Become an insider!

Get our latest payroll and small business articles sent straight to your inbox.

At the writing of this article, we’re more than a year into the COVID-19 pandemic. Time is certainly revealing the effects on small- to medium-sized businesses (SMBs). While traditionally not the most glamorous of topics, payroll was front and centre of this whole experience as businesses had to respond and adjust their workforce with little to no forewarning. (Sort of like a child bursting into a parent’s Zoom call.)

What has the COVID-19 pandemic taught us about the role of payroll?

In March 2020 and again at the start of 2021, Wagepoint conducted a survey of Canadian small business owners in order to learn first-hand about the impacts of rapid change.

We’ve also been extremely honoured to have Steven Van Alstine, Vice-President of Education at the Canadian Payroll Association (CPA), lend his experience, expertise and observations to the conversation. The insights from these discussions will be shared in this article.

Hindsight: Looking back on a year of rapid change and uncertainty.

The business, social and economic impact of change on employers and employees has been profound. Layoffs, rapid transitions to remote work, transforming business models and lockdowns that transcended every part of life — these all happened in the span of a single year. It has been the world’s most intense crash course in navigating the unexpected.

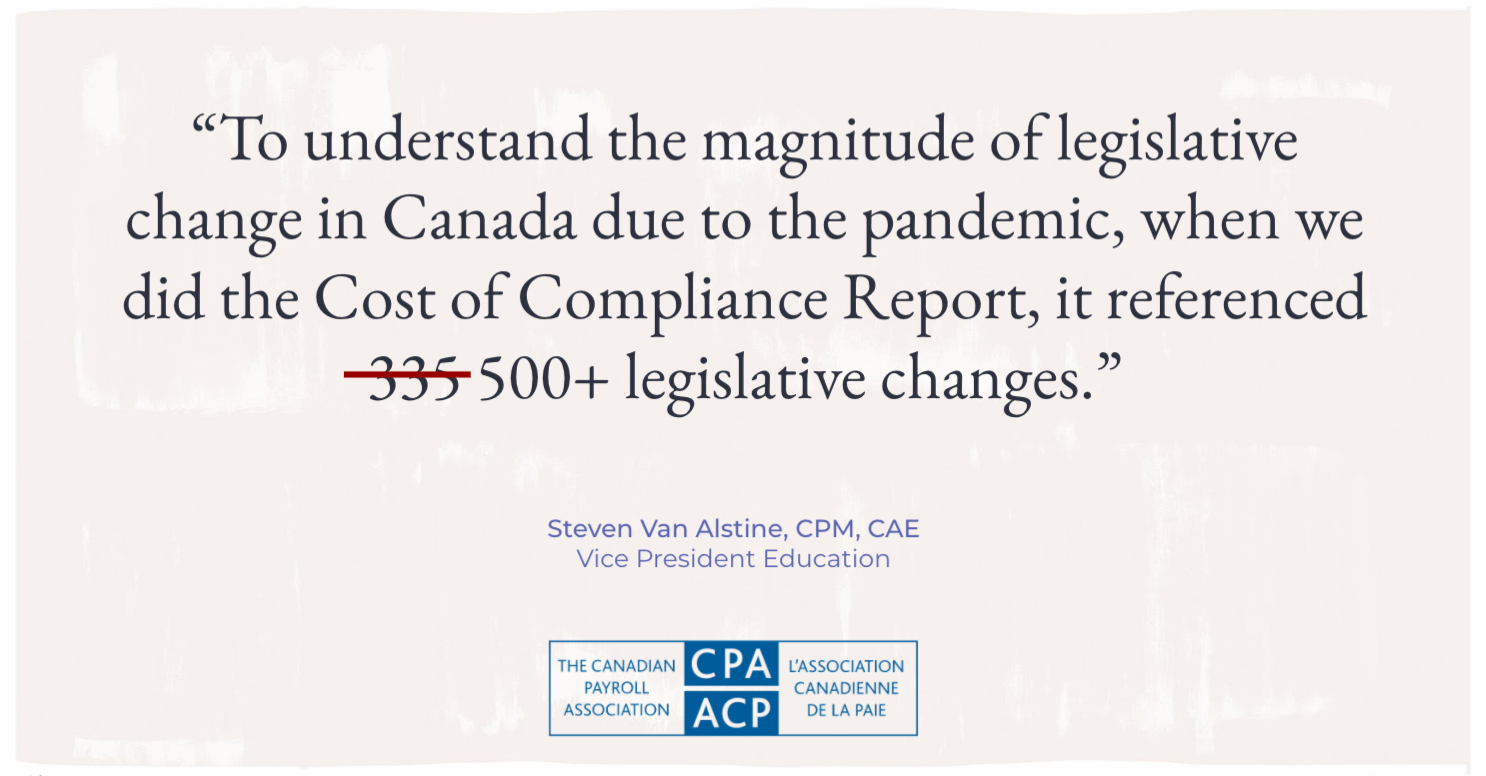

The sheer magnitude of payroll legislative change in Canada.

As everyone, the government included, scrambled to respond, the resulting mountain of payroll legislation rivalled Mount Everest. When the CPA first published its Cost of Compliance Report, there were more than 300 changes to payroll law. Since then, the number has spiraled to more than 500.

Key insight #1: Online payroll (e-payroll) is more than a tool, it’s a business essential.

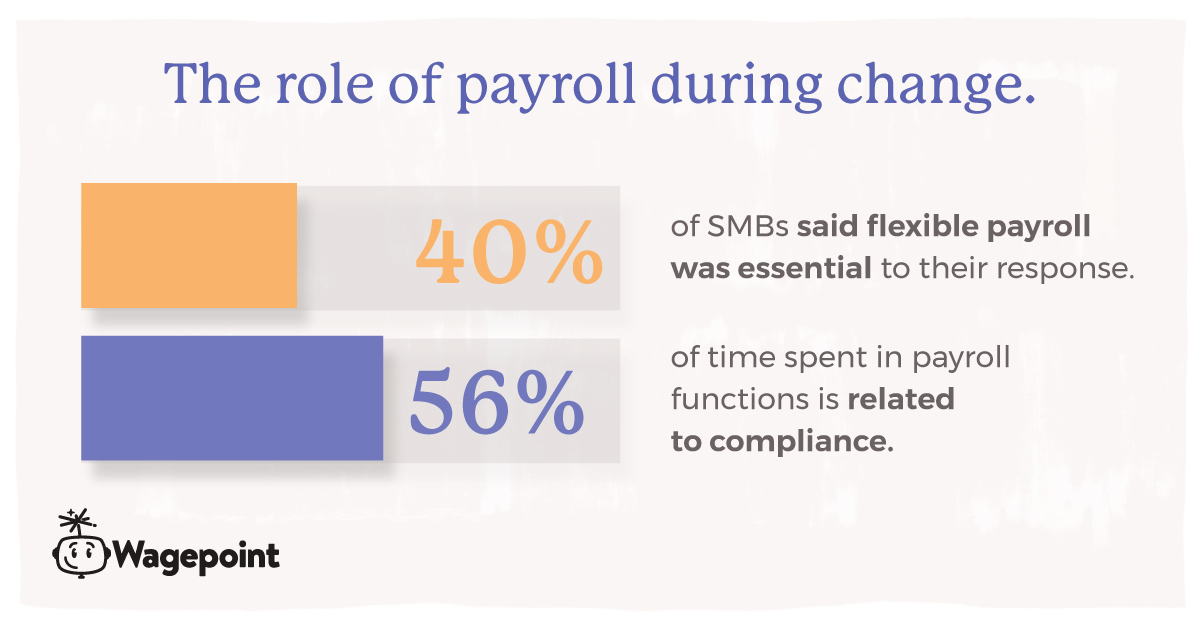

Having an efficient small business payroll process isn’t just a nice-to-have — it’s a must-have. When surveyed, 40% of SMBs said that flexible payroll was essential to their response. In their report Payroll in Focus, the CPA found that 56% of time spent on payroll is spent on compliance, in other words, keeping up with those 500+ legislative changes.

👉 Download a copy of the Business Resilience Report.

What is payroll compliance?

