Become an insider!

Get our latest payroll and small business articles sent straight to your inbox.

Taxes are not the most interesting topic to think about, but they are, nonetheless, necessary. This post will discuss Ontario’s Employer Health Tax (EHT) including when the tax applies, how it’s calculated and how it affects your business.

So, let’s find out if this one applies to you and, if so, what it all means to your bottom line.

The Ontario Employer Health Tax Act was created in 1990 and involves a payroll tax that provides partial funding for the Ontario Health Insurance Plan. Who pays this tax? Ontario employers.

Now, I bet you’re saying, “I just run a small business. Do I have to pay this tax?”

The short answer is “Yes… but maybe no.”

Let me break it down for you.

Does my business need to pay EHT?

Do you have an employer-employee relationship and pay your employee? Your payroll is subject to Ontario’s EHT.

Here’s a breakdown of employers who have to contribute to EHT:

- Employers who have employees that work at their permanent establishment in Ontario.

- Employers who pay their employees (including work-from-home employees) from their permanent establishment in Ontario.

- Employers who have Ontario remuneration (money paid for work or service) over the tax exemption limit.

Are there EHT exemptions?

Here’s where it becomes ‘maybe no’: Employers who qualify are exempt from EHT on the first $1 million of Ontario payroll.

In other words, you don’t have to pay any EHT if your annual payroll does not exceed $1 million. While the Ontario government typically adjusts the EHT exemption every five years, the exemption limit was increased by a large figure during the pandemic due to difficulties surrounding COVID-19 and is scheduled to stay at the $1 million mark through to and including 2028.

Here are all the circumstances you can claim the tax exemption:

- You’re an eligible employer (per the EHT Act).

- You pay income taxes.

- Your payroll for the year in Ontario is less than $5 million (this includes payroll for any associated employers — more on that in a moment).

- Your payroll for the year in Ontario is less than $5 million and you’re a registered charity.

- You’re not controlled by any level of government.

- Your board of directors doesn’t have municipal representatives.

So, what’s a group of associated employers? A group of associated employers means employers who share ownership of the business or have a combination of ownership and individual relationships (related through blood, marriage or adoption). They can only make one EHT exemption claim per year.

In this case, to see if they can claim the exemption, the employers need to take into account the total remuneration for that year for each person in the group. If the total amount for the associated employers exceeds $5 million, they don’t qualify for the exemption.

Registering for an EHT account with the Ontario Ministry of Finance.

The good news is registering for an EHT account with the Ontario Ministry of Finance is pretty easy. Once you do, the ministry will send you annual returns.

Here are the circumstances you’ll need to do so:

- You’re an employer who isn’t eligible for the tax exemption.

or

- You’re an employer who is eligible, but your payroll exceeds your allowable exemption.

To register for an EHT account, start with the Ontario Ministry of Finance form. But, before diving in, make sure you have the following details for your organization:

- Legal name

- Trade name

- Business address

- Mailing address

- Telephone and fax numbers

- Name of contact person or authorized representative

- Payroll start date

- Payroll frequency

- Federal business number (BN)

- Employer type (associated, multiple accounts or public sector employer)

Next, there are three ways to complete your registration:

- Online using the Service Finder portal.

- In-person by calling 1-866-ONT-TAXS (1-866-668-8297) and setting up an appointment with a Ministry of Finance representative.

- Using a self-help workstation at a ServiceOntario centre in your area.

For questions at any time throughout the process, you can contact the Ministry of Finance at 1-866-ONT-TAXS (1-866-668-8297). To learn more about registering for an EHT account, you can also visit the Employer Health Tax page on the Ontario website.

Calculating EHT.

Calculating the amount of EHT an employer pays uses a simple formula.

[the Ontario payroll for the year – the tax exemption] x the applicable tax rate

In other words, take your total Ontario remuneration for the year, subtract the amount of the tax exemption and then multiply that number by the applicable tax rate.

Remuneration is the employment income (box 14 of the T4 slip) that is taxable under sections 5, 6, and 7 of the federal Income Tax Act.

Beyond salary and wages, remuneration also includes:

