Become an insider!

Get our latest payroll and small business articles sent straight to your inbox.

Your business is taking off, and it is time for you to bring on some extra help to keep up that momentum.

You’re scanning through resumes and talking to your network so that you only hire the best talent, but even before you make that hire, the first thing you want to consider if you should be hiring an employee or a contractor.

This is the moment you’ve been waiting for — your first hire — and you want to make sure that you get everything done correctly. This is why you should really understand what the differences are between an employee and a contractor.

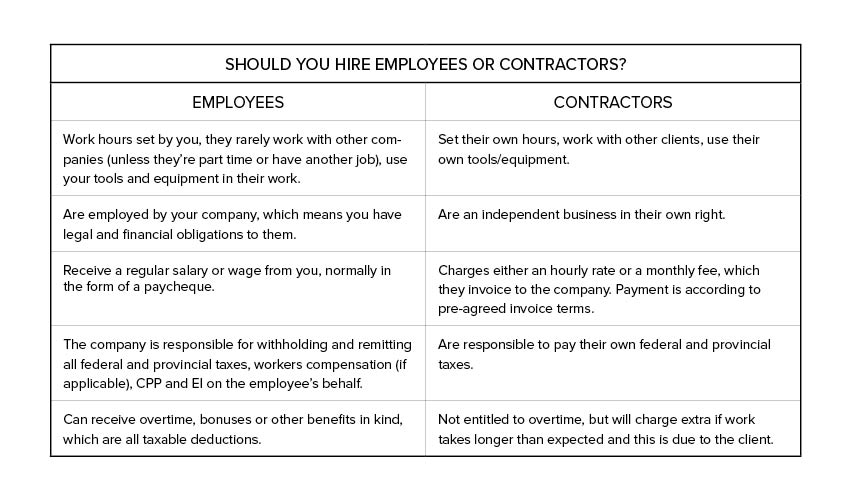

Employees vs Contractors

The CRA determines a worker’s status by looking at:

The intent of the relationship i.e. if the written agreement is a “contract of service”, which signals an employer-employee relationship, or a “contract for services”, which signals a business relationship.

The amount of control the worker has in the job — the more that the employer controls the worker, the less likely it is that the person is a contractor.

Consequences of Misclassifying Employees as Contractors

Consequences of Misclassifying Employees as Contractors

When you are starting out, you might think it’s a smart idea to save money by hiring contractors because you don’t have to worry about paying taxes, vacation, statutory holiday pay or benefits.

But if you end up hiring a contractor who is actually your employee (based on CRA’s legal definition), you’ll end up paying hefty penalties for misclassification.

Some of the things you’ll have to account for in terms of fines:

- Back pay wages you should have paid, including any overtime and minimum wage requirements

- Pay penalties for late filing federal and provincial taxes as well as back pay the taxes owed to the government

- Provide benefits like health insurance, etc. and pay workers’ compensation for any misclassified employees who were injured on the job.

Determining Your Worker’s Status With the CRA

If you are still unsure whether you are hiring your first employee or contractor, you can use the CRA’s Guide RC4110 to determine a worker’s employment status.

Key Takeaways:

It is better to stay compliant with the CRA by fully understanding the differences between employees vs contractors.

- The CRA looks at two things when determining a worker’s employment status – the intent of the relationship, and the amount of control the worker has on the job.

- Avoid hefty penalties by using the CRA’s RC4110 guide to determine if you have hired an employee or a contractor.