If you’re familiar with the industry lingo, the term compliance freely flows in conversation. If you’re a small business owner who’s just looking to find a better way to manage payroll, it likely sounds like jargon or one of those cartoon teachers that drones on with no discernible logic.

Put simply, compliance means following the rules, especially the tax rules, including the regulations surrounding income tax, Employment Insurance (EI) and Canada Pension Plan (CPP). Depending on your business location and industry, it can also include Workers’ Compensation as well as provincial and territorial health and employment taxes.

SMBs and cost of payroll compliance:

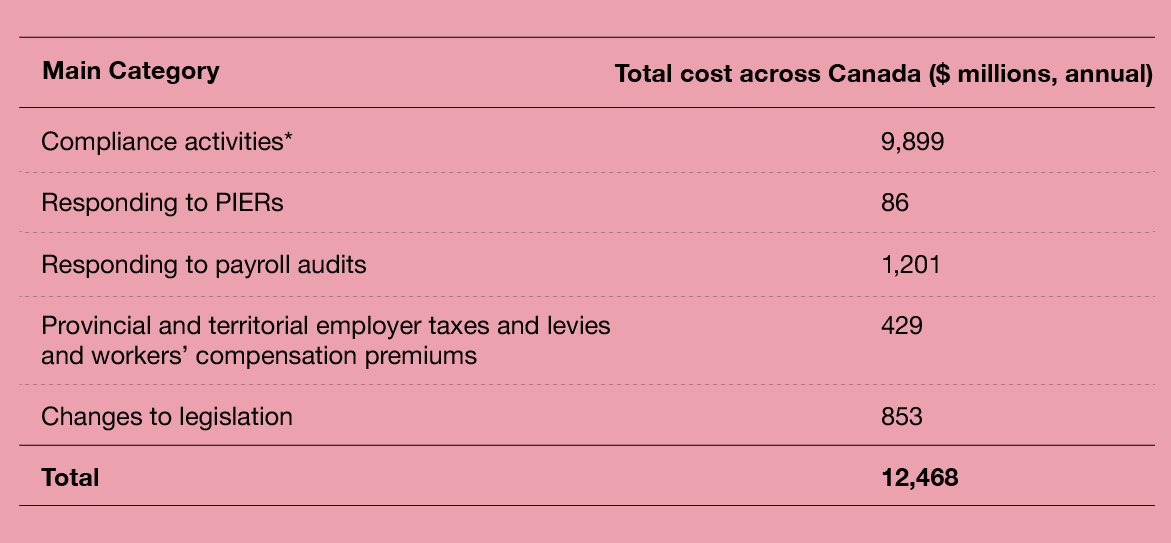

Payroll taxes and compliance represent 37% of the total revenuefor federal, provincial and territorial governments — funding a wide range of public programs. There are more small businesses than any other kind of business in Canada and they are also the largest public sector employer — meaning small businesses are the ones that contribute to this tax base and these programs. When added up, the total cost of compliance is roughly $12, 468 million — again with small businesses often bearing the brunt of these costs.

Source: Payroll in Focus Report.

Key insight #2: Business models changed forever.

In spite of the unplanned nature of the change, the pandemic has actually been a catalyst for much-needed change. A majority, 67% of the businesses in Wagepoint’s survey indicated that the nature of their business had forever changed. These changes ranged from re-thinking the way goods and services were delivered to implementing new software and technologies, like online payroll.

👉 Read a case study of how payroll software was essential to an SMB’s response.

Key insight #3: Payroll is a strategic business function.

