Become an insider!

Get our latest payroll and small business articles sent straight to your inbox.

Starting with tax year 2020, Form 1099-MISC (Miscellaneous Income) has been replaced with Form 1099-NEC (Nonemployee Compensation). Employers no longer need to report non-employee compensation, such as payments to independent contractors, on Form 1099-MISC.

Read for more information on the difference between Form 1099-NEC and Form 1099-MISC.

Diving into W-2s and 1099s.

It’s almost the end of the year, and it’s at this time of the year that employers are responsible for an important aspect of payroll compliance — year-end tax forms.

Whether you need to issue Forms W-2 for employees and/or Form 1099-MISC for contractors, these tax forms have to accurately represent the payroll that was issued for the year.

For most workers, a W-2 or 1099 is just a piece of paper they get at year-end to file their tax returns. But it’s important everyone understands these end-of-year tax forms actually mean.

This is why we thought it might be helpful to break down the W-2 and 1099 tax forms and explain what all those boxes and amounts mean from a payroll standpoint.

👉 Related: How to guarantee a smooth payroll year-end in 8 easy steps.

What is a Form W-2?

Form W-2, Wage and Tax Statement (often just called a W-2 ) reports an employee’s annual wages and the amount of taxes withheld from his or her paycheck for the calendar year. Many of the employee details such as name, SSN and deductions are determined when an employee fills out a W-4 upon employment or when a withholding status changes, such as getting married.

Every employer engaged in business who pays wages, including non-cash payments of $600 or more for the year for services performed by an employee must file a Form W-2 for each employee.

Employers must send W-2 Forms to each employee and the Social Security Administration (SSA) at the end of the year.

Employee copies

Your employee should get three copies of their Form W-2, and all three copies must be issued by January 31 of each year. (As of 2017, employers must also file all federal W-2 Forms (Copy A and Copy 1) with the SSA by January 31.) The three copies that the employee receives are:

-

Copy B is used for reporting their federal income taxes and is generally filed with an employee’s federal income tax return (unless they are filling electronically, in which case they have to provide it to the preparer, but it is not usually forwarded to IRS).

-

Copy 2 is used for reporting state, city or local income tax agency and is filed with the relevant taxing authorities.

-

Copy C is for the employee’s records, and it is recommended that employees retain Copy C for at least three (3) years after they file or the due date of their return, whichever date comes later.

The employer copy and what each of the boxes or fields on the W-2 means

The left side of the form is for reporting taxpayer information, the right side of the form is used to report financials and codes and the bottom of the form reports local and state tax information. For this example, we are following Copy A, the first page of the form that is completed by the employer (IRS instructions) and is to complete all Copies.

-

Box a — The employee’s Social Security Number (SSN) is reported in box (a). This should always be double-checked to ensure it’s correct. If it’s not correct, your employee will need to get a new W-2, as an error could slow the processing of their return.

-

Box b — The Employer Identification Number (EIN) or Federal Tax Identification Number (FEIN) is reported in box (b). An EIN is more or less the employer’s equivalent of an employee’s SSN.

-

Box c — The employer’s address is reported in box (c). This should be your legal company address, which may or may not be where your employees’ actually work.

-

Box d — The control number is an internal number used by your company’s payroll department. If you don’t use control numbers for your company, box (d) will be left blank.

-

Boxes e and f — Employee name and address: (Note: These appear as one big block on the employee’s copies.)

-

The employee’s full name is reported in Box (e). It’s supposed to match the name that’s on their Social Security card. If their name isn’t exactly as it appears on their Social Security card, you will need a new W-2.

-

The employee’s address is reported in Box (f) and should accurately reflect their mailing address, which can be a post office box (without punctuation per USPS preferences). If the address on the W-2 isn’t correct, your employee is required to notify you so that you can update their personal records. However, a new Form W-2 is not required in this case.

-

-

Box 1 — Employee’s total taxable wages, tips and other compensation. This includes fringe benefits, such as bonuses. It does not include tax-exempt deductions, like those for a 401K.

👉 Related: How to handle taxes on bonus wages like a payroll expert.

-

Box 2 — Federal income tax withheld, which is the amount the employer has taken out of each paycheck throughout the year to allow for income tax.

-

Box 3 — Employee’s Social Security Tax (The total of boxes 3 and 7 cannot exceed the maximum wage base.)

-

Box 4 — Employee’s Social Security Tax Withheld (6.2%).

-

Box 5 — Employee’s Medicare Wages and Tips (Same amount as boxes 3 and 7.)

-

Box 6 — Employee’s Medicare Tax Withheld (1.45%).

-

Box 7 — Social Security Tips (The total of boxes 3 and 7 cannot exceed the maximum wage base.)

-

Box 8 — Allocated Tips for hospitality businesses and restaurants. (Do not include this amount in boxes 1, 3, 5, or 7.)

👉 Related: How to manage and pay tipped employees in restaurants.

-

Box 9 — Box not used.

