespective of their location. The final step of setting up your business to be payroll compliant in Los Angeles is to ensure that you have all the correct government tax forms completed.

For every employee you hire, complete the following forms when you hire them:

-

W4 Federal Withholding Allowance Certificate

-

DE 4 Employee’s Withholding Allowance Certificate

-

I-9 Employment Eligibility Verification

Keep in mind that this second group of forms are necessary for every employee, regardless if they’re still working for you at year-end or not.

-

For every employee that works for you throughout the year, you’ll need these forms for each one at year-end: W2 Wage and Tax Statement and/or 1099 Misc. Income – Contractors.

By following these three steps, you’ll be registered with all the appropriate tax agencies, you’ll have a good understanding of your tax payment schedule, and you’ll even have all the employee forms ready for your staff when they come on board.

And you can rest assured that you’ve done everything you need from a payroll administration standpoint to build a solid foundation for your business.