Become an insider!

Get our latest payroll and small business articles sent straight to your inbox.

Life is a series of measured risks.

Sometimes, we drive too fast when we’re late for an appointment; sometimes, we go swimming right after eating; and sometimes, we start a business.

All of these risks we recognize and are willing to live with, but what happens when you take some bigger risks – life-threatening risks? Yes, I understand that is the point of insurance and wills, but what about your business?

When a disaster strikes – fire, flood, or other natural disasters – we have plans in place to get everything back up and running. Do we move the physical business? Can we work from home? Do we replace equipment with new or maybe rental equipment? What about data? Restore from Backup!

There are lots of discussions about Disaster Recovery Plans and preparation sites available on the internet. Most of them focus on you getting your business back up and running.

But, as a small business owner, what happens if you die or are seriously injured?

Does the business just close? Do your employees still get paid? What about your bills? Lines of credit? Taxes? Who knows how to access all of your information? Who knows about your accounts?

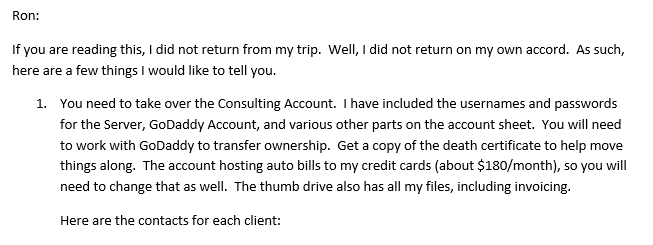

This is why I have the Broccoli File.

In the event that one of my life threatening risks leaves me dead or in a vegetative state (hence the name), this file contains the keys to the kingdom – usernames, passwords, accounts, and other important information.

While not a pleasant thought, planning for this eventuality is important. When you have people who are depending on you, which often includes employees, investors, and family, you have a responsibility to take care of them.

This responsibility does not end simply because of an injury or death. So, you need to make preparations.

These are the three elements you need to account for in your Broccoli File:

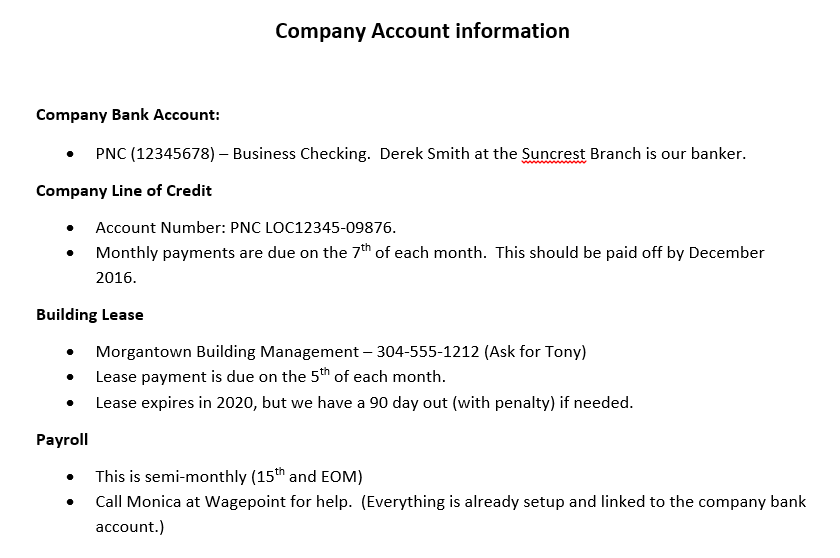

1. List your Business accounts

This list should include all business accounts – bank accounts, lines of credit, vendor accounts, loans. Make sure you include the name of the institution, account number, payment details (such as monthly due dates and amounts), and a phone number to contact the institution.

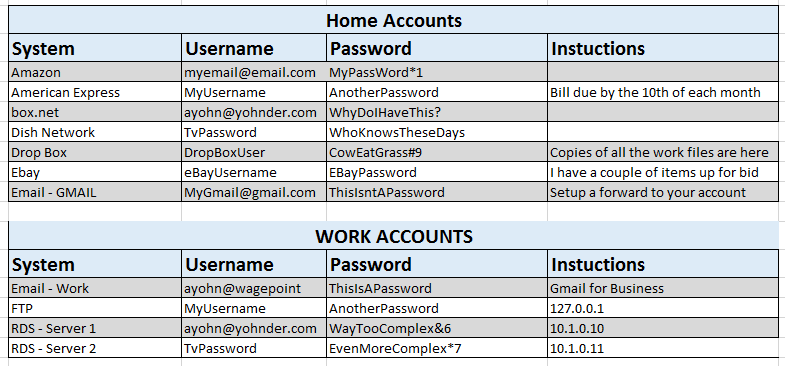

2. List your IT accounts

This list should include your email accounts, access accounts (usernames and passwords), logins, and any special instructions.

Remember, this is not a file you share – don’t keep it on the network, in a file sync service, or email it to anyone, including yourself. Print it out and keep it in a safe location. The best thing you can do is to save it on your local machine and use at least a password to protect it; encrypt it if you can.

3. List any specific Instructions

The instructions should include helpful information to speed any processes along.

For example; remind them to get copies of a death certificate, billing or invoicing timelines, and other items that are time sensitive. These should be addressed to specific people to make sure things are taken care of appropriately.

The message here is not to stop taking risks. But, as a business owner, you do have a responsibility to the people who depend on you.

Make sure all of your ducks are in a row because you never know when you will need your Broccoli file.