-

Box 10 — Show the total dependent care benefits under a dependent care assistance program (section 129) paid or incurred by you for your employee.

-

Box 11 — The purpose of box 11 is for the SSA to determine if any part of the amount reported in box 1 or boxes 3 and/or 5 was earned in a prior year. Report distributions to an employee from a non-qualified plan or nongovernmental section 457(b) plan in box 11. Also report these distributions in box 1.

-

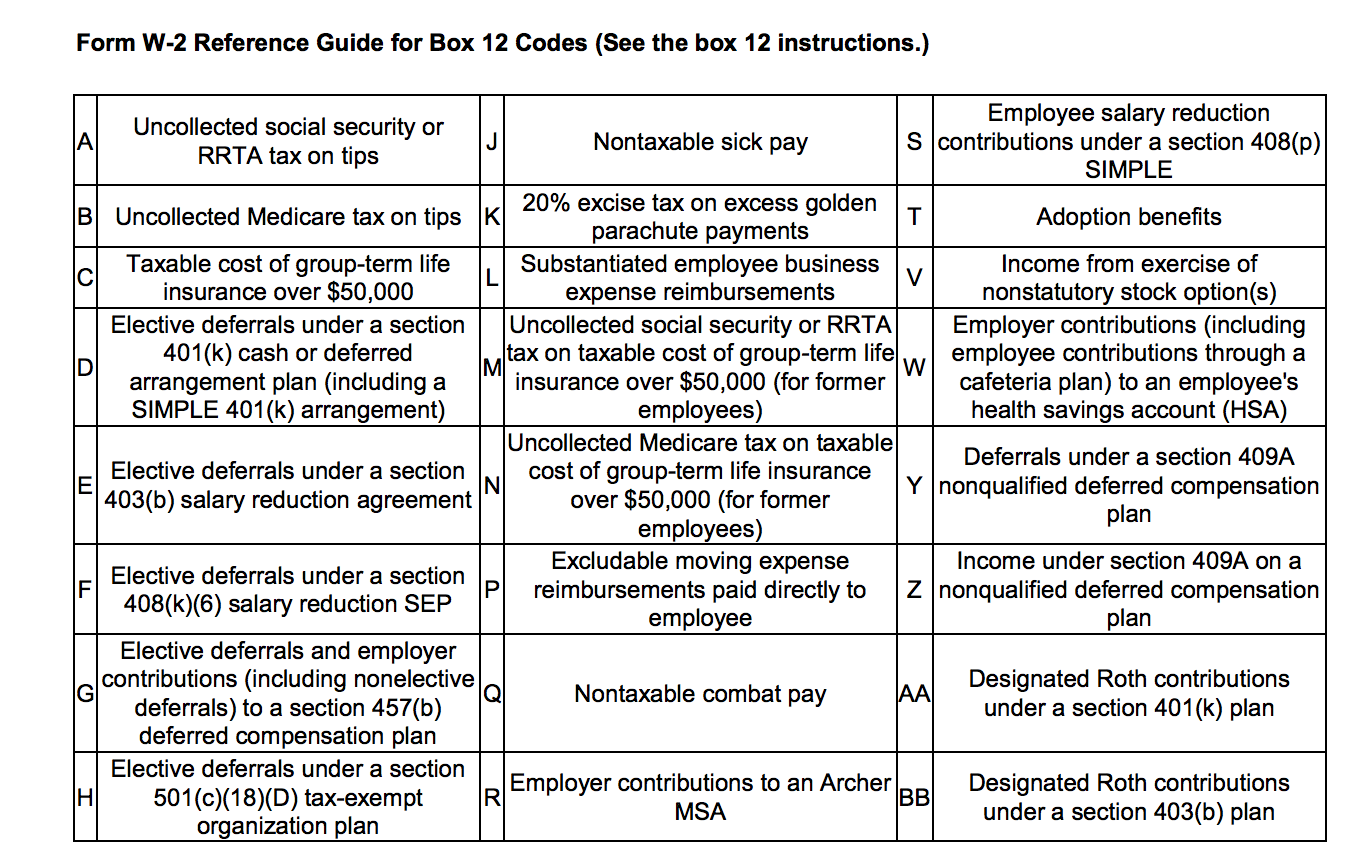

Box 12a, b, c or d — This is the box where you record any items listed as codes A through EE. Note that the codes do not relate to where they should be entered in boxes 12a through 12d . For example, if you are only required to report code D in box 12, you can enter code D and the amount in box 12a . Report in any items that are listed as codes. Employers may only list four codes on Copy A. If more codes are required, so is an additional W-2 Form. More than four codes can be listed on the employee copies.

-

Box 13 Checkboxes

-

Statutory employee — Check this box for statutory employees whose earnings are subject to social security and Medicare taxes, but not subject to federal income tax withholding.

-

Retirement plan — Check this box if the employee was an “active participant” (for any part of the year) in any of the following.

-

Third-party sick pay — Check this box only if you are a third-party sick pay payer filing a Form W-2 for an insured’s employee or are an employer reporting sick pay payments made by a third party.