- tips and gratuities paid through an employer

- bonuses

- commissions and other similar payments

- vacation pay

- taxable allowances and benefits

- directors’ fees

- payments for casual labour

- amounts paid by an employer to top up benefits

- advances of salaries and wages, and

- stock option benefits

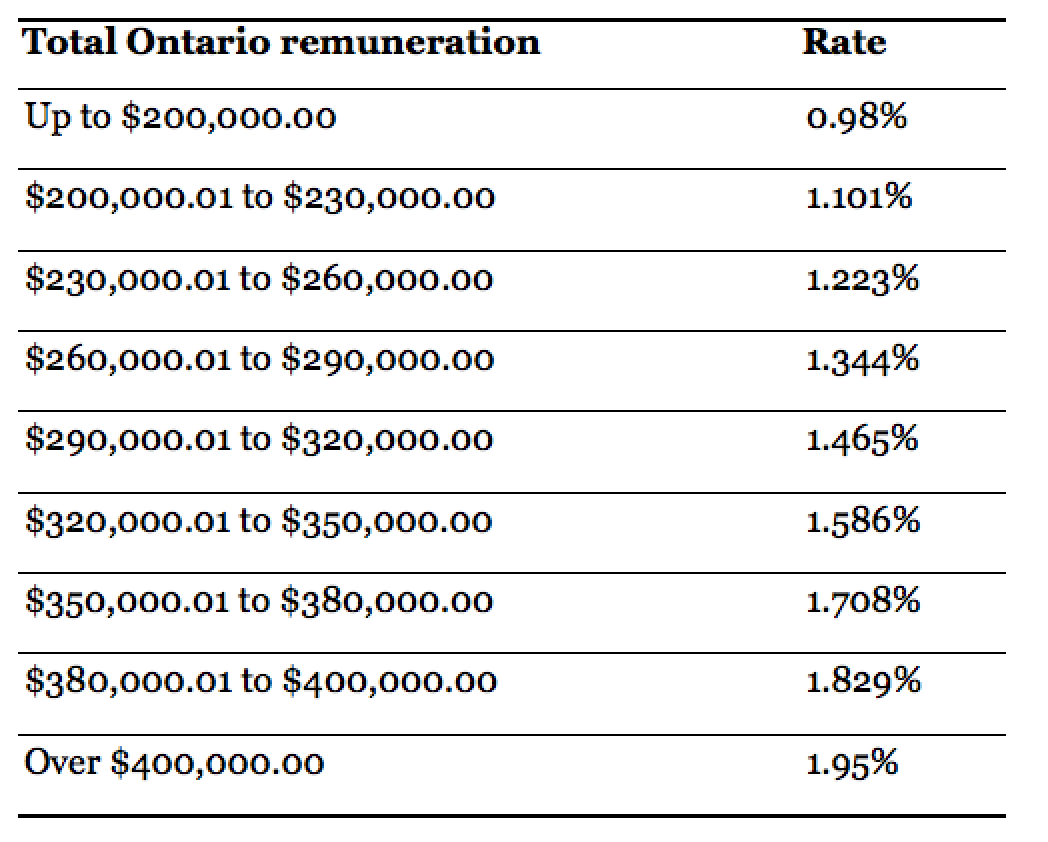

As for the EHT tax rates, those vary depending on your payroll totals for Ontario. See the chart below to see how the rate is assigned.

These rates are accurate as of February 2023.

Check the Ontario Ministry of Finance EHT page for the most up-to-date rates.

For example, an employer with $155,000 of Ontario payroll, without any tax exemption, will have a tax rate of 0.98%, and would pay EHT of $1,519 for the year. ($155,000 x 0.0098 = $1,519.)

Paying EHT.

Generally, paying EHT is handled by filing and paying an annual return on or before March 15th of the following calendar year. That changes if your payroll for the year is more than $1.2 million.

As of 2021, for employers with Ontario remuneration that’s more than $1,200,000, paying EHT is done in monthly installments, due by the 15th of the following month. You’ll still file an annual return on or before March 15th of the following calendar year, but keep in mind that the payment schedule is more frequent.

Calculating EHT installment payments.

Calculating how much you’d pay for your EHT installment payment works in a very similar way to calculating EHT in general. Here’s an example of what it would look like.

Say your monthly payroll is always $210,000. In the year, that’d mean you have $2,520,000 for your annual payroll, but keep in mind, the first $1 million is exempt from the tax, so from January until May, you wouldn’t pay tax yet. Because your total to that point would only be $1,050,000, that total is still within the $1.2 million threshold that would trigger the monthly installments.

Come June is when you’d hit that threshold since you’ll have processed a total of $1,260,000 in payroll. But, again, that first million dollars is exempt, so the payment you’ll be making is only on the $260,000 for June. Take that, multiply it by your tax rate (in this case 1.95%), and then voila, you have the payment to make: $5,070.

For each month remaining, take the $210,000 and multiply it by the tax rate (1.95%) to get the amount owed for the monthly installment: $4,095.

Note: Wagepoint doesn’t calculate installment payments. Wagepoint’s calculation starts once the exemption is reached.

Wrapping up EHT.

So, there you have it.

There’s a strong possibility that as a new business owner you will not be required to pay any EHT, but as you grow to reach over $1 million of Ontario payroll, you’ll want to keep this Ontario tax in mind.

If you’d like more information or have additional questions about EHT, visit Ontario’s Ministry of Finance EHT page, which breaks down these calculations, filing an EHT return, penalties and more.

The advice we share on our blog is intended to be informational. It does not replace the expertise of accredited business professionals.

Last updated February 10, 2023