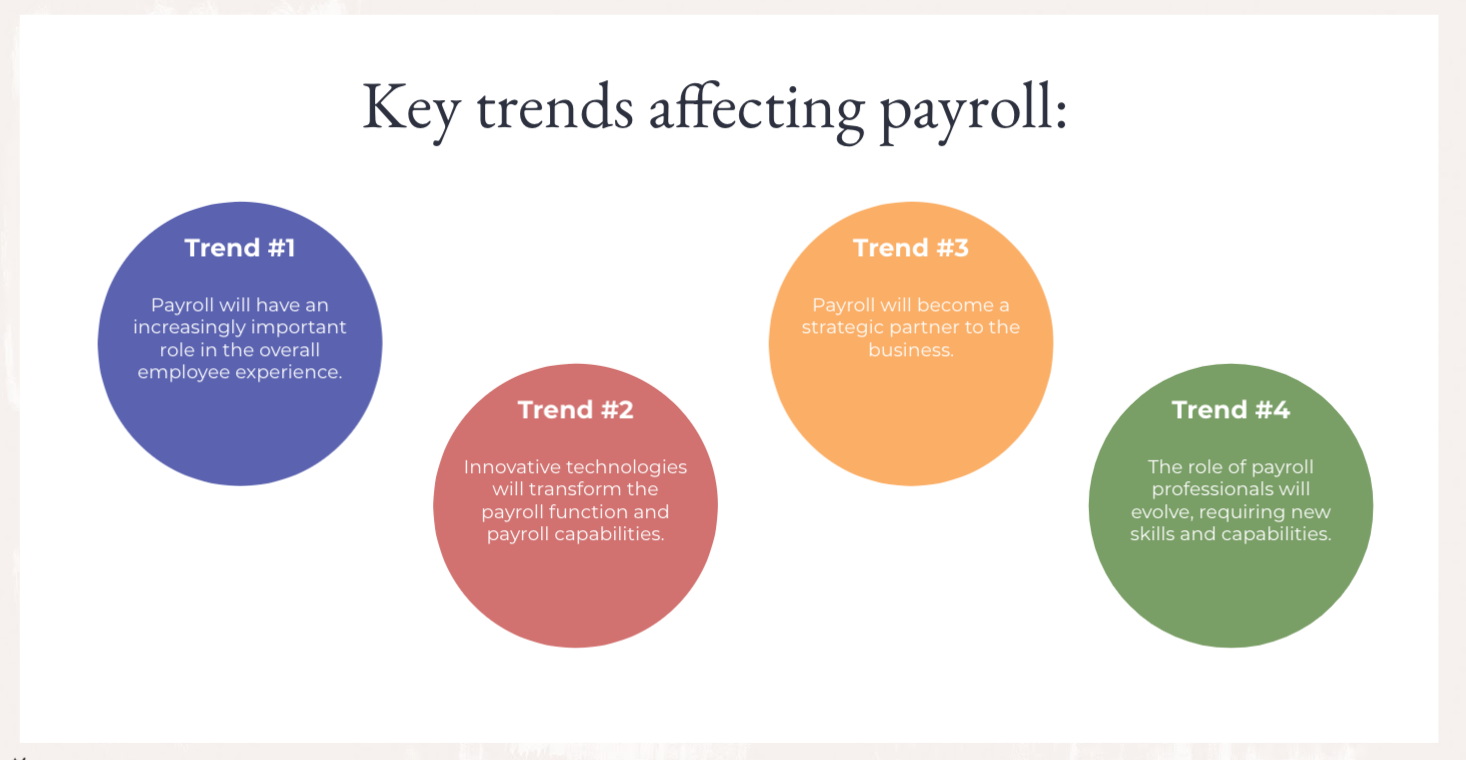

A year ago, no one could have predicted this transformation of the role of payroll and how organizations, like Wagepoint, have been industry leaders. Looking forward and further facilitating innovation makes this an exciting time for the profession as a whole.

— Steven Van Alstine, Vice-President of Education, CPA

This past year taught us all that payroll and business continuity go hand in hand. Employers depend on their employees and employees depend on their pay cheques and benefits. In a short period of time, payroll has gone from being transactional to the forefront as a strategic and essential business function.

As technology evolves and more of the manual processes of payroll get automated, there’ll be shifting needs in skills and roles among payroll professionals. There’ll be a greater emphasis on payroll knowledge and the optimization of HR processes, rather than the pure administrative components.

HR isn’t a thing you do. It’s the thing that runs your business and it includes the function of payroll and I think that’s often very misunderstood.

— Bianca Mueller, Community Manager, Wagepoint

Watch the webinar.

On May 6, 2021, Bianca and Steven joined forces to host a webinar on the role of payroll in business success and resilience. Watch the full session below.

Helpful resources.

