Become an insider!

Get our latest payroll and small business articles sent straight to your inbox.

As you work on your calendar year-end for 2020, you’re likely to come across the requirement to complete a Form PD27. If you’re getting confused with how to fill out the sections, don’t worry. We’ve gathered as much information as we could to help you complete it.

The 10% Temporary Wage Subsidy for employers in a nutshell.

In response to the pandemic, the Canadian government introduced the 10% Temporary Wage Subsidy (TWS) as a source of financial relief for small business owners.

Through the TWS, eligible employers could reduce their federal and provincial tax remittance by 10% of their gross remuneration paid during the claim period of March 18 to June 19, 2020. The maximum that can be claimed is $1,375 for each employee, up to $25,000 per employer.

Since the TWS is considered to be income, all small business owners who’ve benefited from the program must include it in their year-end reporting. Even if you’re retroactively applying for the subsidies but haven’t received it yet, it still needs to be accrued for in the period that it falls within.

What is Form PD27 and who needs to submit one?

If you took advantage of the Temporary Wage Subsidy, you’ll need to fill out Form PD27 10% Temporary Wage Subsidy Self-Identification Form for Employers to self-report your eligibility for the program. This form lets CRA properly document the reduction in remittances on your payroll program account and reduces your potential of receiving a discrepancy notice at the end of the year.

Form PD27 is a three-page form with five parts:

- Parts A and B — This is where you provide information to identify your business.

- Part C — This section must be completed if you have more than one payroll account number (RP) and have claimed (or intend to claim) the TWS on more than one of these accounts.

- Part D — This is where you enter your TWS claim amounts. (We’ll do a deeper dive in the next section.)

- Part E — This is where the employer or an authorized officer of the company must provide their signature to certify and attest that the information provided in the report is valid.

⚡ Wagepoint customers: If you have multiple companies with different payroll account numbers, you must complete and submit separate PD27 forms for each payroll account number with a TWS claim.

You need to complete and submit Form PD27 if:

- You are eligible for TWS and

- You already reduced your remittances.

- You intend to reduced your remittances (the PD27 will help calculate your eligible TWS amount)

- You claimed the Canada Emergency Wage Subsidy (CEWS) and, need to confirm the amount of the TWS you are taking advantage of in relation to CEWS.

If you weren’t eligible for TWS:

Form PD27 will be used to reconcile the subsidy on your payroll program (RP) account(s).

How to fill out the self-identification form.