-

-

Box 14 — If you included 100% of a vehicle’s annual lease value in the employee’s income, it also must be reported here or in a separate statement to your employee. You also may use this box for any other information that you want to give to your employee, such as state disability taxes withheld. Remember to label each item.

-

Box 15 through 20 — State and local tax information

-

Enter the two-letter abbreviation for the name of the state.

-

The employer’s state ID numbers are assigned by the individual states and may be different than the EIN/FEIN.

-

The state and local information boxes can be used to report wages and taxes for up to two states and two localities. Keep each state’s and locality’s information separated by the broken line. If you need to report information for more than two states or localities, you will need to prepare a second W-2

-

What is a Form 1099?

Form 1099 provides your independent contractors and the IRS with the necessary information to properly calculate their tax liability. It’s basically your W-2 for contractors.

So, when your contract workers prepare their tax return, they will need to be sure to transfer all of the information from their various 1099s to their tax return.

The most common 1099 form is the 1099-MISC (Miscellaneous Income). This is the form that independent contractors receive from those who have paid them. If they work as a freelancer for you, they will receive a 1099-MISC form showing what they were paid. However, if you haven’t paid them at least $600 in the past year, they will not need to get a 1099-MISC – but they are still required to report their income.

👉 Related: Contractor vs. employee: A mini guide for American small businesses.

There are many types of 1099 forms and each for a variety of purposes, which is why your contract workers should be aware of the different kinds of 1099 forms.

-

1099-INT — This form is used to report interest income. A bank or other financial institution might issue a 1099-INT form to a person who received interest income from a CD, or from a deposit account.

-

1099-C — This form is used if a person has received debt forgiveness on a loan, which is considered income, and as such, they will be issued a 1099-C.

-

1099-S — Income proceeds from real estate transactions.

-

1099-A — Acquisition or abandonment of secured property.

-

1099-B — Proceeds from broker and barter exchange transactions.

-

1099-CAP — Changes in corporate control and capital structure.

-

1099-DIV — Dividends and distributions.

-

1099-G — Certain government payments.

-

1099-H — Health coverage tax credit (HCTC) advance payments.

-

1099-K — Merchant card and third-party network payments.

-

1099-LTC — Long-term care and accelerated death benefits.

-

1099-OID — Original issue discount.

-

1099-PATR — Taxable distributions received from cooperatives.

-

1099-Q — Payments from qualified education programs (Under Sections 529 and 530).

-

1099-R — Distributions from pensions, annuities, retirement or profit-sharing plans, IRAs, insurance contracts, etc.

-

1099-SA — Distributions from an HSA, Archer MSA, or Medicare Advantage MSA.

For the purpose of this post, we will be concentrating on the 1099-MISC form.

Form 1099-MISC deadlines and responsibilities.

Employers are required to file Copy A of Paper Form 1099-MISC with Form 1096 with entries for Box 7 (payments to contract workers) by January 31.

Employers are required to file Copy A of Paper Form 1099-MISC with Form 1096 with no entries for Box 7 (payments to contract workers) by February 28.

Electronic copies of 1099s are due March 31.

What do the different amounts on a 1099-MISC mean?

First, just as with a W-2, Copy A is the one that employer files with the IRS. Copy 2 and 3 go to the employee for filing taxes and personal record-keeping. Also, the employer address and EIN must match and the employee’s SSN and address must also be accurate.

Box 1 — As the employer, if you pay for their rent of office space, farmland or pasture, or machinery, this figure will be reported in Box 1. Only amounts of $600 or more are required to be reported.

Box 2 — Reports any royalties your contract workers received in excess of $10. Royalties generally cover license fees for copyrights, patents and trademarks.

Box 7 — The IRS considers any money an independent contractor earn from an individual or business that does not officially employ them to be taxable self-employment income. The employer must report this income in box 7 of Form 1099-MISC for each person they paid more than $600 for the year.

It’s important to keep in mind that self-employed taxpayers generally aren’t subject to income tax withholding. In most cases, boxes 4 and 16, which report federal and state income tax withholding, will be empty. However, if your contract workers fail to provide you with a completed W-9 form that provides their taxpayer identification number, they may be subject to backup withholding.

Other boxes on the 1099-MISC form:

Box 3 — This box covers reportable payments not specifically covered elsewhere, like prize winnings or termination payments not considered wages.

The remaining boxes report specific types of payments, and brief descriptions of the types of payments to be reported in each box can be found on the back of the 1099-MISC form.

-

For example, Box 6 is for payments received for providing health care services, and Box 9 is for proceeds from the sale of certain consumer goods.

As an employer, it is your responsibility to ensure that the right year-end tax forms are provided to your employees and independent contractors. But taking it one step further to make sure that your workers understand the makeup of each form will help them file their tax returns at year-end more accurately.

Disclaimer: The advice we share on our blog is intended to be informational. It does not replace the expertise of accredited business professionals.