Become an insider!

Get our latest payroll and small business articles sent straight to your inbox.

It’s a big day when you’ve come to the point in your life and it’s time for you to hire your first employee! As a small business owner, it’s the realization that your dream of starting your own business has finally come true.

So, it’s no surprise that you need to make sure you’ve done everything correctly for this first hire and all future hires.

The first step to that is ensuring you’ve made the right hire for your business – do you need to be hiring your first employee, or should that be a contractor?

Employee or Contractor

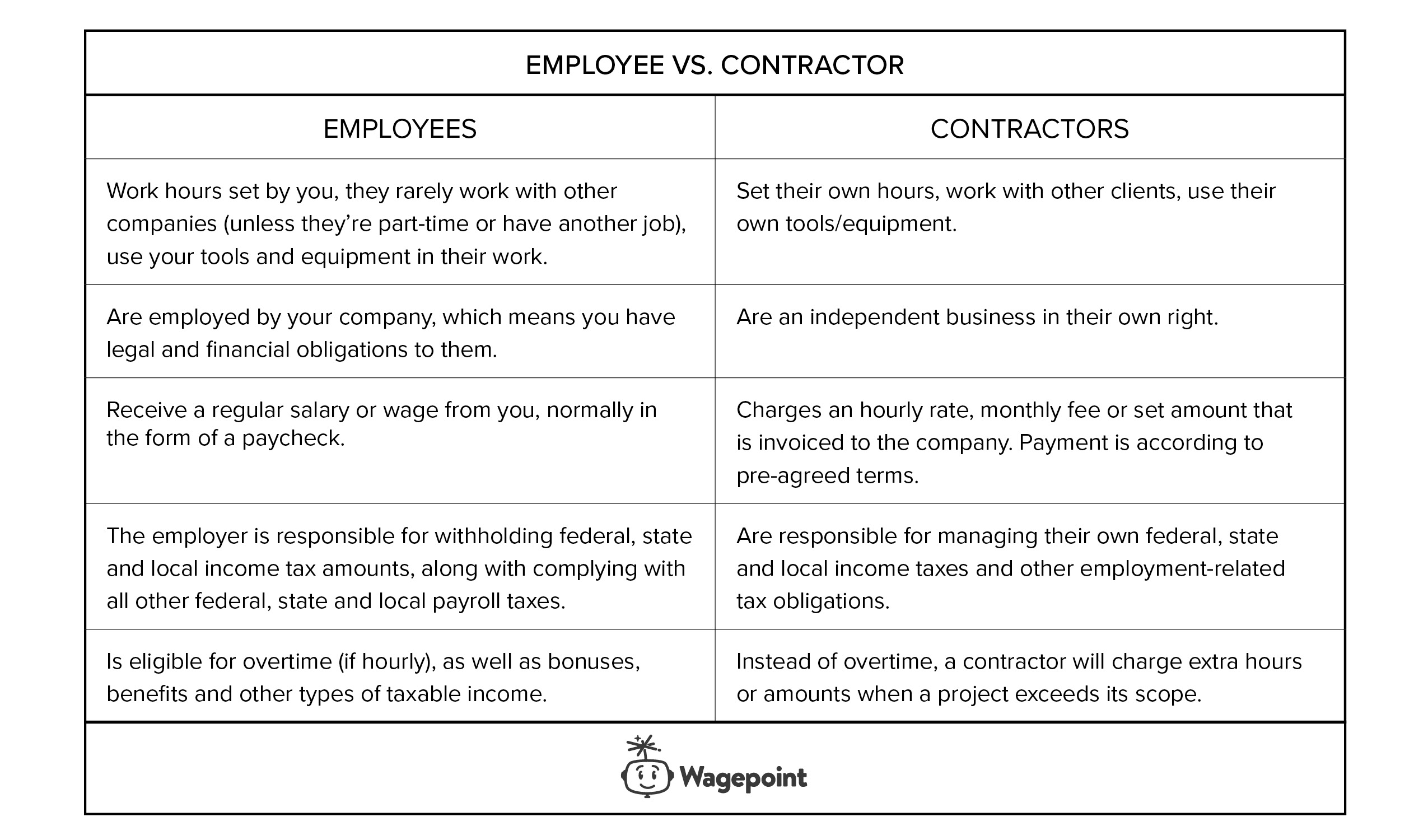

There are a number of differences between hiring an employee or contractor.

This handy table explains the key differences between employees and contractors.

As you can see, it all boils down to who is dictating the terms of the relationship from hours worked, to the responsibility for paying taxes, how they are paid for work, etc.

Consequences of Misclassifying Employees as Contractors

Hiring contractors when you are starting your business is good for a number of reasons: the flexibility it offers you in hiring and firing, the cost savings, and the reduced liability among other things.

But the issue arises if your contractor is actually your employee (based on the legal definition). If that is the case, you will be paying for the expensive consequences of misclassifying your employees as contractors!

The classification matters to the government for tax reasons obviously, but under the Fair Labor Standards Act, this misclassification also impacts your team.

So if it turns out you’ve been treating your contractors like employees, you’ll need to:

- Back pay wages you should have paid, including any overtime and minimum wage requirements.

- Pay penalties for filing federal and state income and employment taxes late as well as back pay the taxes owed to the government.

- Provide benefits like health insurance, etc. and pay workers’ compensation for any misclassified employees who were injured on the job.

Determining Your Worker’s Status with the IRS

If you are still unsure whether you are hiring your first employee or contractor, you can complete the IRS Form SS-8 and get a ruling from the government directly. Keep in mind though that it can take up to six months to hear back from the IRS.

Key Takeaways

- There are differences between employees and contractors you need to be aware of as a small business owner. It boils down to who is dictating the terms of the relationship.

- Misclassifying employees as contractors can have serious financial and legal implications for your business. If you aren’t sure about your worker’s status, complete the IRS Form SS-8 to get a ruling from the government directly.

Disclaimer: The advice we share on our blog is intended to be informational. It does not replace the expertise of accredited business professionals.