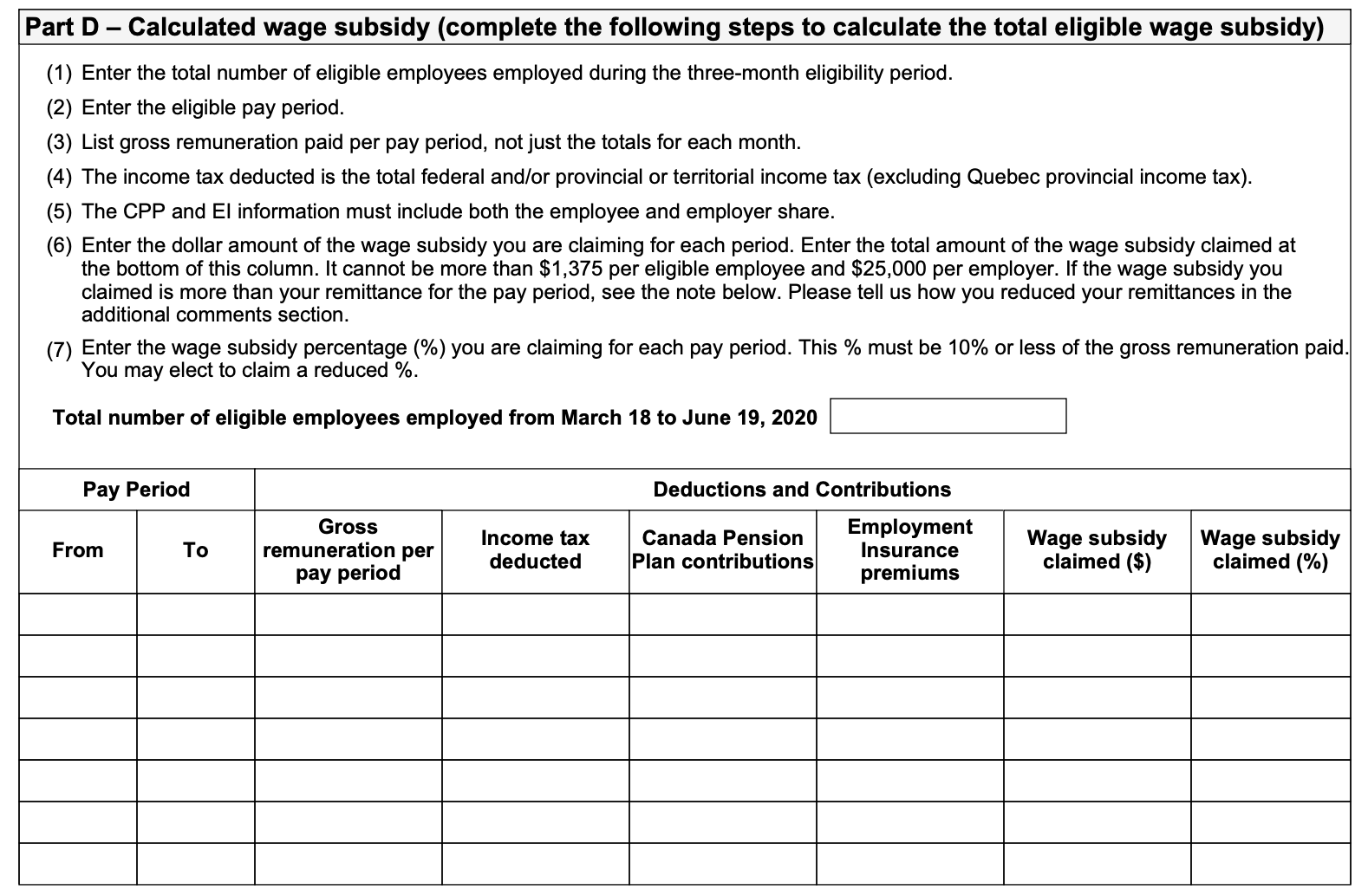

Here is the information employers will need to provide to complete Part D of the PD27:

1. Total number of eligible employees employed from March 18 to June 19, 2020 — Enter the total highest number of eligible employees in any one period.

2. Pay periods — List all pay periods with a pay date that falls within the March 18 to June 19, 2020 claim period.

⚡ Wagepoint customers: If you have multiple pay groups, we recommend that you fill out a separate PD27 for each pay group.

3. Gross remuneration per pay period — List the gross remuneration paid per pay period.

4. Income tax deducted — The total federal and provincial/territorial income tax (excluding Quebec provincial income tax).

5. Canada Pension Plan contributions and Employment Insurance premiums — Be sure to include both the employee and employer contributions.

6. Wage subsidy claimed ($) — Enter the dollar amount of the wage subsidy you are claiming for each pay period. This amount should be 10% of the gross remuneration paid for that pay period (if you are claiming the full 10%).

👉 Reminder: The total amount claimed cannot be more than $1,375 per eligible employee and $25,000 per employer.

7. Wage subsidy claimed (%) — Enter the wage subsidy percentage (%) you are claiming for each pay period. This percentage must be 10% or less of the gross remuneration paid. You may elect to claim a reduced %.

- If you also participated in the Canada Emergency Wage Subsidy (CEWS), you may only claim the maximum subsidy amount as outlined by the CEWS guidelines for each period. For instance, if you were eligible for both during the same period, you would claim the full TWS and then adjust your CEWS claim to ensure you didn’t go over or under the maximum allowable amount.

8. Total — Tally up the totals for each of the columns and enter those amounts in the “Totals” row of Part D.

9. Additional comments — As noted in Form PD27, “You can reduce your current payroll remittance of federal and/or provincial, or territorial income tax only by the amount of the subsidy. If the eligible wage subsidy calculated is more than the income tax deducted, you can deduct this amount from the income tax portion of future remittances.” You might have already guessed this — but this is the section where you would provide this information.

⚡ Wagepoint customers: If you DID NOT utilize your maximum allowance during the eligibility period, we automatically reduced future remittances in 2020. Be sure to enter this information in this section as well.

Want further guidance on how to report the data so it accurately reflects your special circumstances? You can reference this super handy resource from the CRA. It provides examples based on different scenarios.