Two main sources were cited several times in this article and the webinar. Here’s how to find them and download copies of your own. The downloads for each resource are complimentary.

- The Wagepoint Small Business Resilience Report (includes a link to download the report).

- CPA Payroll in Focus Report (each section of the report is available for download).

Implementing a digital e-payroll strategy.

Today, payroll is being recognized as an essential function on the front lines of business continuity, a prerequisite for resilience and a key contributor to overall business wellness. When the right payroll solution is put in place, it’s not only cost-effective, it’s able to:

- Lower your risk for costly mistakes, such as late payroll tax remittances.

- Reduce stress/workload by automating manual processes.

- Keep you current/in real-time.

- Be done off-site/remotely.

- Help with collaboration.

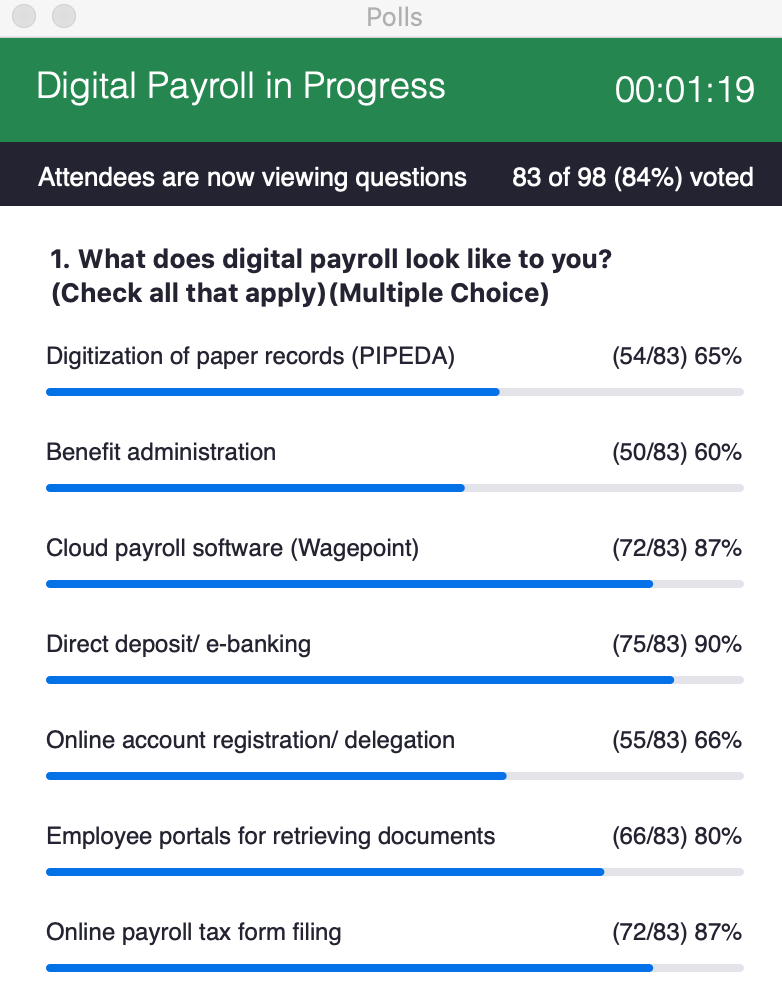

What are small businesses looking for in an online payroll software solution?

We wanted to know too, so we asked during the webinar. According to the industry professionals in attendance, the top features were:

- Direct deposit/e-banking (90%)

- Online payroll tax form filing and a cloud-based solution both tied for second (87%)

- An employee portal for retrieving documents, like paystubs and T4s (80%)

Special offers to get started with Wagepoint:

With the increasingly strategic role of payroll, simple, online software, like Wagepoint, helps you pay both employees and contractors quickly and easily. We help automate the time-consuming parts of compliance, like payroll taxes, and we have a convenient, online employee portal. Our software is also easy to use and we’re not kidding when we say we have the world’s friendliest support.

⚡ Small businesses who run their own payroll can get the first month free.

⚡ Accountants and bookkeepers start saving 10% right from the start.

The advice we share on our blog and in our webinars is intended to be informational. It does not replace the expertise of working with accredited business professionals.