Become an insider!

Get our latest payroll and small business articles sent straight to your inbox.

Dallas, along with Fort Worth and Arlington, commonly known as DFW, is the fourth most populous metro area in the United States.

Outside of the megacities in the industrial northeast, you won’t find a greater concentration of capital, people, and innovation. All of that coupled with the fact that Dallas is the home of Southern hospitality makes it an ideal place to set up a new, high-growth business.

Some of the other benefits include:

-

A supportive and vibrant tech community that started to rally together when Alexander Muse, Cofounder of ShopSavvy launched StartupMuse, a Texas startup blog in 2005.

-

Access to Tech Wildcatters, a mentor driven accelerator with dozens of successful portfolio companies

-

A lower cost of living in a city that has an active social scene with lots of cultural activities.

There are also some challenges you should be aware of before you make a decision to set up shop in Dallas.

-

As with most cities outside of San Francisco, startups must show some traction or a clear route-to-revenue before investors will put money behind it, so you should be prepared to bootstrap.

-

Dallas is still a big city with a small town mindset, so remember that gossip spreads just as fast as good news. So, be careful not to tread on too many toes.

Pros and cons aside, if you are starting a new business in Dallas, we’ve got all the information you need to register your business correctly and keep your company and employees compliant with Dallas, Texas payroll regulations.

Steps for Setting up your Payroll in Dallas, Texas

Irrespective of your location, there are three action items you need to complete in order to set up your business in Dallas:

-

Business registration

-

Tax payments

-

Compliance requirements

Let’s review each step in more detail.

Business Registration

The first phase is to set up your business with the appropriate governmental departments, namely, the IRS, State of Texas, and TEXNET, which is the State of Texas Financial Network.

The Texas Secretary of State has a number of helpful start-up and small business resources you can refer to when starting your small business in Texas.

-

IRS: Apply for your Federal Employer Identification Number (FEIN).

-

State of Texas: Register for Unemployment taxes

-

State of Texas: Register your business to pay Sales Tax by filling out the Texas Online Tax Registration form.

-

TexNet Online portal: Register your business so you can pay your business taxes online using the TexNet electronic payment network.

Tax Payments

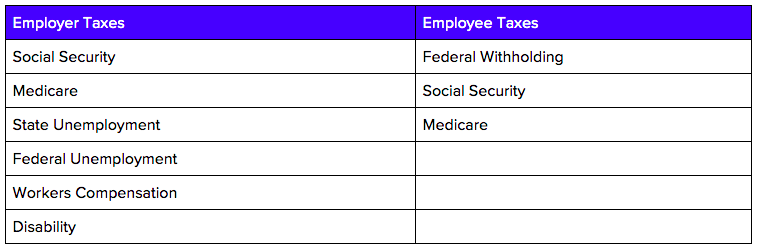

With your business registration out of the way, let’s look at the different tax payments you will have to pay for your business and your employees:

In order to determine the tax payment schedule for all levels of government, you will need to know how much payroll you paid your employees in the previous year and/or quarter.

Federal Taxes: Payable to the IRS via electronic funds transfer (EFTPS)

-

You’ll pay Semi-weekly, if you paid more than $2,500 in payroll.

-

You’ll pay Monthly, if you paid less than $2,500 in payroll.

-

You’ll pay Next Day, if you paid more than $100,000 in payroll.

-

For new employers, your tax liability for any quarter in the look-back period before you started or acquired your business is considered to be zero. Therefore, you are a monthly schedule depositor for the first calendar year of your business.

(Note: These are based on your previous quarterly payroll payments.)

As there are no state income taxes in Texas you’ll only have to worry about paying your state and Federal unemployment taxes quarterly.

Compliance Requirements

As an employer, you are responsible for ensuring that your company and your employees are fully compliant. A big part of that is completing all the necessary paperwork.

Some of these forms are required right when you hire them, while you have the option to wait until year-end for some of the other forms.

For every employee you hire, complete the following forms when you hire them:

-

W4 Federal Withholding Allowance Certificate

-

I-9 Employment Eligibility Verification

Keep in mind that this second group of forms are necessary for every employee, regardless if they’re still working for you at year-end or not.

-

For every employee that works for you throughout the year, you’ll need these forms for each one at year-end: W2 Wage and Tax Statement and/or 1099 Misc. Income – Contractors.

These three steps will lay the foundation for your business, so that you are covered on the administration front. Your business will be registered with the tax agencies in your state, you’ll have a good handle on your tax payment schedule, and you’ll also have all the employee forms you need to keep on hand for your staff.