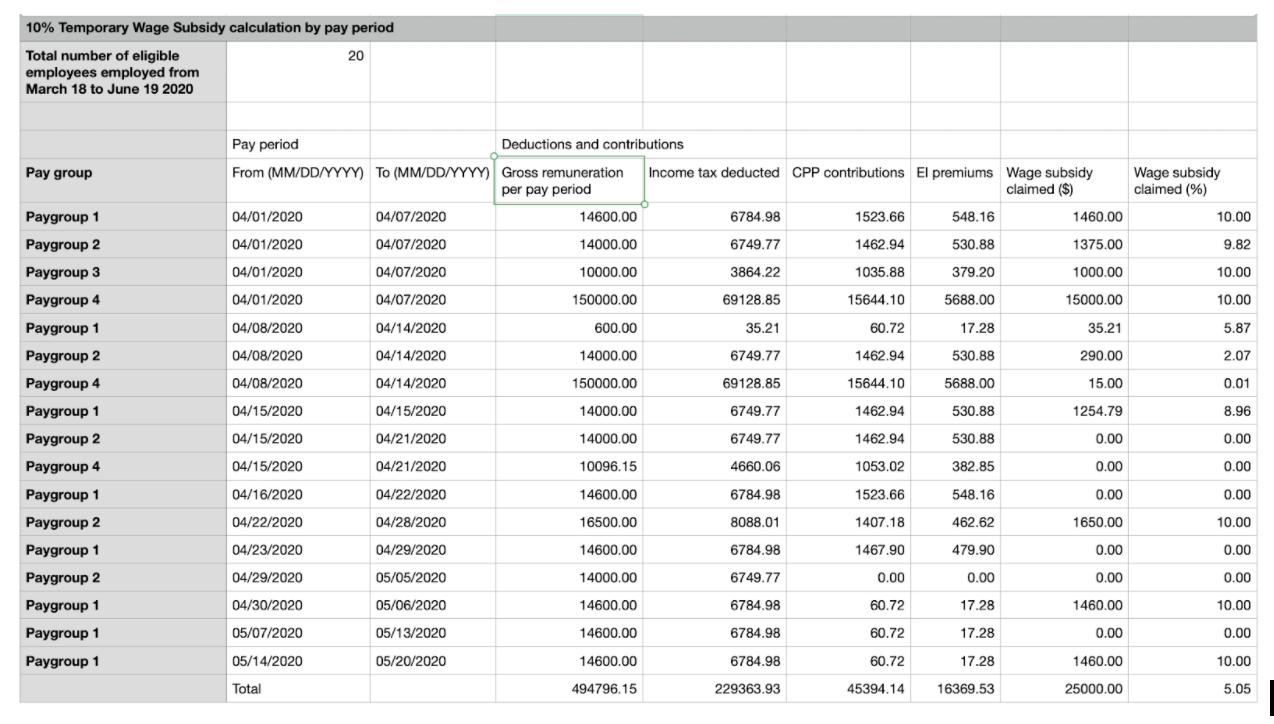

Temporary Wage Subsidy Calculation by Pay Period CSV Report.

If you’re a Wagepoint customer, we wanted to make your life a little bit easier by creating the Temporary Wage Subsidy Calculation by Pay Period CSV Report. In this report, you’ll find gross remuneration, income tax, CPP and EI amounts in our CSV report for each eligible pay period.

If you need instructions on how to download it, you can reference our knowledge base article.

When is the TWS Self-Identification Form due?

In short, ASAP.

You don’t have to wait until you file your T4 information to get it done. The government is accepting them now. The way we see it, it’s similar to resolving conflict with a worker — the sooner you deal with it, the better!

⚡ If you used Wagepoint to reduce your remittances, you are required to complete and submit Form PD27 to the CRA as soon as possible.

How to submit Form PD27 to the CRA.

Small business owners must file the TWS Self-Identification Form through the CRA either electronically or manually. Keep in mind that you must complete and file the form on your own, unless you work with a bookkeeper or accountant — they can submit it on your behalf.

Should you choose to file Form PD27 electronically, here’s where you can do so:

| Filing on your own behalf:

Use your My Business Account. |

Bookkeepers and accountants:

File on a client’s behalf using Represent a Client. |

Alternatively, you can manually file your PD27 by mailing or faxing the TWS self-identification form to your National Verification and Collections Centre (NVCC):

| Newfoundland and Labrador NVCC

Post Office Box 12071 Station A St John’s NL A1B 3Z1 Fax number: 709-772-6677 |

Surrey NVCC

9755 King George Boulevard Surrey BC V3T 5E1 Fax number: 604-585-5774 |

| Shawinigan NVCC

4695 Shawinigan-Sud Boulevard Shawinigan-Sud QC G9P 5H9 Fax number: 819-536-5031 |

Winnipeg NVCC

66 Stapon Road Winnipeg MB R3C 3M2 Fax number: 204-984-4138 |

Helpful links to CRA PD-27 resources.

For more information, these are the primary links used to help in writing this article:

👉 Stay on top of all payroll-related deadlines with our 2022 Canadian Small Business Payroll Calendar.

The advice we share on our blog is intended to be informational. It does not replace the expertise of accredited business professionals. Wagepoint assumes no responsibility for errors or omissions in this document.